Question 4 Please round your answers to the nearest whole number (no decimals)! BERN is a Belgian company that was founded many years ago. It decides to incorporate a subsidiary in January 2022. You are the CFO of BERN and it is your responsibility to write the financial plan for the subsidiary based on the following elements: Incorporation date: January 2022 Initial investment: 45 000 (the investment takes place in 2022) Sales year 1 (2022): 272 000. Expected growth rate of the turnover: 4.7% per year Salaries: 12% of the turnover Purchases of raw materials: 43 900 the first year then 2.1% growth per year Monthly rent: 2 000, in 2022 then 2% growth per year Other operating expenses: 13% of sales Depreciation: linear in 5 years Working capital need: 10% of sales Corporate tax rate: 20%. You will establish the financial plan over a period of 3 years. You are not asked to value the company. You are only required to present the financial plan.

Question 4 Please round your answers to the nearest whole number (no decimals)! BERN is a Belgian company that was founded many years ago. It decides to incorporate a subsidiary in January 2022. You are the CFO of BERN and it is your responsibility to write the financial plan for the subsidiary based on the following elements: Incorporation date: January 2022 Initial investment: 45 000 (the investment takes place in 2022) Sales year 1 (2022): 272 000. Expected growth rate of the turnover: 4.7% per year Salaries: 12% of the turnover Purchases of raw materials: 43 900 the first year then 2.1% growth per year Monthly rent: 2 000, in 2022 then 2% growth per year Other operating expenses: 13% of sales Depreciation: linear in 5 years Working capital need: 10% of sales Corporate tax rate: 20%. You will establish the financial plan over a period of 3 years. You are not asked to value the company. You are only required to present the financial plan.

