Question #4 please can be handwritten or Microsoft word thanks. Need to show work. Exhibits 9 attached.

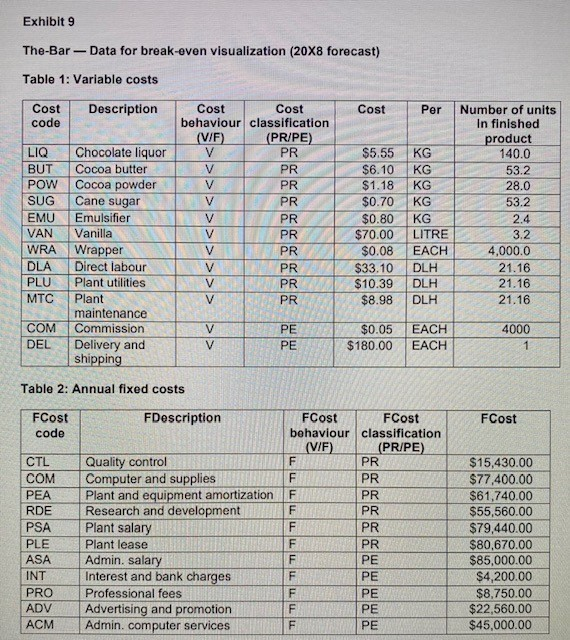

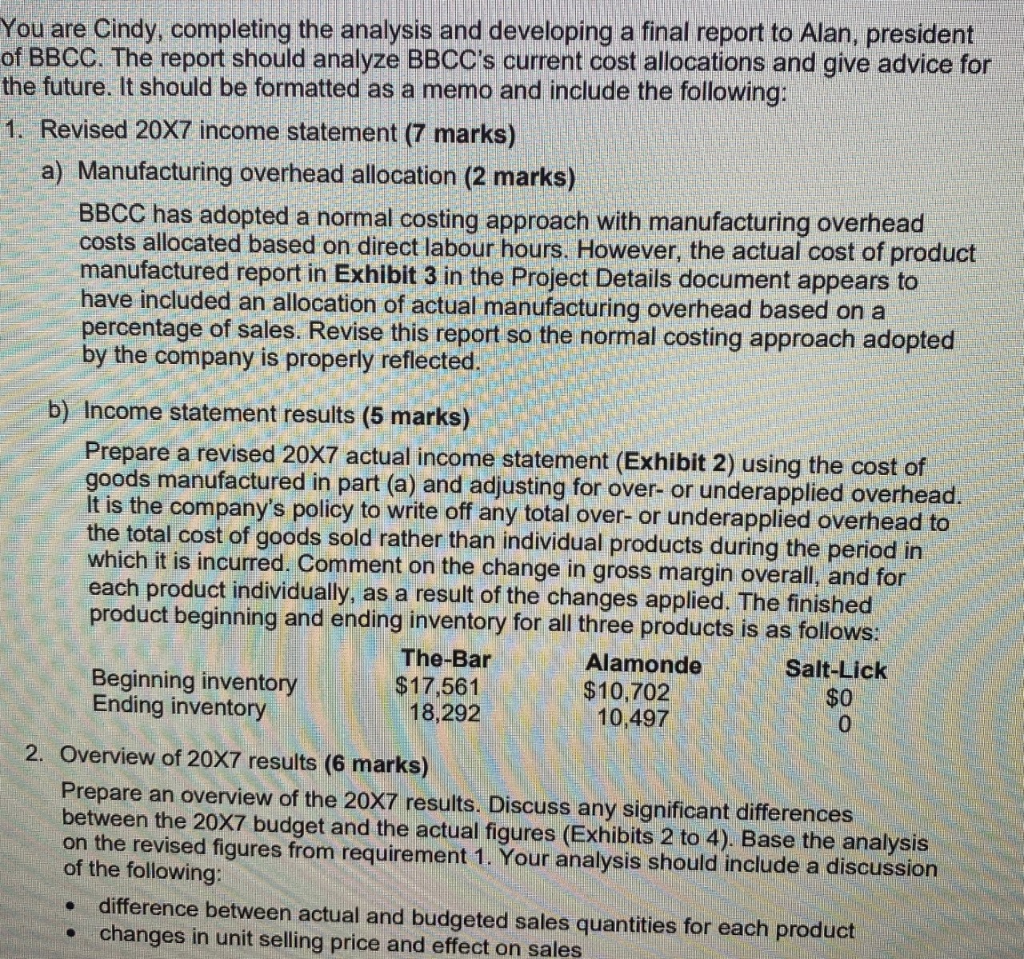

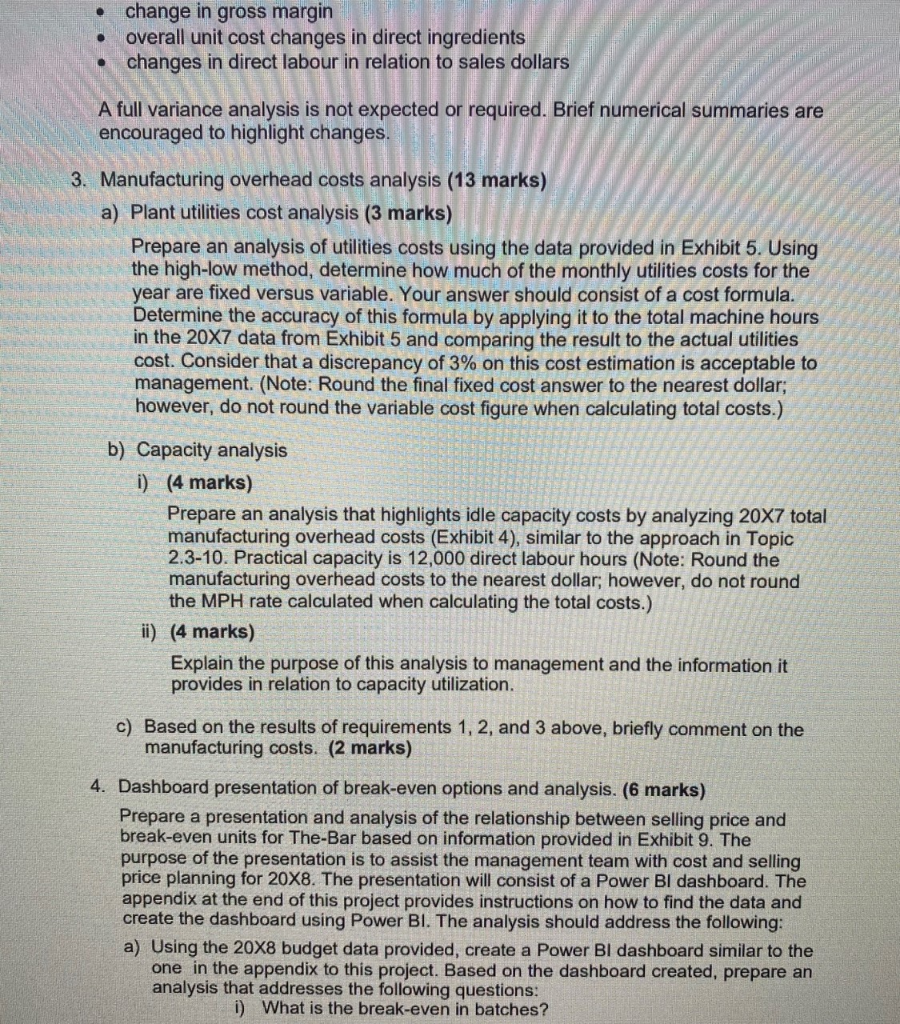

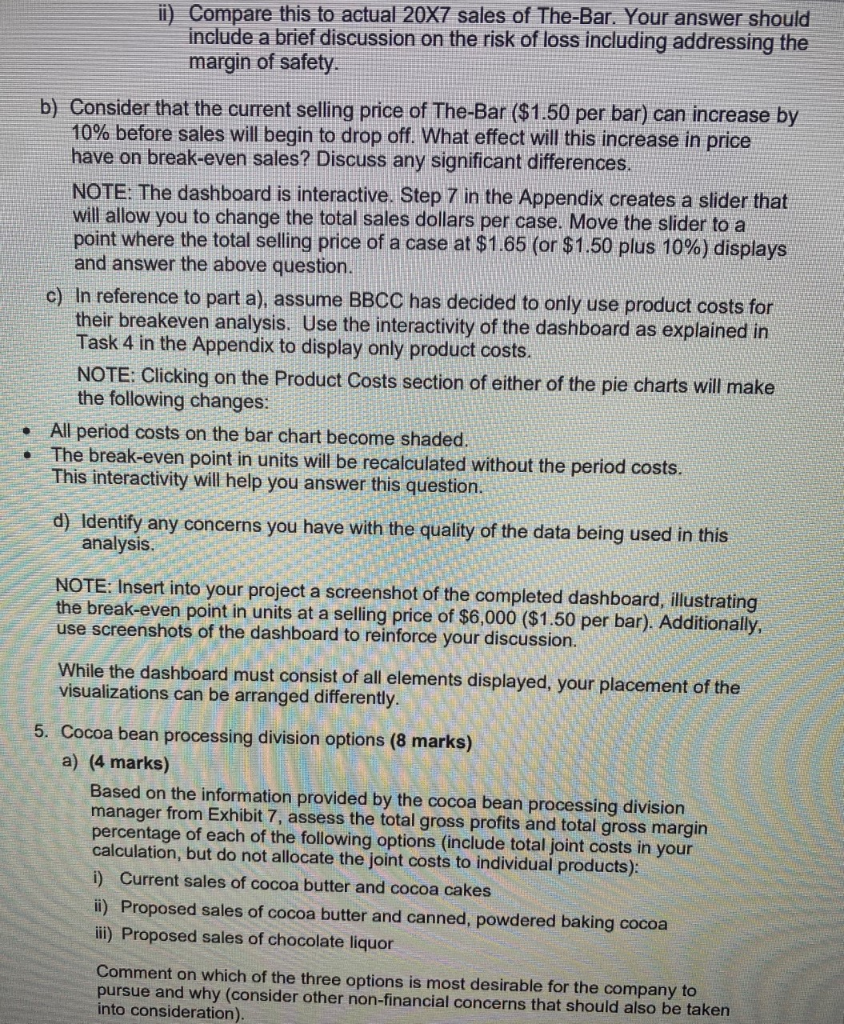

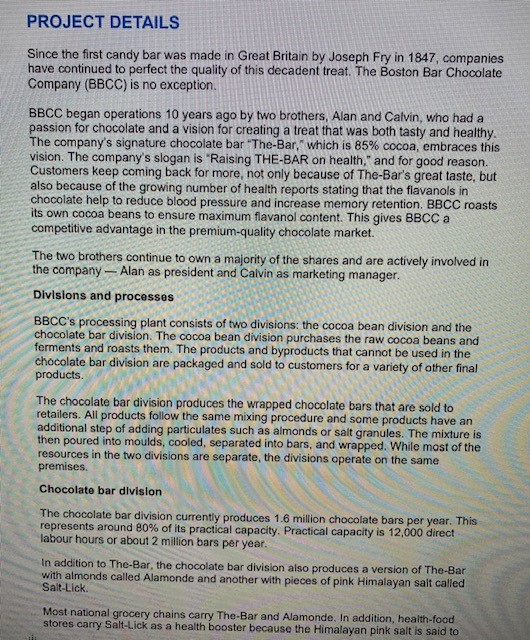

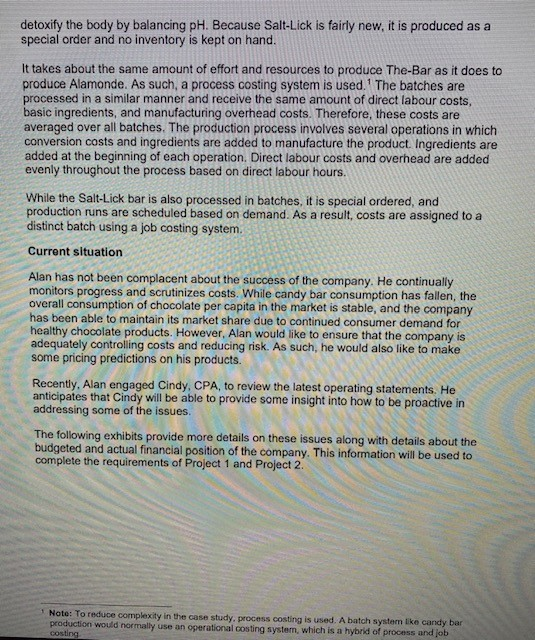

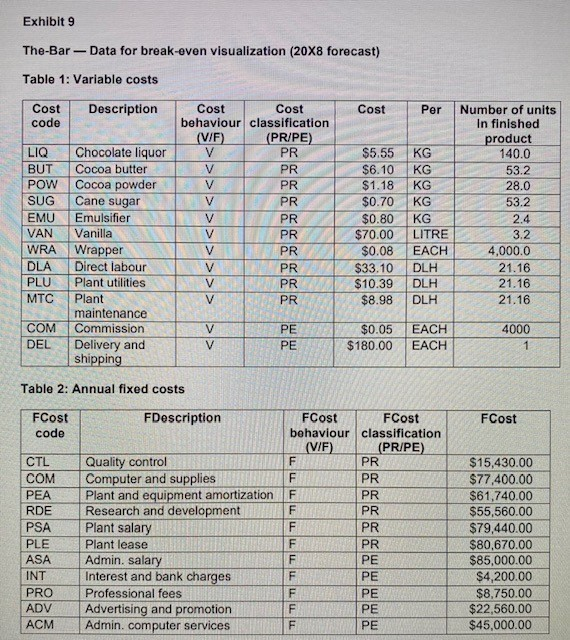

You are Cindy, completing the analysis and developing a final report to Alan, president of BBCC. The report should analyze BBCC's current cost allocations and give advice for the future. It should be formatted as a memo and include the following: 1. Revised 20X7 income statement (7 marks) a) Manufacturing overhead allocation (2 marks) BBCC has adopted a normal costing approach with manufacturing overhead costs allocated based on direct labour hours. However, the actual cost of product manufactured report in Exhibit 3 in the Project Details document appears to have included an allocation of actual manufacturing overhead based on a percentage of sales. Revise this report so the normal costing approach adopted by the company is properly reflected. b) Income statement results (5 marks) Prepare a revised 20X7 actual income statement (Exhibit 2) using the cost of goods manufactured in part (a) and adjusting for over- or underapplied overhead. It is the company's policy to write off any total over- or underapplied overhead to the total cost of goods sold rather than individual products during the period in which it is incurred. Comment on the change in gross margin overall, and for each product individually, as a result of the changes applied. The finished product beginning and ending inventory for all three products is as follows: The-Bar Alamonde Salt-Lick Beginning inventory $17,561 $10,702 $0 Ending inventory 18,292 10,497 2. Overview of 20X7 results (6 marks) Prepare an overview of the 20x7 results. Discuss any significant differences between the 20x7 budget and the actual figures (Exhibits 2 to 4). Base the analysis on the revised figures from requirement 1. Your analysis should include a discussion of the following: difference between actual and budgeted sales quantities for each product changes in unit selling price and effect on sales . . . change in gross margin overall unit cost changes in direct ingredients changes in direct labour in relation to sales dollars A full variance analysis is not expected or required. Brief numerical summaries are encouraged to highlight changes. 3. Manufacturing overhead costs analysis (13 marks) a) Plant utilities cost analysis (3 marks) Prepare an analysis of utilities costs using the data provided in Exhibit 5. Using the high-low method, determine how much of the monthly utilities costs for the year are fixed versus variable. Your answer should consist of a cost formula. Determine the accuracy of this formula by applying it to the total machine hours in the 20X7 data from Exhibit 5 and comparing the result to the actual utilities cost. Consider that a discrepancy of 3% on this cost estimation is acceptable to management. (Note: Round the final fixed cost answer to the