Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4: The Cranberries Sound Company plans to sell 75,000 units in August and 85,000 units in September. The desired monthly ending inventory in units

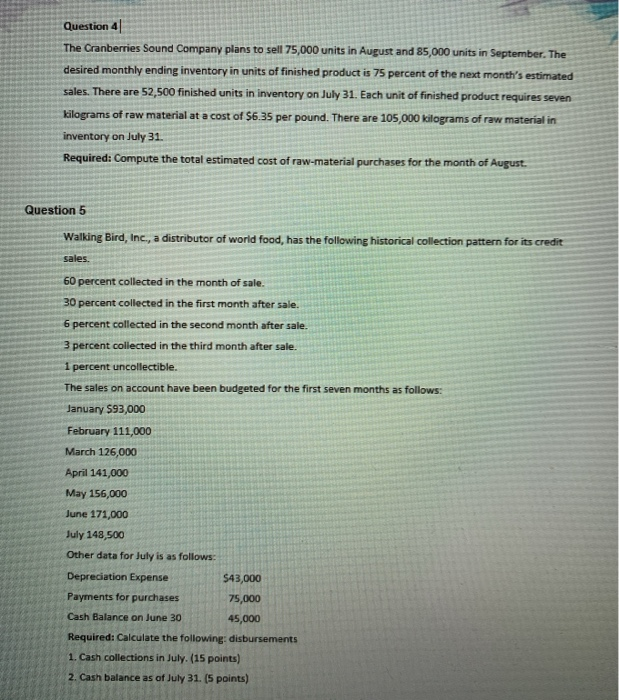

Question 4:

The Cranberries Sound Company plans to sell 75,000 units in August and 85,000 units in September. The desired monthly ending inventory in units of finished product is 75 percent of the next months estimated sales. There are 52,500 finished units in inventory on July 31. Each unit of finished product requires seven kilograms of raw material at a cost of $6.35 per pound. There are 105,000 kilograms of raw material in inventory on July 31.

Required: Compute the total estimated cost of raw-material purchases for the month of August.

Question 5:

Walking Bird, Inc., a distributor of world food, has the following historical collection pattern for its credit sales.

60 percent collected in the month of sale.

30 percent collected in the first month after sale.

6 percent collected in the second month after sale.

3 percent collected in the third month after sale.

1 percent uncollectible.

The sales on account have been budgeted for the first seven months as follows:

January $93,000

February 111,000

March. 126,000

April 141,000

May 156,000

June 171,000

July 148,500

Other data for July is as follows:

Depreciation Expense $43,000

Payments for purchases 75,000

Cash Balance on June 30. 45,000

Required: Calculate the following:

1. Cash collections in July. (15 points)

2. Cash balance as of July 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started