Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Please assist with question 4 rate of return for the shares was 15%. Josephine wants to sell these shares to pay for her

Question 4 Please assist with question 4

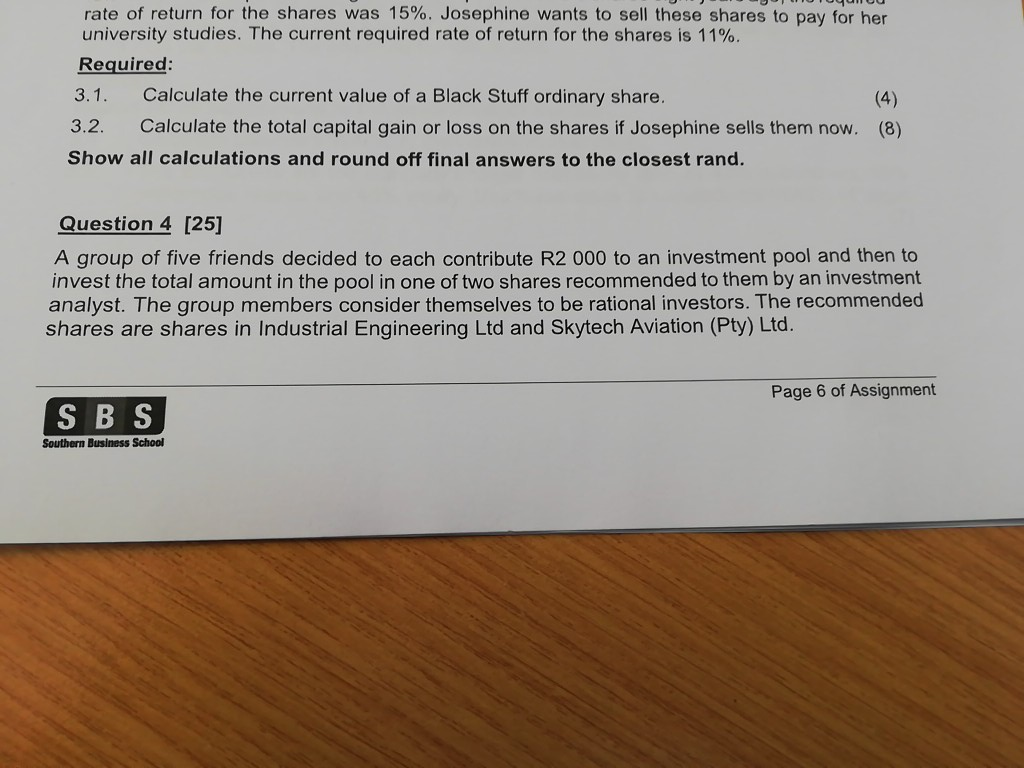

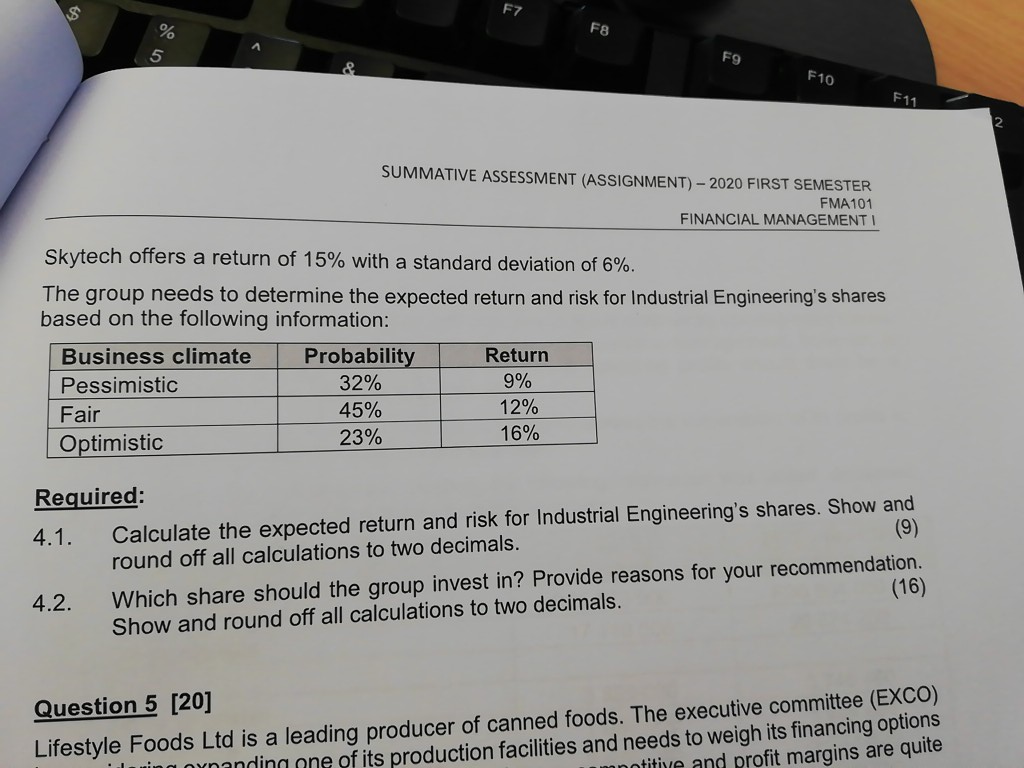

rate of return for the shares was 15%. Josephine wants to sell these shares to pay for her university studies. The current required rate of return for the shares is 11%. Required: 3.1. Calculate the current value of a Black Stuff ordinary share. (4) 3.2. Calculate the total capital gain or loss on the shares if Josephine sells them now. (8) Show all calculations and round off final answers to the closest rand. Question 4 [25] A group of five friends decided to each contribute R2 000 to an investment pool and then to invest the total amount in the pool in one of two shares recommended to them by an investment analyst. The group members consider themselves to be rational investors. The recommended shares are shares in Industrial Engineering Ltd and Skytech Aviation (Pty) Ltd. Page 6 of Assignment SBS Southern Business School F7 18 F8 5 F9 F10 F11 SUMMATIVE ASSESSMENT (ASSIGNMENT) - 2020 FIRST SEMESTER FMA 101 FINANCIAL MANAGEMENT I Skytech offers a return of 15% with a standard deviation of 6%. The group needs to determine the expected return and risk for Industrial Engineering's shares based on the following information: Business climate Probability Return Pessimistic 32% 9% Fair 45% 12% Optimistic 23% 16% Required: 4.1. Calculate the expected return and risk for Industrial Engineering's shares. Show and round off all calculations to two decimals. (9) 4.2. Which share should the group invest in? Provide reasons for your recommendation. Show and round off all calculations to two decimals. (16) Question 5 [20] Lifestyle Foods Ltd is a leading producer of canned foods. The executive committee (EXCO) mina nynondina nne of its production facilities and needs to weigh its financing options notitive and profit margins are quiteStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started