nearest dollar; however, do not round the variable cost figure when calculating total costs.) b) Capacity analysis i) (4 marks) Prepare an analysis that highlights idle capacity costs by analyzing 20x7 total manufacturing overhead costs (Exhibit 4), similar to the approach in Topic 2.3-10. Practical capacity is 12,000 direct labour hours (Note: Round the manufacturing overhead costs to the nearest dollar; however, do not round the MPH rate calculated when calculating the total costs.) ii) (4 marks) Explain the purpose of this analysis to management and the information it provides in relation to capacity utilization. c) Based on the results of requirements 1, 2, and 3 above, briefly comment on the manufacturing costs. (2 marks) 4. Dashboard presentation of break-even options and analysis. (6 marks) Prepare a presentation and analysis of the relationship between selling price and break-even units for The-Bar based on information provided in Exhibit 9. The purpose of the presentation is to assist the management team with cost and selling price planning for 20X8. The presentation will consist of a Power BI dashboard. The appendix at the end of this project provides instructions on how to find the data and create the dashboard using Power BI. The analysis should address the following: a) Using the 20X8 budget data provided, create a Power BI dashboard similar to the one in the appendix to this project. Based on the dashboard created, prepare an analysis that addresses the following questions: i) What is the break-even in batches? ii) Compare this to actual 20X7 sales of The-Bar. Your answer should include a brief discussion on the risk of loss including addressing the margin of safety. b) Consider that the current selling price of The-Bar ($1.50 per bar) can increase by 10% before sales will begin to drop off. What effect will this increase in price have on break-even sales? Discuss any significant differences. NOTE: The dashboard is interactive. Step 7 in the Appendix creates a slider that will allow you to change the total sales dollars per case. Move the slider to a point where the total selling price of a case $1.65 (or $1.50 plus 10%) displays and answer the above question. c) In reference to part a), assume BBCC has decided to only use product costs for their breakeven analysis. Use the interactivity of the dashboard as explained in Task 4 in the Appendix to display only product costs. NOTE: Clicking on the Product Costs section of either of the pie charts will make the following changes: All period costs on the bar chart become shaded. The break-even point in units will be recalculated without the period costs. This interactivity will help you answer this question. d) Identify any concerns you have with the quality of the data being used in this analysis. . NOTE: Insert into your project a screenshot of the completed dashboard, illustrating the break-even point in units at a selling price of $6,000 ($1.50 per bar). Additionally, use screenshots of the dashboard to reinforce your discussion. While the dashboard must consist of all elements displayed, your placement of the visualizations can be arranged differently. 