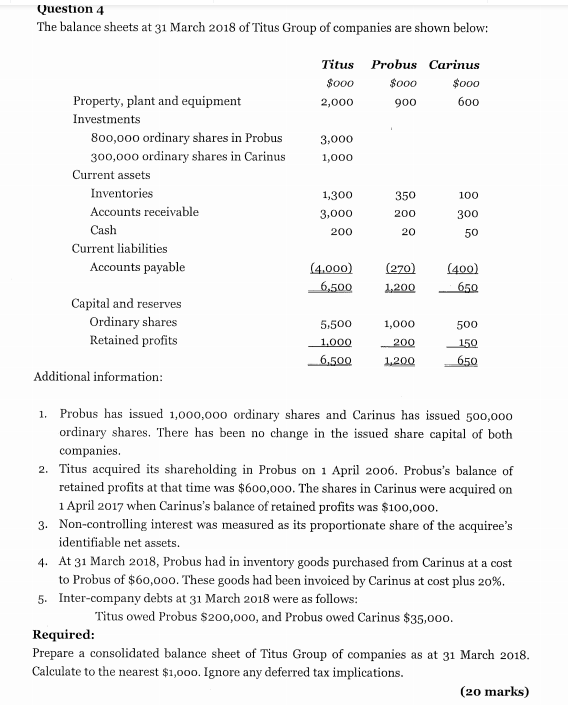

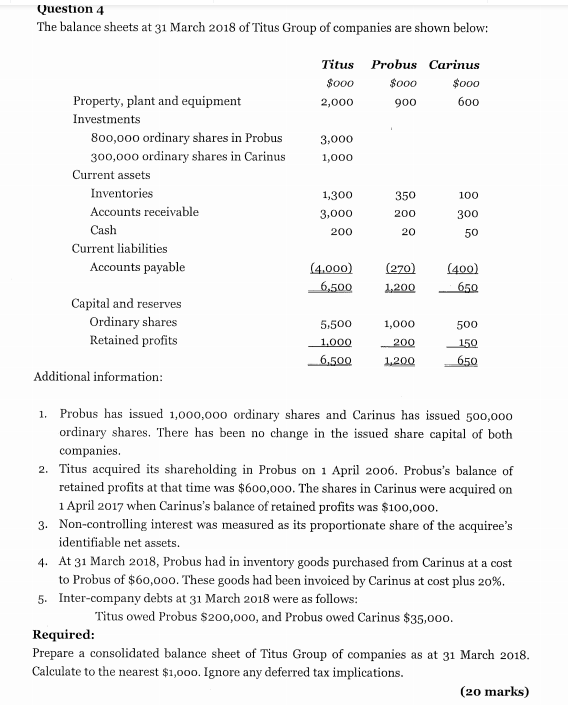

Question 4 The balance sheets at 31 March 2018 of Titus Group of companies are shown below: Titus Probus Carinus $000 $000 $000 2,000 900 600 3,000 1,000 Property, plant and equipment Investments 800,000 ordinary shares in Probus 300,000 ordinary shares in Carinus Current assets Inventories Accounts receivable Cash Current liabilities Accounts payable 1,300 350 100 300 3,000 200 200 20 50 (4.000) 6,500 (270) 1.200 (400) 650 Capital and reserves Ordinary shares Retained profits 500 5.500 1.000 6,500 1,000 200 1.200 150 650 Additional information: 1. Probus has issued 1,000,000 ordinary shares and Carinus has issued 500,000 ordinary shares. There has been no change in the issued share capital of both companies. 2. Titus acquired its shareholding in Probus on 1 April 2006. Probus's balance of retained profits at that time was $600,000. The shares in Carinus were acquired on 1 April 2017 when Carinus's balance of retained profits was $100,000. 3. Non-controlling interest was measured as its proportionate share of the acquiree's identifiable net assets. 4. At 31 March 2018, Probus had in inventory goods purchased from Carinus at a cost to Probus of $60,000. These goods had been invoiced by Carinus at cost plus 20%. 5. Inter-company debts at 31 March 2018 were as follows: Titus owed Probus $200,000, and Probus owed Carinus $35,000. Required: Prepare a consolidated balance sheet of Titus Group of companies as at 31 March 2018. Calculate to the nearest $1,000. Ignore any deferred tax implications. (20 marks) Question 4 The balance sheets at 31 March 2018 of Titus Group of companies are shown below: Titus Probus Carinus $000 $000 $000 2,000 900 600 3,000 1,000 Property, plant and equipment Investments 800,000 ordinary shares in Probus 300,000 ordinary shares in Carinus Current assets Inventories Accounts receivable Cash Current liabilities Accounts payable 1,300 350 100 300 3,000 200 200 20 50 (4.000) 6,500 (270) 1.200 (400) 650 Capital and reserves Ordinary shares Retained profits 500 5.500 1.000 6,500 1,000 200 1.200 150 650 Additional information: 1. Probus has issued 1,000,000 ordinary shares and Carinus has issued 500,000 ordinary shares. There has been no change in the issued share capital of both companies. 2. Titus acquired its shareholding in Probus on 1 April 2006. Probus's balance of retained profits at that time was $600,000. The shares in Carinus were acquired on 1 April 2017 when Carinus's balance of retained profits was $100,000. 3. Non-controlling interest was measured as its proportionate share of the acquiree's identifiable net assets. 4. At 31 March 2018, Probus had in inventory goods purchased from Carinus at a cost to Probus of $60,000. These goods had been invoiced by Carinus at cost plus 20%. 5. Inter-company debts at 31 March 2018 were as follows: Titus owed Probus $200,000, and Probus owed Carinus $35,000. Required: Prepare a consolidated balance sheet of Titus Group of companies as at 31 March 2018. Calculate to the nearest $1,000. Ignore any deferred tax implications. (20 marks)