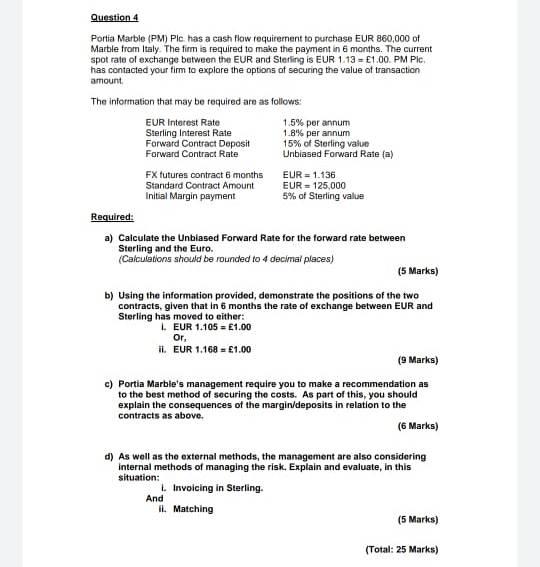

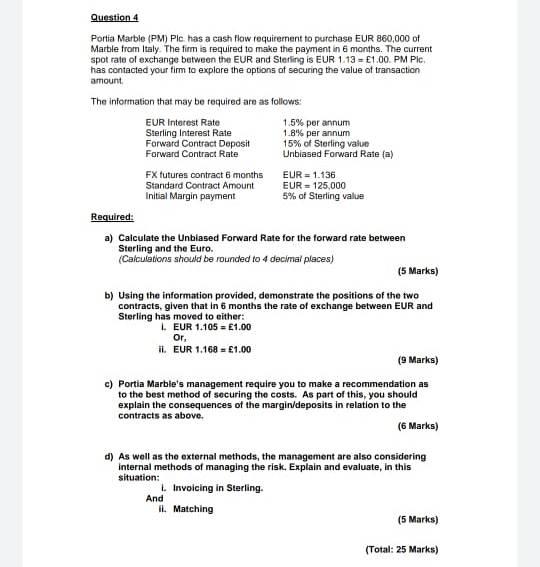

Question 4 Portia Marble (PM) Ple has a cash flow requirement to purchase EUR 860,000 of Marble from Italy The firm is required to make the payment in 6 months. The current spot rate of exchange between the EUR and Sterling is EUR 1.13 = 1.00 PM Plc. has contacted your firm to explore the options of securing the value of transaction amount The information that may be required are as follows: EUR Interest Rate Sterling Interest Rate Forward Contract Deposit Forward Contract Rate 1.5% per annum 1.8% per annum 15% of Sterling value Unbiased Forward Rate (a) FX futures contract 6 months Standard Contract Amount Initial Margin payment EUR = 1.136 EUR = 125,000 5% of Sterling value Required: a) Calculate the Unblased Forward Rate for the forward rate between Sterling and the Euro. (Calculations should be rounded to 4 decimal places) (5 Marks) b) Using the information provided, demonstrate the positions of the two contracts, given that in 6 months the rate of exchange between EUR and Sterling has moved to either: LEUR 1.105 = 1.00 Or 1. EUR 1.168 = 21.00 (9 Marks) c) Portia Marble's management require you to make a recommendation as to the best method of securing the costs. As part of this, you should explain the consequences of the margin/deposits in relation to the contracts as above. (6 Marks) d) As well as the external methods, the management are also considering Internal methods of managing the risk. Explain and evaluate, in this situation: L. Invoicing in Sterling Il Matching (5 Marks) And (Total: 25 Marks) Question 4 Portia Marble (PM) Ple has a cash flow requirement to purchase EUR 860,000 of Marble from Italy The firm is required to make the payment in 6 months. The current spot rate of exchange between the EUR and Sterling is EUR 1.13 = 1.00 PM Plc. has contacted your firm to explore the options of securing the value of transaction amount The information that may be required are as follows: EUR Interest Rate Sterling Interest Rate Forward Contract Deposit Forward Contract Rate 1.5% per annum 1.8% per annum 15% of Sterling value Unbiased Forward Rate (a) FX futures contract 6 months Standard Contract Amount Initial Margin payment EUR = 1.136 EUR = 125,000 5% of Sterling value Required: a) Calculate the Unblased Forward Rate for the forward rate between Sterling and the Euro. (Calculations should be rounded to 4 decimal places) (5 Marks) b) Using the information provided, demonstrate the positions of the two contracts, given that in 6 months the rate of exchange between EUR and Sterling has moved to either: LEUR 1.105 = 1.00 Or 1. EUR 1.168 = 21.00 (9 Marks) c) Portia Marble's management require you to make a recommendation as to the best method of securing the costs. As part of this, you should explain the consequences of the margin/deposits in relation to the contracts as above. (6 Marks) d) As well as the external methods, the management are also considering Internal methods of managing the risk. Explain and evaluate, in this situation: L. Invoicing in Sterling Il Matching (5 Marks) And (Total: 25 Marks)