5. Cocoa bean processing division options (8 marks) a) (4 marks) Based on the information provided by the cocoa bean processing division manager from Exhibit 7, assess the total gross profits and total gross margin percentage of each of the following options (include total joint costs in your calculation, but do not allocate the joint costs to individual products): i) Current sales of cocoa butter and cocoa cakes ii) Proposed sales of cocoa butter and canned, powdered baking cocoa iii) Proposed sales of chocolate liquor Comment on which of the three options is most desirable for the company to pursue and why (consider other non-financial concerns that should also be taken into consideration). PROJECT DETAILS Since the first candy bar was made in Great Britain by Joseph Fry in 1847, companies have continued to perfect the quality of this decadent treat. The Boston Bar Chocolate Company (BBCC) is no exception. BBCC began operations 10 years ago by two brothers, Alan and Calvin, who had a passion for chocolate and a vision for creating a treat that was both tasty and healthy. is vision. The company's slogan is "Raising THE-BAR on health," and for good reason. Customers keep coming back for more, not only because of The-Bar's great taste, but also because of the growing number of health reports stating that the flavanols in chocolate help to reduce blood pressure and increase memory retention. BBCC roasts its own cocoa beans to ensure maximum flavanol content. This gives BBCC a competitive advantage in the premium-quality chocolate market. The two brothers continue to own a majority of the shares and are actively involved in the company - Alan as president and Calvin as marketing manager. Divisions and processes BBCC's processing plant consists of two divisions: the cocoa bean division and the chocolate bar division. The cocoa bean division purchases the raw cocoa beans and ferments and roasts them. The products and byproducts that cannot be used in the chocolate bar division are packaged and sold to customers for a variety of other final products. The chocolate bar division produces the wrapped chocolate bars that are sold to retailers. All products follow the same mixing procedure and some products have an additional step of adding particulates such as almonds or salt granules. The mixture is then poured into moulds, cooled, separated into bars, and wrapped. While most of the resources in the two divisions are separate, the divisions operate on the same premises. Chocolate bar division The chocolate bar division currently produces 1.6 million chocolate bars per year. This represents around 80% of its practical capacity. Practical capacity is 12,000 direct labour hours or about 2 million bars per year. In addition to The-Bar, the chocolate bar division also produces a version of The-Bar with almonds called Alamonde and another with pieces of pink Himalayan salt called Salt-Lick. Most national grocery chains carry The-Bar and Alamonde. In addition, health-food stores carry Salt-Lick as a health booster because the Himalayan pink salt is said to detoxify the body by balancing pH. Because