Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 - PRESENTATION Terengganu Batik Sdn Bhd (TBSB) is a manufacturer of batik fabrics and textiles. Operating in Marang, Terengganu since 2010, it is

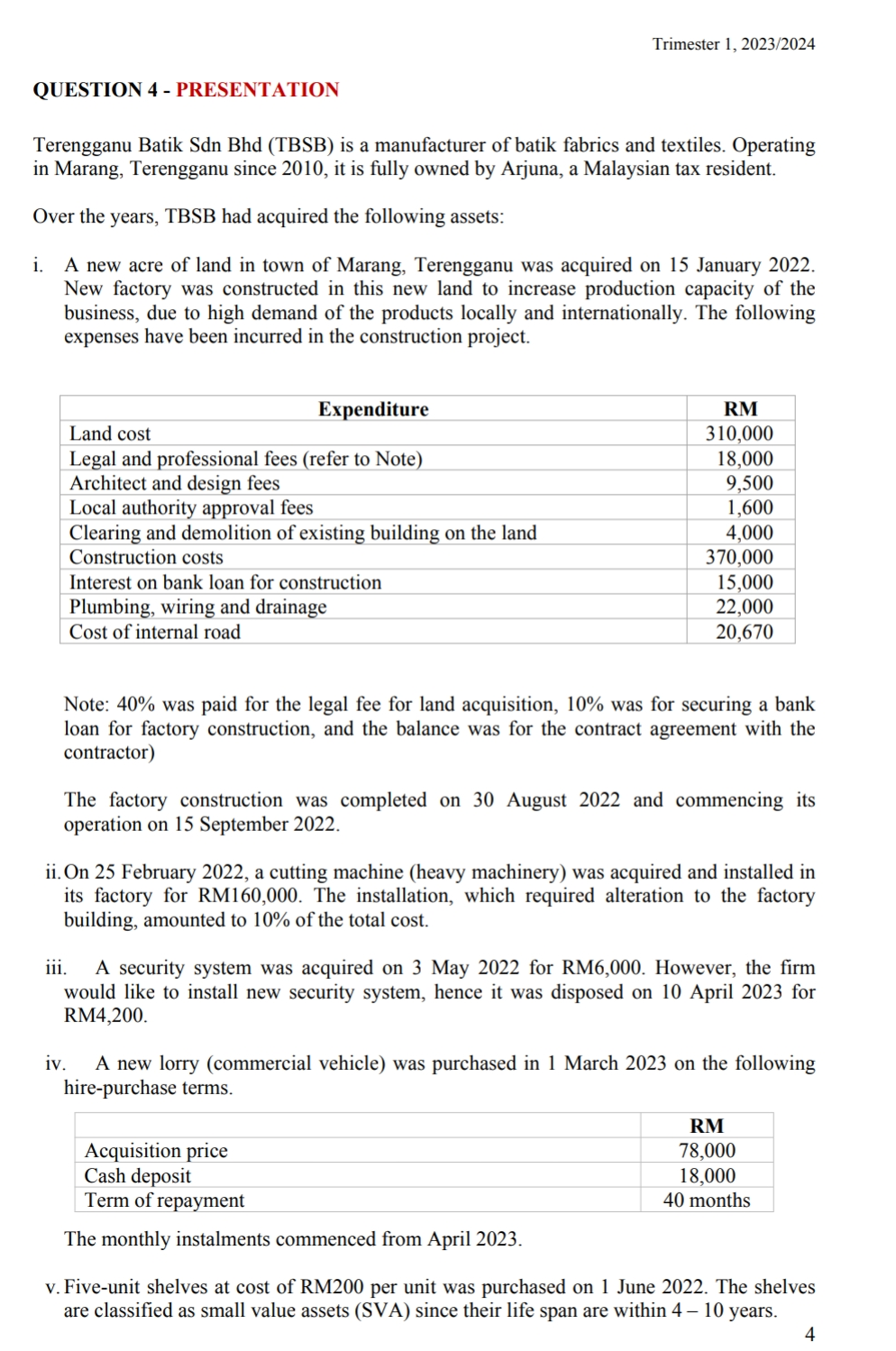

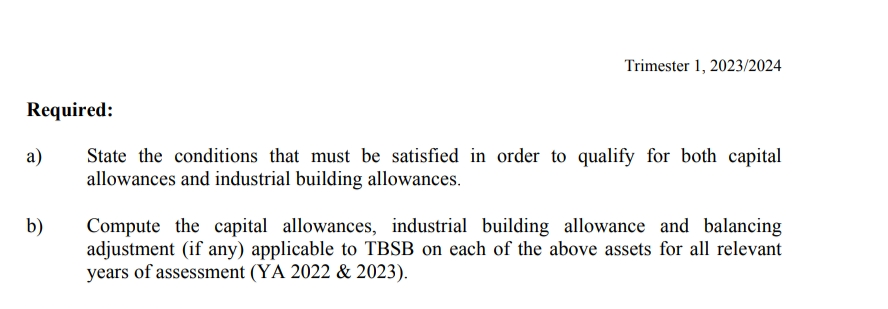

QUESTION 4 - PRESENTATION Terengganu Batik Sdn Bhd (TBSB) is a manufacturer of batik fabrics and textiles. Operating in Marang, Terengganu since 2010, it is fully owned by Arjuna, a Malaysian tax resident. Over the years, TBSB had acquired the following assets: i. A new acre of land in town of Marang, Terengganu was acquired on 15 January 2022. New factory was constructed in this new land to increase production capacity of the business, due to high demand of the products locally and internationally. The following expenses have been incurred in the construction project. Note: 40% was paid for the legal fee for land acquisition, 10% was for securing a bank loan for factory construction, and the balance was for the contract agreement with the contractor) The factory construction was completed on 30 August 2022 and commencing its operation on 15 September 2022. ii. On 25 February 2022, a cutting machine (heavy machinery) was acquired and installed in its factory for RM160,000. The installation, which required alteration to the factory building, amounted to 10% of the total cost. iii. A security system was acquired on 3 May 2022 for RM6,000. However, the firm would like to install new security system, hence it was disposed on 10 April 2023 for RM4,200. iv. A new lorry (commercial vehicle) was purchased in 1 March 2023 on the following hire-purchase terms. The monthly instalments commenced from April 2023. v. Five-unit shelves at cost of RM200 per unit was purchased on 1 June 2022. The shelves are classified as small value assets (SVA) since their life span are within 4-10 years. 4 Required: a) State the conditions that must be satisfied in order to qualify for both capital allowances and industrial building allowances. b) Compute the capital allowances, industrial building allowance and balancing adjustment (if any) applicable to TBSB on each of the above assets for all relevant years of assessment (YA 2022 \& 2023)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started