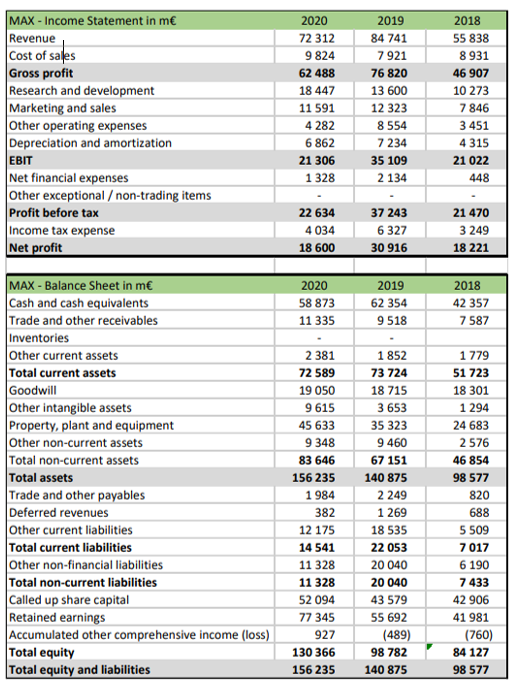

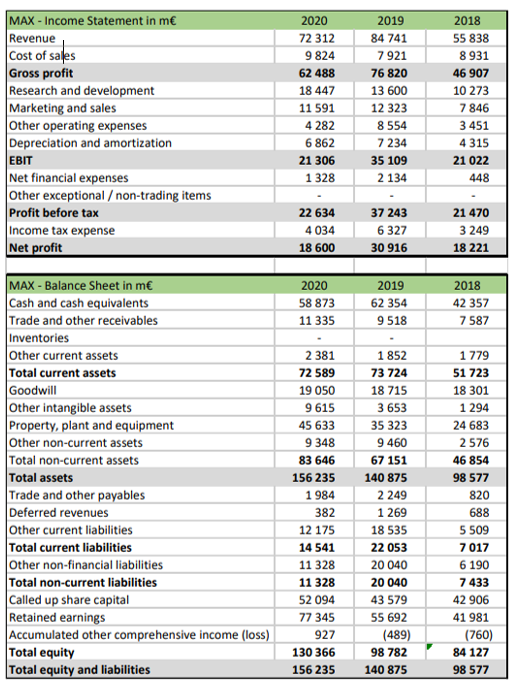

MAX - Income Statement in m Revenue Cost of salles Gross profit Research and development Marketing and sales Other operating expenses Depreciation and amortization EBIT Net financial expenses Other exceptional / non-trading items Profit before tax Income tax expense Net profit MAX - Balance Sheet in m Cash and cash equivalents Trade and other receivables Inventories Other current assets Total current assets Goodwill Other intangible assets Property, plant and equipment Other non-current assets Total non-current assets Total assets Trade and other payables Deferred revenues Other current liabilities Total current liabilities Other non-financial liabilities Total non-current liabilities Called up share capital Retained earnings Accumulated other comprehensive income (loss) Total equity Total equity and liabilities 2020 72 312 9 824 62 488 18 447 11 591 4 282 6 862 21 306 1328 22 634 4 034 18 600 2020 58 873 11 335 2 381 72 589 19 050 9 615 45 633 9 348 83 646 156 235 1984 382 12 175 14 541 11 328 11 328 52 094 77 345 927 130 366 156 235 2019 84 741 7921 76 820 13 600 12 323 8 554 7 234 35 109 2 134 37 243 6 327 30 916 2019 62 354 9 518 1 852 73 724 18 715 3 653 35 323 9 460 67 151 140 875 2 249 1269 18 535 22 053 20 040 20 040 43 579 55 692 (489) 98 782 140 875 2018 55 838 8 931 46 907 10 273 7846 3 451 4 315 21 022 448 21 470 3 249 18 221 2018 42 357 7 587 1779 51 723 18 301 1294 24 683 2576 46 854 98 577 820 688 5 509 7 017 6 190 7 433 42 906 41 981 (760) 84 127 98 577 MAX - Income Statement in m Revenue Cost of salles Gross profit Research and development Marketing and sales Other operating expenses Depreciation and amortization EBIT Net financial expenses Other exceptional / non-trading items Profit before tax Income tax expense Net profit MAX - Balance Sheet in m Cash and cash equivalents Trade and other receivables Inventories Other current assets Total current assets Goodwill Other intangible assets Property, plant and equipment Other non-current assets Total non-current assets Total assets Trade and other payables Deferred revenues Other current liabilities Total current liabilities Other non-financial liabilities Total non-current liabilities Called up share capital Retained earnings Accumulated other comprehensive income (loss) Total equity Total equity and liabilities 2020 72 312 9 824 62 488 18 447 11 591 4 282 6 862 21 306 1328 22 634 4 034 18 600 2020 58 873 11 335 2 381 72 589 19 050 9 615 45 633 9 348 83 646 156 235 1984 382 12 175 14 541 11 328 11 328 52 094 77 345 927 130 366 156 235 2019 84 741 7921 76 820 13 600 12 323 8 554 7 234 35 109 2 134 37 243 6 327 30 916 2019 62 354 9 518 1 852 73 724 18 715 3 653 35 323 9 460 67 151 140 875 2 249 1269 18 535 22 053 20 040 20 040 43 579 55 692 (489) 98 782 140 875 2018 55 838 8 931 46 907 10 273 7846 3 451 4 315 21 022 448 21 470 3 249 18 221 2018 42 357 7 587 1779 51 723 18 301 1294 24 683 2576 46 854 98 577 820 688 5 509 7 017 6 190 7 433 42 906 41 981 (760) 84 127 98 577

Question 4 Please round your answers to the nearest whole number (no decimals)! BERN is a Belgian company that was founded many years ago. It decides to incorporate a subsidiary in January 2022. You are the CFO of BERN and it is your responsibility to write the financial plan for the subsidiary based on the following elements: Incorporation date: January 2022 Initial investment: 45 000 (the investment takes place in 2022) Sales year 1 (2022): 272 000. Expected growth rate of the turnover: 4.7% per year Salaries: 12% of the turnover Purchases of raw materials: 43 900 the first year then 2.1% growth per year Monthly rent: 2 000, in 2022 then 2% growth per year Other operating expenses: 13% of sales Depreciation: linear in 5 years Working capital need: 10% of sales Corporate tax rate: 20%. You will establish the financial plan over a period of 3 years. You are not asked to value the company. You are only required to present the financial plan.

Question 4 Please round your answers to the nearest whole number (no decimals)! BERN is a Belgian company that was founded many years ago. It decides to incorporate a subsidiary in January 2022. You are the CFO of BERN and it is your responsibility to write the financial plan for the subsidiary based on the following elements: Incorporation date: January 2022 Initial investment: 45 000 (the investment takes place in 2022) Sales year 1 (2022): 272 000. Expected growth rate of the turnover: 4.7% per year Salaries: 12% of the turnover Purchases of raw materials: 43 900 the first year then 2.1% growth per year Monthly rent: 2 000, in 2022 then 2% growth per year Other operating expenses: 13% of sales Depreciation: linear in 5 years Working capital need: 10% of sales Corporate tax rate: 20%. You will establish the financial plan over a period of 3 years. You are not asked to value the company. You are only required to present the financial plan.