Salt-Lick is fairly new, it is produced as a special order and no inventory is kept on hand. It takes about the same amount of effort and resources to produce The-Bar as it does to produce Alamonde. As such, a process costing system is used. The batches are processed in a similar manner and receive the same amount of direct labour costs, basic ingredients, and manufacturing overhead costs. Therefore, these costs are averaged over all batches. The production process involves several operations in which conversion costs and ingredients are added to manufacture the product. Ingredients are added at the beginning of each operation. Direct labour costs and overhead are added evenly throughout the process based on direct labour hours. While the Salt-Lick bar is also processed in batches, it is special ordered, and production runs are scheduled based on demand. As a result, costs are assigned to a distinct batch using a job costing system. Current situation Alan has not been complacent about the success of the company. He continually monitors progress and scrutinizes costs. While candy bar consumption has fallen, the overall consumption of chocolate per capita in the market is stable, and the company has been able to maintain its market share due to continued consumer demand for healthy chocolate products. However, Alan would like to ensure that the company is adequately controlling costs and reducing risk. As such, he would also like to make some pricing predictions on his products. Recently, Alan engaged Cindy, CPA, to review the latest operating statements. He anticipates that Cindy will be able to provide some insight into how to be proactive in addressing some of the issues. The following exhibits provide more details on these issues along with details about the budgeted and actual financial position of the company. This information will be used to complete the requirements of Project 1 and Project 2 Note: To reduce complexity in the case study, process costing is used. A batch system like candy bar production would normally use an operational costing system, which is a hybrid of process and job costing Exhibit 9 The-Bar - Data for break-even visualization (20X8 forecast) Table 1: Variable costs Description Cost Cost code Per LIQ Chocolate liquor BUT Cocoa butter POW Cocoa powder SUG Cane sugar EMU Emulsifier VAN Vanilla WRA Wrapper DLA Direct labour PLU Plant utilities MTC Plant maintenance COM Commission DEL Delivery and shipping Cost Cost behaviour classification (V/F) (PR/PE) V PR V PR V PR V PR V PR V PR V PR V PR V PR V PR $5.55 $6.10 $1.18 $0.70 $0.80 $70.00 $0.08 $33.10 $10.39 $8.98 KG KG KG KG KG LITRE EACH DLH DLH DLH Number of units In finished product 140.0 53.2 28.0 53.2 2.4 3.2 4,000.0 21.16 21.16 21.16 V V PE PE $0.05 $180.00 EACH EACH 4000 1 Table 2: Annual fixed costs FCost code FCost FDescription FCost FCost behaviour classification (V/F) (PR/PE) Quality control F PR Computer and supplies F PR Plant and equipment amortization F PR Research and development PR Plant salary F PR Plant lease PR Admin. salary PE Interest and bank charges PE Professional fees F PE Advertising and promotion