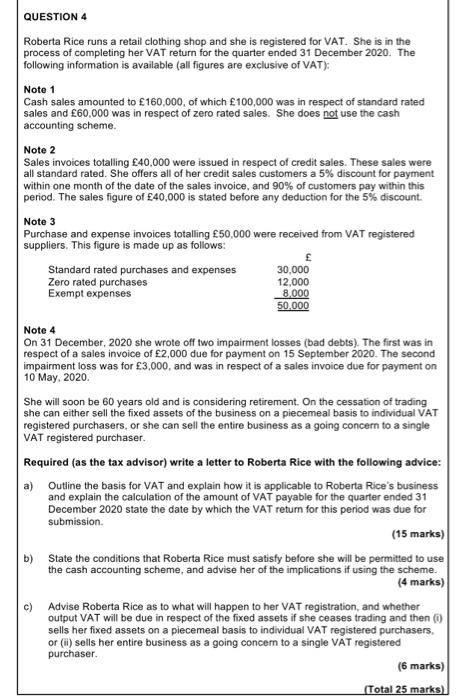

QUESTION 4 Roberta Rice runs a retail clothing shop and she is registered for VAT. She is in the process of completing her VAT return for the quarter ended 31 December 2020. The following information is available (all figures are exclusive of VAT): Note 1 Cash sales amounted to 160,000, of which 100,000 was in respect of standard rated sales and 60,000 was in respect of zero rated sales. She does not use the cash accounting scheme. Note 2 Sales invoices totalling 40.000 were issued in respect of credit sales. These sales were all standard rated. She offers all of her credit sales customers a 5% discount for payment within one month of the date of the sales invoice, and 90% of customers pay within this period. The sales figure of 40,000 is stated before any deduction for the 5% discount. Note 3 Purchase and expense invoices totalling 50,000 were received from VAT registered suppliers. This figure is made up as follows: Standard rated purchases and expenses 30,000 Zero rated purchases 12,000 Exempt expenses 8,000 50.000 Note 4 On 31 December, 2020 she wrote off two impairment losses (bad debts). The first was in respect of a sales invoice of 2,000 due for payment on 15 September 2020. The second impairment loss was for 3,000, and was in respect of a sales invoice due for payment on 10 May, 2020 She will soon be 60 years old and is considering retirement. On the cessation of trading she can either sell the fixed assets of the business on a piecemeal basis to individual VAT registered purchasers, or she can sell the entire business as a going concern to a single VAT registered purchaser. Required (as the tax advisor) write a letter to Roberta Rice with the following advice: a) Outline the basis for VAT and explain how it is applicable to Roberta Rice's business and explain the calculation of the amount of VAT payable for the quarter ended 31 December 2020 state the date by which the VAT return for this period was due for submission (15 marks) b) State the conditions that Roberta Rice must satisfy before she will be permitted to use the cash accounting scheme, and advise her of the implications if using the scheme. (4 marks) c) Advise Roberta Rice as to what will happen to her VAT registration, and whether output VAT will be due in respect of the fixed assets if she ceases trading and then sells her fixed assets on a piecemeal basis to individual VAT registered purchasers. or (i) sells her entire business as a going concem to a single VAT registered purchaser (6 marks) (Total 25 marks) QUESTION 4 Roberta Rice runs a retail clothing shop and she is registered for VAT. She is in the process of completing her VAT return for the quarter ended 31 December 2020. The following information is available (all figures are exclusive of VAT): Note 1 Cash sales amounted to 160,000, of which 100,000 was in respect of standard rated sales and 60,000 was in respect of zero rated sales. She does not use the cash accounting scheme. Note 2 Sales invoices totalling 40.000 were issued in respect of credit sales. These sales were all standard rated. She offers all of her credit sales customers a 5% discount for payment within one month of the date of the sales invoice, and 90% of customers pay within this period. The sales figure of 40,000 is stated before any deduction for the 5% discount. Note 3 Purchase and expense invoices totalling 50,000 were received from VAT registered suppliers. This figure is made up as follows: Standard rated purchases and expenses 30,000 Zero rated purchases 12,000 Exempt expenses 8,000 50.000 Note 4 On 31 December, 2020 she wrote off two impairment losses (bad debts). The first was in respect of a sales invoice of 2,000 due for payment on 15 September 2020. The second impairment loss was for 3,000, and was in respect of a sales invoice due for payment on 10 May, 2020 She will soon be 60 years old and is considering retirement. On the cessation of trading she can either sell the fixed assets of the business on a piecemeal basis to individual VAT registered purchasers, or she can sell the entire business as a going concern to a single VAT registered purchaser. Required (as the tax advisor) write a letter to Roberta Rice with the following advice: a) Outline the basis for VAT and explain how it is applicable to Roberta Rice's business and explain the calculation of the amount of VAT payable for the quarter ended 31 December 2020 state the date by which the VAT return for this period was due for submission (15 marks) b) State the conditions that Roberta Rice must satisfy before she will be permitted to use the cash accounting scheme, and advise her of the implications if using the scheme. (4 marks) c) Advise Roberta Rice as to what will happen to her VAT registration, and whether output VAT will be due in respect of the fixed assets if she ceases trading and then sells her fixed assets on a piecemeal basis to individual VAT registered purchasers. or (i) sells her entire business as a going concem to a single VAT registered purchaser (6 marks) (Total 25 marks)