Answered step by step

Verified Expert Solution

Question

1 Approved Answer

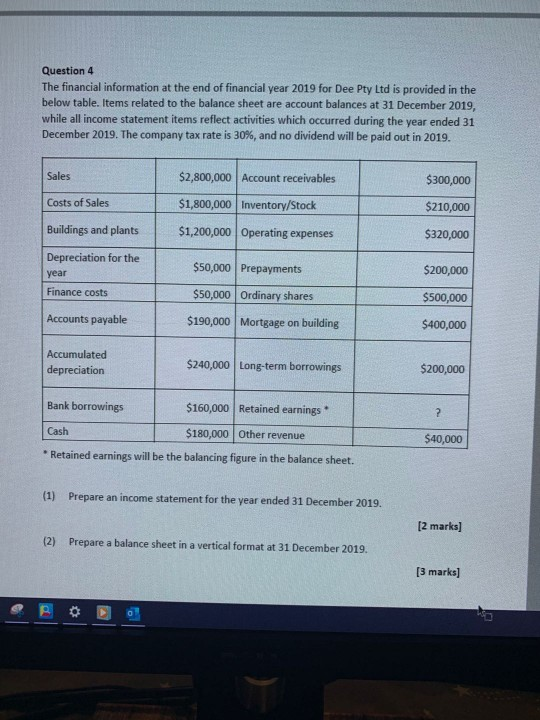

Question 4 The financial information at the end of financial year 2019 for Dee Pty Ltd is provided in the below table. Items related to

Question 4 The financial information at the end of financial year 2019 for Dee Pty Ltd is provided in the below table. Items related to the balance sheet are account balances at 31 December 2019, while all income statement items reflect activities which occurred during the year ended 31 December 2019. The company tax rate is 30%, and no dividend will be paid out in 2019. Sales $300,000 $2,800,000 Account receivables $1,800,000 Inventory/Stock Costs of Sales $210,000 Buildings and plants $1,200,000 Operating expenses $320,000 $50,000 Prepayments Depreciation for the year Finance costs $50,000 Ordinary shares $200,000 $500,000 $400,000 Accounts payable $190,000 Mortgage on building Accumulated depreciation $240,000 Long-term borrowings $200,000 Bank borrowings $160,000 Retained earnings Cash $180,000 Other revenue *Retained earnings will be the balancing figure in the balance sheet. $40,000 (1) Prepare an income statement for the year ended 31 December 2019. [2 marks] (2) Prepare a balance sheet in a vertical format at 31 December 2019. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started