PE Admin. computer services F PE CTL COM PEA RDE PSA PLE ASA INT PRO ADV ACM $15,430.00 $77,400.00 $61,740.00 $55,560.00 $79,440.00 $80,670.00 $85,000.00 $4,200.00 $8,750.00 $22,560.00 $45,000.00 You are Cindy, completing the analysis and developing a final report to Alan, president of BBCC. The report should analyze BBCC's current cost allocations and give advice for the future. It should be formatted as a memo and include the following: 1. Revised 20X7 income statement (7 marks) a) Manufacturing overhead allocation (2 marks) BBCC has adopted a normal costing approach with manufacturing overhead costs allocated based on direct labour hours. However, the actual cost of product manufactured report in Exhibit 3 in the Project Details document appears to have included an allocation of actual manufacturing overhead based on a percentage of sales. Revise this report so the normal costing approach adopted by the company is properly reflected. b) Income statement results (5 marks) Prepare a revised 20X7 actual income statement (Exhibit 2) using the cost of goods manufactured in part (a) and adjusting for over- or underapplied overhead. It is the company's policy to write off any total over- or underapplied overhead to the total cost of goods sold rather than individual products during the period in which it is incurred. Comment on the change in gross margin overall, and for each product individually, as a result of the changes applied. The finished product beginning and ending inventory for all three products is as follows: The-Bar Alamonde Salt-Lick Beginning inventory $17,561 $10,702 $0 Ending inventory 18,292 10,497 2. Overview of 20X7 results (6 marks) Prepare an overview of the 20x7 results. Discuss any significant differences between the 20x7 budget and the actual figures (Exhibits 2 to 4). Base the analysis on the revised figures from requirement 1. Your analysis should include a discussion of the following: difference between actual and budgeted sales quantities for each product changes in unit selling price and effect on sales . . . change in gross margin overall unit cost changes in direct ingredients changes in direct labour in relation to sales dollars A full variance analysis is not expected or required. Brief numerical summaries are encouraged to highlight changes. 3. Manufacturing overhead costs analysis (13 marks) a) Plant utilities cost analysis (3 marks) Prepare an analysis of utilities costs using the data provided in Exhibit 5. Using the high-low method, determine how much of the monthly utilities costs for the year are fixed versus variable. Your answer should consist of a cost formula. Determine the accuracy of this formula by applying it to the total machine hours in the 20X7 data from Exhibit 5 and comparing the result to the actual utilities cost. Consider that a discrepancy of 3% on this cost estimation is acceptable to management. (Note: Round the final fixed cost answer to the nearest dollar; however, do not round the variable cost figure when calculating total costs.) b) Capacity analysis i) (4 marks) Prepare an analysis that highlights idle capacity costs by analyzing 20x7 