Answered step by step

Verified Expert Solution

Question

1 Approved Answer

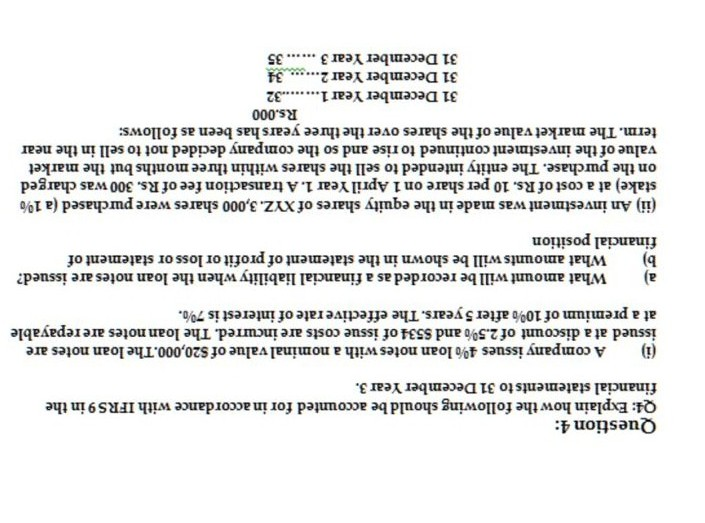

Question 4: Q4: Explain how the following should be accounted for in accordance with IFRS 9 in the financial statements to 31 December Year 3.

Question 4: Q4: Explain how the following should be accounted for in accordance with IFRS 9 in the financial statements to 31 December Year 3. A company issues 1% loan notes with a nominal value of $20,000. The loan notes are issued at a discount of 2.5% and 5534 of issue costs are incurred. The loan notes are repayable at a premium of 10% after 5 years. The effective rate of interest is 7. a) What amount will be recorded as a financial liability when the loan notes are issued? b) What amounts will be shown in the statement of profit or loss or statement of financial position (ii) An investment was made in the equity shares of XYZ. 3,000 shares were purchased (a 1% stake) at a cost of Rs. 10 per share on 1 April Year 1. A transaction fee of Rs. 300 was charged on the purchase. The entity intended to sell the shares within three months but the market value of the investment continued to rise and so the company decided not to sell in the near term. The market value of the shares over the three years has been as follows: Rs.000 31 December Year 1........32 31 December Year 2...... 34 31 December Year 3 ...... 35 Question 4: Q4: Explain how the following should be accounted for in accordance with IFRS 9 in the financial statements to 31 December Year 3. A company issues 1% loan notes with a nominal value of $20,000. The loan notes are issued at a discount of 2.5% and 5534 of issue costs are incurred. The loan notes are repayable at a premium of 10% after 5 years. The effective rate of interest is 7. a) What amount will be recorded as a financial liability when the loan notes are issued? b) What amounts will be shown in the statement of profit or loss or statement of financial position (ii) An investment was made in the equity shares of XYZ. 3,000 shares were purchased (a 1% stake) at a cost of Rs. 10 per share on 1 April Year 1. A transaction fee of Rs. 300 was charged on the purchase. The entity intended to sell the shares within three months but the market value of the investment continued to rise and so the company decided not to sell in the near term. The market value of the shares over the three years has been as follows: Rs.000 31 December Year 1........32 31 December Year 2...... 34 31 December Year 3 ...... 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started