Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Recent information on the earnings per share and share price of Par Co is as follows: Year Earnings per share (cents) Year-end

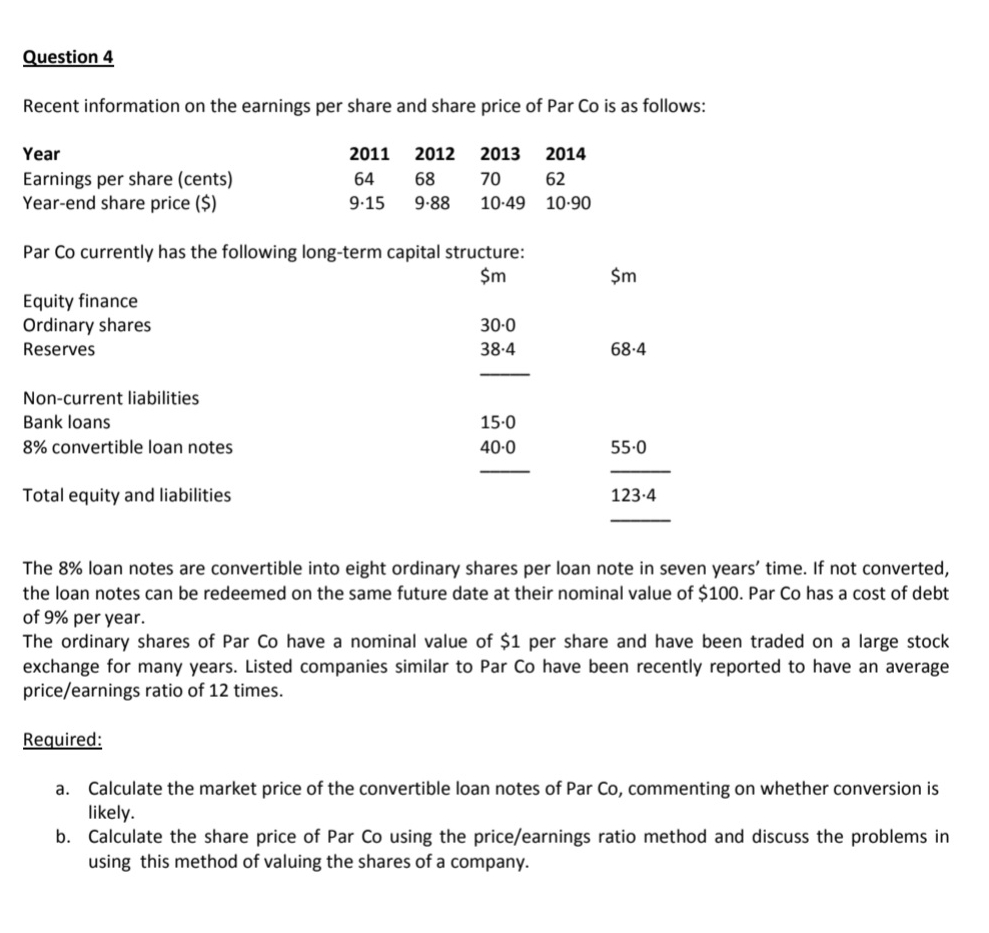

Question 4 Recent information on the earnings per share and share price of Par Co is as follows: Year Earnings per share (cents) Year-end share price ($) 2011 2012 2013 2014 64 68 70 62 9-15 9.88 10-49 10.90 Par Co currently has the following long-term capital structure: Equity finance Ordinary shares Reserves Non-current liabilities Bank loans 8% convertible loan notes Total equity and liabilities $m $m 30-0 38.4 68.4 15-0 40-0 55.0 123-4 The 8% loan notes are convertible into eight ordinary shares per loan note in seven years' time. If not converted, the loan notes can be redeemed on the same future date at their nominal value of $100. Par Co has a cost of debt of 9% per year. The ordinary shares of Par Co have a nominal value of $1 per share and have been traded on a large stock exchange for many years. Listed companies similar to Par Co have been recently reported to have an average price/earnings ratio of 12 times. Required: a. Calculate the market price of the convertible loan notes of Par Co, commenting on whether conversion is likely. b. Calculate the share price of Par Co using the price/earnings ratio method and discuss the problems in using this method of valuing the shares of a company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the market price of the convertible loan notes we first need to determine their present value The convertible loan notes can be convert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started