Answered step by step

Verified Expert Solution

Question

1 Approved Answer

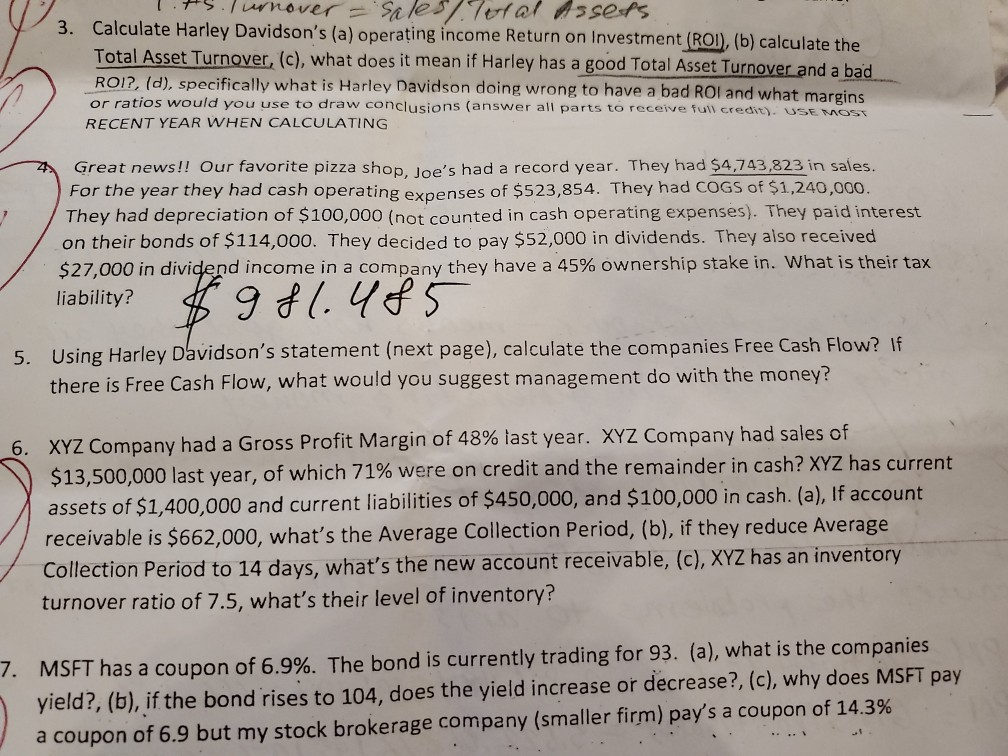

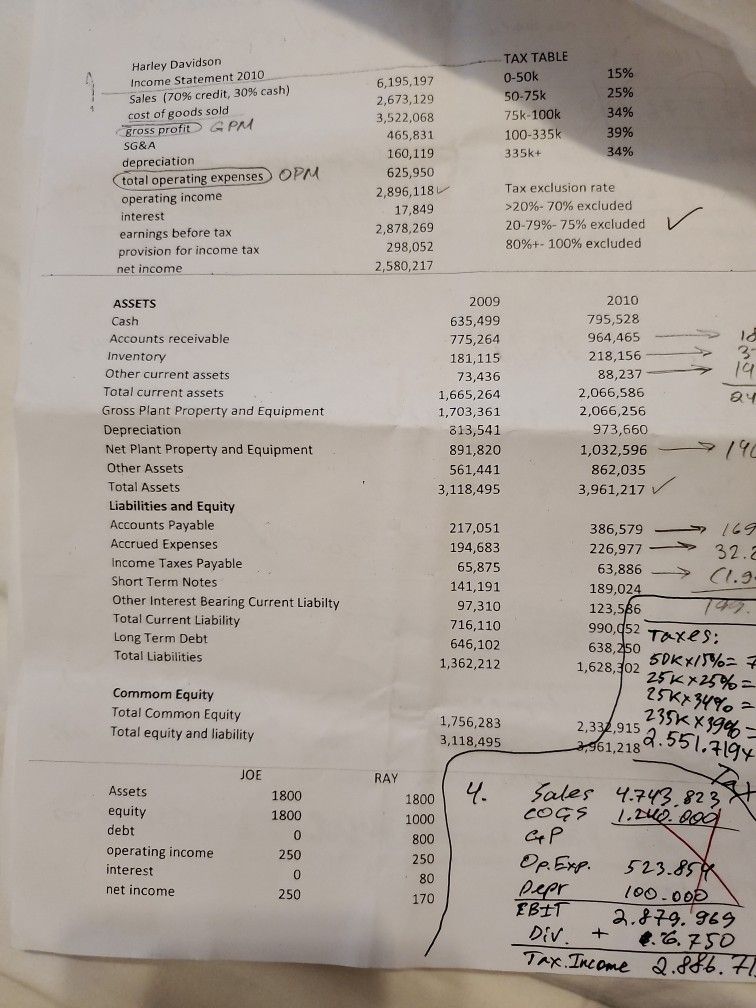

question 4 only the taxable income question 5 only the free cash flow question 6 everything please T.AS. Turnover = sales) Total Assets 3. Calculate

