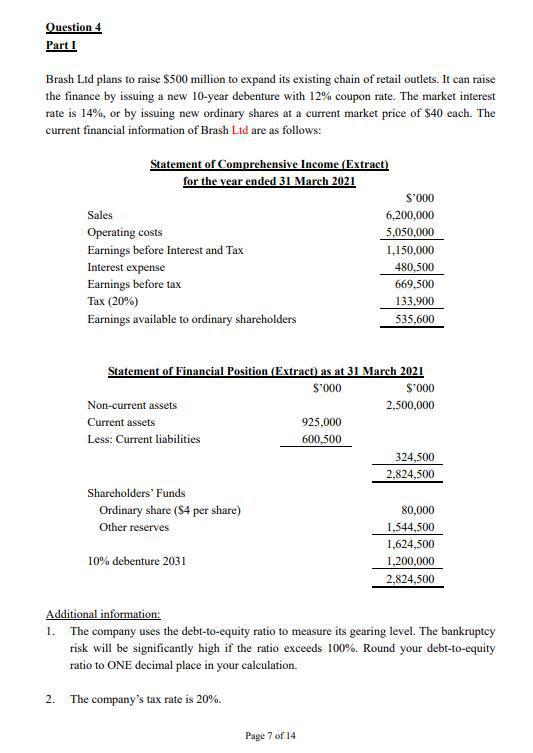

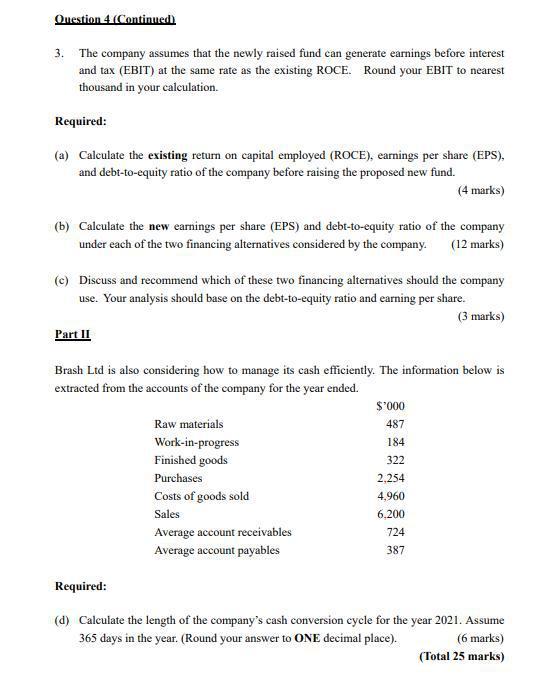

Question 4 Part 1 Brash Ltd plans to raise $500 million to expand its existing chain of retail outlets. It can raise the finance by issuing a new 10-year debenture with 12% coupon rate. The market interest rate is 14%, or by issuing new ordinary shares at a current market price of $40 each. The current financial information of Brash Ltd are as follows: Statement of Comprehensive Income (Extract) for the year ended 31 March 2021 S'000 Sales 6,200,000 Operating costs 5,050,000 Earnings before Interest and Tax 1,150,000 Interest expense 480,500 Earnings before tax 669,500 Tax (20%) 133,900 Earnings available to ordinary shareholders 535,600 Statement of Financial Position (Extract) as at 31 March 2021 $'000 $'000 Non-current assets 2,500,000 Current assets 925,000 Less: Current liabilities 600,500 324,500 2,824,500 Shareholders' Funds Ordinary share (94 per share) 80,000 Other reserves 1,544,500 1,624,500 10% debenture 2031 1,200,000 2,824,500 Additional information: 1. The company uses the debt-to-equity ratio to measure its gearing level. The bankruptcy risk will be significantly high if the ratio exceeds 100%. Round your debt-to-equity ratio to ONE decimal place in your calculation. 2. The company's tax rate is 20%. Page 7 of 14 Question 4 (Continued 3. The company assumes that the newly raised fund can generate earnings before interest and tax (EBIT) at the same rate as the existing ROCE. Round your EBIT to nearest thousand in your calculation Required: (a) Calculate the existing return on capital employed (ROCE), earnings per share (EPS), and debt-to-equity ratio of the company before raising the proposed new fund. (4 marks) (b) Calculate the new earnings per share (EPS) and debt-to-equity ratio of the company under each of the two financing alternatives considered by the company. (12 marks) (c) Discuss and recommend which of these two financing alternatives should the company use. Your analysis should base on the debt-to-equity ratio and earning per share. (3 marks) Part II 184 Brash Ltd is also considering how to manage its cash efficiently. The information below is extracted from the accounts of the company for the year ended. $'000 Raw materials 487 Work-in-progress Finished goods 322 Purchases 2,254 Costs of goods sold 4,960 Sales 6.200 Average account receivables 724 Average account payables 387 Required: (d) Calculate the length of the company's cash conversion cycle for the year 2021. Assume 365 days in the year. (Round your answer to ONE decimal place). (6 marks) (Total 25 marks)