Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION FOUR Adam and Eve are in partnership sharing profits and losses 4:3 respectively. They agreed to amalgamate their business with that of Abraham

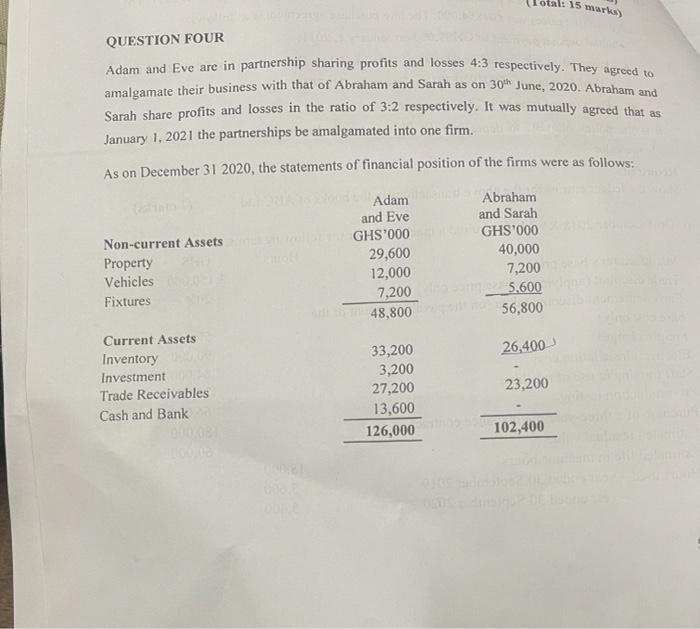

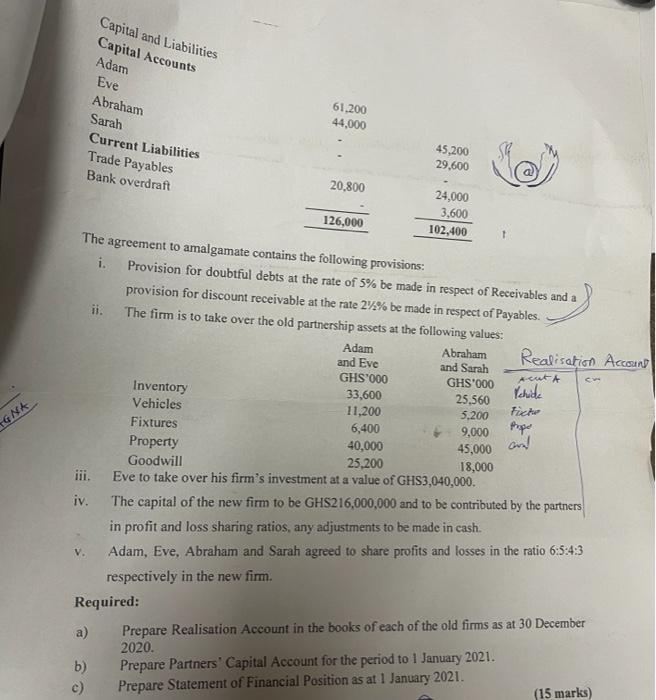

QUESTION FOUR Adam and Eve are in partnership sharing profits and losses 4:3 respectively. They agreed to amalgamate their business with that of Abraham and Sarah as on 30th June, 2020. Abraham and Sarah share profits and losses in the ratio of 3:2 respectively. It was mutually agreed that as January 1, 2021 the partnerships be amalgamated into one firm. As on December 31 2020, the statements of financial position of the firms were as follows: Non-current Assets Property Vehicles Fixtures Current Assets Inventory Investment Trade Receivables Cash and Bank knoff Adam and Eve GHS'000 29,600 12,000 7,200 48,800 33,200 3,200 27,200 13,600 126,000 otal: 15 marks) 0505 Abraham and Sarah GHS'000 40,000 7,200 5,600 56,800 26,400 23,200 102,400 GNA iv. Capital and Liabilities Capital Accounts Adam Eve Abraham Sarah Current Liabilities Trade Payables Bank overdraft a) b) c) 61,200 44,000 The agreement to amalgamate contains the following provisions: i. 20,800 126,000 Required: Provision for doubtful debts at the rate of 5% be made in respect of Receivables and a provision for discount receivable at the rate 2% % be made in respect of Payables. The firm is to take over the old partnership assets at the following values: Adam and Eve GHS'000 33,600 11,200 45,200 29,600 24,000 3,600 102,400 6,400 40,000 Abraham and Sarah Inventory Vehicles Fixtures Property Goodwill 25,200 Eve to take over his firm's investment at a value of GHS3,040,000. GHS'000 25,560 5,200 9,000 45,000 18,000 Realisation Account peut A Vahide Fiche prope The capital of the new firm to be GHS216,000,000 and to be contributed by the partners in profit and loss sharing ratios, any adjustments to be made in cash. Adam, Eve, Abraham and Sarah agreed to share profits and losses in the ratio 6:5:4:3 respectively in the new firm. CH Prepare Realisation Account in the books of each of the old firms as at 30 December 2020. Prepare Partners' Capital Account for the period to 1 January 2021. Prepare Statement of Financial Position as at 1 January 2021. (15 marks)

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started