question 4 only the taxable income question 5 only the free cash flow question 6 everything please

T.AS. Turnover = sales) Total Assets 3. Calculate Harley Davidson's (a) operating income Return on Investment (ROI), (b) calculate the Total Asset Turnover, (c), what does it mean if Harley has a good Total Asset Turnover and a bad ROI?, (d), specifically what is Harley Davidson doing wrong to have a bad ROI and what margins or ratios would you use to draw conclusions (answer all parts to receive full credit). USE MOST RECENT YEAR WHEN CALCULATING Great news!! Our favorite pizza shop loe's had a record year. They had $4,743,823 in sales. For the year they had cash operating expenses of $523,854. They had COGS of $1,240,000. They had depreciation of $100,000 (not counted in cash operating expenses). They paid interest on their bonds of $114,000. They decided to pay $52,000 in dividends. They also received $27,000 in dividend income in a company they have a 45% ownership stake in. What is their tax liability? 9 41.465 5. Using Harley Davidson's statement (next page), calculate the companies Free Cash Flow? If there is Free Cash Flow, what would you suggest management do with the money? 6. XYZ Company had a Gross Profit Margin of 48% last year. XYZ Company had sales of $13,500,000 last year, of which 71% were on credit and the remainder in cash? XYZ has current assets of $1,400,000 and current liabilities of $450,000, and $100,000 in cash. (a), If account receivable is $662,000, what's the Average Collection Period, (b), if they reduce Average Collection Period to 14 days, what's the new account receivable, (c), XYZ has an inventory turnover ratio of 7.5, what's their level of inventory? 7. MSFT has a coupon of 6.9%. The bond is currently trading for 93. (a), what is the companies yield?, (b), if the bond rises to 104, does the yield increase or decrease?, (c), why does MSFT pay a coupon of 6.9 but my stock brokerage company (smaller firm) pay's a coupon of 14.3% TAX TABLE 0-50k 50-75k 75k-100k 100-335k 335k+ 15% 25% 34% 39% 34% Harley Davidson Income Statement 2010 Sales (70% credit, 30% cash) cost of goods sold gross profit GPM SG&A depreciation total operating expenses OPM operating income interest earnings before tax provision for income tax net income 6,195,197 2,673,129 3,522,068 465,831 160,119 625,950 2,896,118 17,849 2,878,269 298,052 2,580,217 Tax exclusion rate >20%-70% excluded 20-79%-75% excluded 80%+- 100% excluded V ASSETS Cash Accounts receivable Inventory Other current assets Total current assets Gross Plant Property and Equipment Depreciation Net Plant Property and Equipment Other Assets Total Assets Liabilities and Equity Accounts Payable Accrued Expenses Income Taxes Payable Short Term Notes Other Interest Bearing Current Liabilty Total Current Liability Long Term Debt Total Liabilities 2009 635,499 775,264 181,115 73,436 1,665,264 1,703,361 813,541 891,820 561,441 3,118,495 2010 795,528 964,465 218,156 88,237 2,066,586 2,066,256 973,660 1,032,596 862,035 3,961,217 v 217,051 194,683 65,875 141,191 97,310 716,110 646,102 1,362,212 386,579 - 226,977 -> 63,886 -> 189,024 123,586 > 169 32.3 (1.9- 1,628,502 50kx/% 990,452 Taxes: 638,450 50KX/%- 7 25kx25%= 25k434% Commom Equity Total Common Equity Total equity and liability 235k X 39%- 1,756,283 3,118,495 2,337,915 2 2,961,218 2.551.776 RAY nar JOE 1800 1800 1800 0 Assets equity debt operating income interest net income 1000 800 250 250 Sales 4.743,823 & cocs 1.200.000 GP Op. Exp. 523.854 Depr 100.000 EBIT 2.879.969 Div. + 6.750 Tax. Income 2.886.71 250 170Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started