total manufacturing overhead costs (Exhibit 4), similar to the approach in Topic 2.3-10. Practical capacity is 12,000 direct labour hours (Note: Round the manufacturing overhead costs to the nearest dollar; however, do not round the MPH rate calculated when calculating the total costs.) ii) (4 marks) Explain the purpose of this analysis to management and the information it provides in relation to capacity utilization. c) Based on the results of requirements 1, 2, and 3 above, briefly comment on the manufacturing costs. (2 marks) 4. Dashboard presentation of break-even options and analysis. (6 marks) Prepare a presentation and analysis of the relationship between selling price and break-even units for The-Bar based on information provided in Exhibit 9. The purpose of the presentation is to assist the management team with cost and selling price planning for 20X8. The presentation will consist of a Power BI dashboard. The appendix at the end of this project provides instructions on how to find the data and create the dashboard using Power BI. The analysis should address the following: a) Using the 20X8 budget data provided, create a Power BI dashboard similar to the one in the appendix to this project. Based on the dashboard created, prepare an analysis that addresses the following questions: i) What is the break-even in batches? ii) Compare this to actual 20X7 sales of The-Bar. Your answer should include a brief discussion on the risk of loss including addressing the margin of safety. b) Consider that the current selling price of The-Bar ($1.50 per bar) can increase by 10% before sales will begin to drop off. What effect will this increase in price have on break-even sales? Discuss any significant differences. NOTE: The dashboard is interactive. Step 7 in the Appendix creates a slider that will allow you to change the total sales dollars per case. Move the slider to a point where the total selling price of a case $1.65 (or $1.50 plus 10%) displays and answer the above question. c) In reference to part a), assume BBCC has decided to only use product costs for their breakeven analysis. Use the interactivity of the dashboard as explained in Task 4 in the Appendix to display only product costs. NOTE: Clicking on the Product Costs section of either of the pie charts will make the following changes: All period costs on the bar chart become shaded. The break-even point in units will be recalculated without the period costs. This interactivity will help you answer this question. d) Identify any concerns you have with the quality of the data being used in this analysis. . NOTE: Insert into your project a screenshot of the completed dashboard, illustrating the break-even point in units at a selling price of $6,000 ($1.50 per bar). Additionally, use screenshots of the dashboard to reinforce your discussion. While the dashboard must consist of all elements displayed, your placement of the visualizations can be arranged differently. 