Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 PP Land is a company doing a business of property development. Due to lack of its working capital, the financial statement of PP

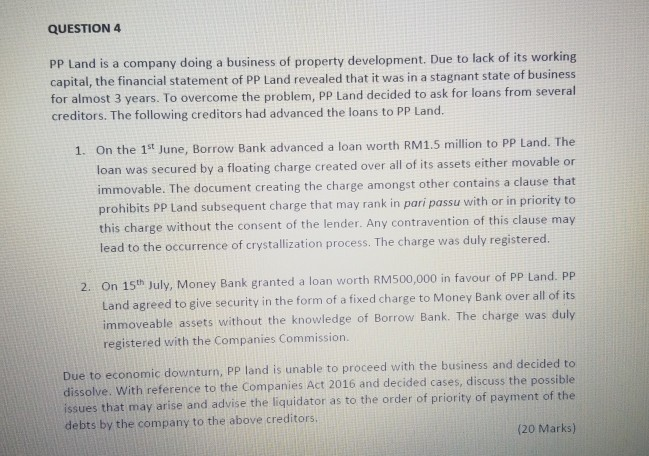

QUESTION 4 PP Land is a company doing a business of property development. Due to lack of its working capital, the financial statement of PP Land revealed that it was in a stagnant state of business for almost 3 years. To overcome the problem, PP Land decided to ask for loans from several creditors. The following creditors had advanced the loans to PP Land. 1. On the 1st June, Borrow Bank advanced a loan worth RM1.5 million to PP Land. The loan was secured by a floating charge created over all of its assets either movable or immovable. The document creating the charge amongst other contains a clause that prohibits PP Land subsequent charge that may rank in pari passu with or in priority to this charge without the consent of the lender. Any contravention of this clause may lead to the occurrence of crystallization process. The charge was duly registered. 2. On 15th July, Money Bank granted a loan worth RM500,000 in favour of PP Land. PP Land agreed to give security in the form of a fixed charge to Money Bank over all of its immoveable assets without the knowledge of Borrow Bank. The charge was duly registered with the Companies Commission. Due to economic downturn, PP land is unable to proceed with the business and decided to dissolve. With reference to the Companies Act 2016 and decided cases, discuss the possible issues that may arise and advise the liquidator as to the order of priority of payment of the debts by the company to the above creditors, (20 Marks) QUESTION 4 PP Land is a company doing a business of property development. Due to lack of its working capital, the financial statement of PP Land revealed that it was in a stagnant state of business for almost 3 years. To overcome the problem, PP Land decided to ask for loans from several creditors. The following creditors had advanced the loans to PP Land. 1. On the 1st June, Borrow Bank advanced a loan worth RM1.5 million to PP Land. The loan was secured by a floating charge created over all of its assets either movable or immovable. The document creating the charge amongst other contains a clause that prohibits PP Land subsequent charge that may rank in pari passu with or in priority to this charge without the consent of the lender. Any contravention of this clause may lead to the occurrence of crystallization process. The charge was duly registered. 2. On 15th July, Money Bank granted a loan worth RM500,000 in favour of PP Land. PP Land agreed to give security in the form of a fixed charge to Money Bank over all of its immoveable assets without the knowledge of Borrow Bank. The charge was duly registered with the Companies Commission. Due to economic downturn, PP land is unable to proceed with the business and decided to dissolve. With reference to the Companies Act 2016 and decided cases, discuss the possible issues that may arise and advise the liquidator as to the order of priority of payment of the debts by the company to the above creditors, (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started