Answered step by step

Verified Expert Solution

Question

1 Approved Answer

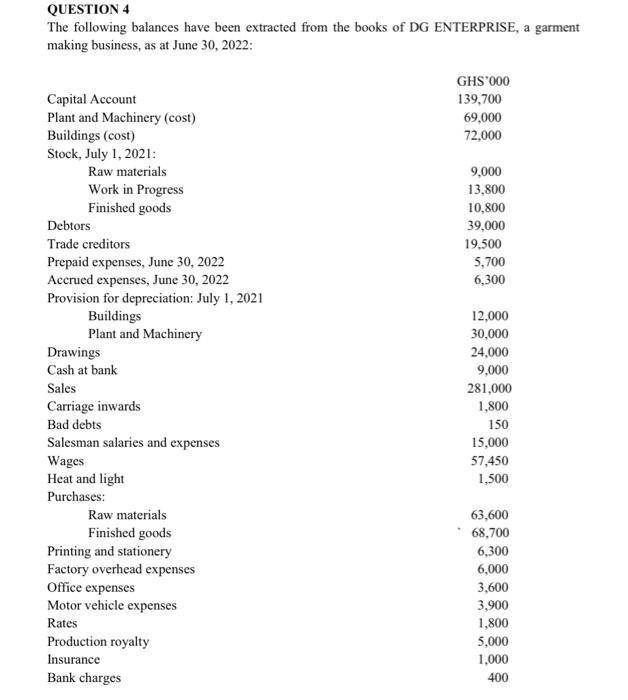

QUESTION 4 The following balances have been extracted from the books of DG ENTERPRISE, a garment making business, as at June 30, 2022: Capital

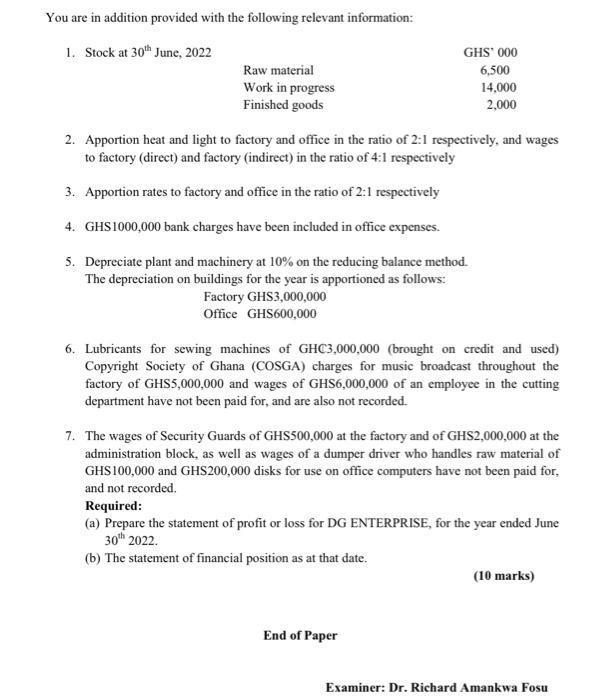

QUESTION 4 The following balances have been extracted from the books of DG ENTERPRISE, a garment making business, as at June 30, 2022: Capital Account Plant and Machinery (cost) Buildings (cost) Stock, July 1, 2021: Raw materials Work in Progress Finished goods Debtors Trade creditors Prepaid expenses, June 30, 2022 Accrued expenses, June 30, 2022 Provision for depreciation: July 1, 2021 Buildings Plant and Machinery Drawings Cash at bank Sales Carriage inwards Bad debts Salesman salaries and expenses Wages Heat and light Purchases: Raw materials Finished goods Printing and stationery Factory overhead expenses Office expenses Motor vehicle expenses Rates Production royalty Insurance Bank charges GHS'000 139,700 69,000 72,000 9,000 13,800 10,800 39,000 19,500 5,700 6,300 12,000 30,000 24,000 9,000 281,000 1,800 150 15,000 57,450 1,500 63,600 68,700 6,300 6,000 3,600 3,900 1,800 5,000 1,000 400 You are in addition provided with the following relevant information: 1. Stock at 30th June, 2022 Raw material Work in progress Finished goods GHS' 000 6,500 14,000 2,000 2. Apportion heat and light to factory and office in the ratio of 2:1 respectively, and wages to factory (direct) and factory (indirect) in the ratio of 4:1 respectively 3. Apportion rates to factory and office in the ratio of 2:1 respectively 4. GHS1000,000 bank charges have been included in office expenses. 5. Depreciate plant and machinery at 10% on the reducing balance method. The depreciation on buildings for the year is apportioned as follows: Factory GHS3,000,000 Office GHS600,000 6. Lubricants for sewing machines of GHC3,000,000 (brought on credit and used) Copyright Society of Ghana (COSGA) charges for music broadcast throughout the factory of GHS5,000,000 and wages of GHS6,000,000 of an employee in the cutting department have not been paid for, and are also not recorded. 7. The wages of Security Guards of GHS500,000 at the factory and of GHS2,000,000 at the administration block, as well as wages of a dumper driver who handles raw material of GHS100,000 and GHS200,000 disks for use on office computers have not been paid for, and not recorded. Required: (a) Prepare the statement of profit or loss for DG ENTERPRISE, for the year ended June 30th 2022. (b) The statement of financial position as at that date. End of Paper (10 marks) Examiner: Dr. Richard Amankwa Fosu

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Profit and loss accoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started