5. Cocoa bean processing division options (8 marks) a) (4 marks) Based on the information provided by the cocoa bean processing division manager from Exhibit 7, assess the total gross profits and total gross margin percentage of each of the following options (include total joint costs in your calculation, but do not allocate the joint costs to individual products): i) Current sales of cocoa butter and cocoa cakes ii) Proposed sales of cocoa butter and canned, powdered baking cocoa iii) Proposed sales of chocolate liquor Comment on which of the three options is most desirable for the company to pursue and why (consider other non-financial concerns that should also be taken into consideration). PROJECT DETAILS Since the first candy bar was made in Great Britain by Joseph Fry in 1847, companies have continued to perfect the quality of this decadent treat. The Boston Bar Chocolate Company (BBCC) is no exception. BBCC began operations 10 years ago by two brothers, Alan and Calvin, who had a passion for chocolate and a vision for creating a treat that was both tasty and healthy. is vision. The company's slogan is "Raising THE-BAR on health," and for good reason. Customers keep coming back for more, not only because of The-Bar's great taste, but also because of the growing number of health reports stating that the flavanols in chocolate help to reduce blood pressure and increase memory retention. BBCC roasts its own cocoa beans to ensure maximum flavanol content. This gives BBCC a competitive advantage in the premium-quality chocolate market. The two brothers continue to own a majority of the shares and are actively involved in the company - Alan as president and Calvin as marketing manager. Divisions and processes BBCC's processing plant consists of two divisions: the cocoa bean division and the chocolate bar division. The cocoa bean division purchases the raw cocoa beans and ferments and roasts them. The products and byproducts that cannot be used in the chocolate bar division are packaged and sold to customers for a variety of other final products. The chocolate bar division produces the wrapped chocolate bars that are sold to retailers. All products follow the same mixing procedure and some products have an additional step of adding particulates such as almonds or salt granules. The mixture is then poured into moulds, cooled, separated into bars, and wrapped. While most of the resources in the two divisions are separate, the divisions operate on the same premises. Chocolate bar division The chocolate bar division currently produces 1.6 million chocolate bars per year. This represents around 80% of its practical capacity. Practical capacity is 12,000 direct labour hours or about 2 million bars per year. In addition to The-Bar, the chocolate bar division also produces a version of The-Bar with almonds called Alamonde and another with pieces of pink Himalayan salt called Salt-Lick. Most national grocery chains carry The-Bar and Alamonde. In addition, health-food stores carry Salt-Lick as a health booster because the Himalayan pink salt is said to detoxify the body by balancing pH. Because Salt-Lick is fairly new, it is produced as a special order and no inventory is kept on hand. It takes about the same amount of effort and resources to produce The-Bar as it does to produce Alamonde. As such, a process costing system is used. The batches are processed in a similar manner and receive the same amount of direct labour costs, basic ingredients, and manufacturing overhead costs. Therefore, these costs are averaged over all batches. The production process involves several operations in which conversion costs and ingredients are added to manufacture the product. Ingredients are added at the beginning of each operation. Direct labour costs and overhead are added evenly throughout the process based on direct labour hours. While the Salt-Lick bar is also processed in batches, it is special ordered, and production runs are scheduled based on demand. As a result, costs are assigned to a distinct batch using a job costing system. Current situation Alan has not been complacent about the success of the company. He continually monitors progress and scrutinizes costs. While candy bar consumption has fallen, the overall consumption of chocolate per capita in the market is stable, and the company has been able to maintain its market share due to continued consumer demand for healthy chocolate products. However, Alan would like to ensure that the company is adequately controlling costs and reducing risk. As such, he would also like to make some pricing predictions on his products. Recently, Alan engaged Cindy, CPA, to review the latest operating statements. He anticipates that Cindy will be able to provide some insight into how to be proactive in addressing some of the issues. The following exhibits provide more details on these issues along with details about the budgeted and actual financial position of the company. This information will be used to complete the requirements of Project 1 and Project 2 Note: To reduce complexity in the case study, process costing is used. A batch system like candy bar production would normally use an operational costing system, which is a hybrid of process and job costing Exhibit 9 The-Bar - Data for break-even visualization (20X8 forecast) Table 1: Variable costs Description Cost Cost code Per LIQ Chocolate liquor BUT Cocoa butter POW Cocoa powder SUG Cane sugar EMU Emulsifier VAN Vanilla WRA Wrapper DLA Direct labour PLU Plant utilities MTC Plant maintenance COM Commission DEL Delivery and shipping Cost Cost behaviour classification (V/F) (PR/PE) V PR V PR V PR V PR V PR V PR V PR V PR V PR V PR $5.55 $6.10 $1.18 $0.70 $0.80 $70.00 $0.08 $33.10 $10.39 $8.98 KG KG KG KG KG LITRE EACH DLH DLH DLH Number of units In finished product 140.0 53.2 28.0 53.2 2.4 3.2 4,000.0 21.16 21.16 21.16 V V PE PE $0.05 $180.00 EACH EACH 4000 1 Table 2: Annual fixed costs FCost code FCost FDescription FCost FCost behaviour classification (V/F) (PR/PE) Quality control F PR Computer and supplies F PR Plant and equipment amortization F PR Research and development PR Plant salary F PR Plant lease PR Admin. salary PE Interest and bank charges PE Professional fees F PE Advertising and promotion PE Admin. computer services F PE CTL COM PEA RDE PSA PLE ASA INT PRO ADV ACM $15,430.00 $77,400.00 $61,740.00 $55,560.00 $79,440.00 $80,670.00 $85,000.00 $4,200.00 $8,750.00 $22,560.00 $45,000.00