Question: QUESTION 4 The objectives of FIN 48 include a. Increasing transp ency in financial statements with respect to tax matters b. Enhancing comparability in financial

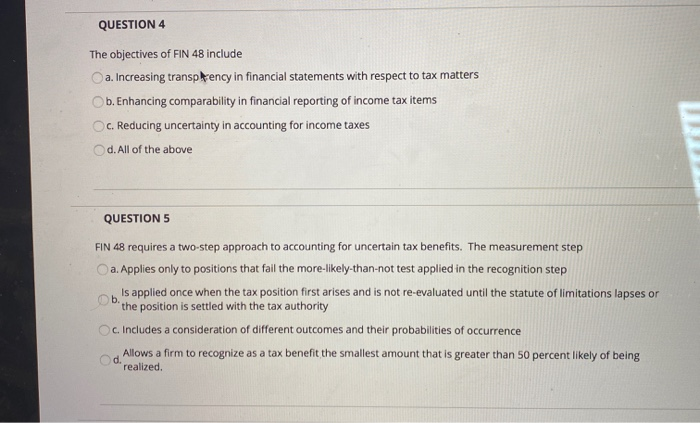

QUESTION 4 The objectives of FIN 48 include a. Increasing transp ency in financial statements with respect to tax matters b. Enhancing comparability in financial reporting of income tax items c. Reducing uncertainty in accounting for income taxes d. All of the above QUESTION 5 b FIN 48 requires a two-step approach to accounting for uncertain tax benefits. The measurement step a. Applies only to positions that fail the more-likely-than-not test applied in the recognition step Is applied once when the tax position first arises and is not re-evaluated until the statute of limitations lapses or the position is settled with the tax authority c. Includes a consideration of different outcomes and their probabilities of occurrence Allows a firm to recognize as a tax benefit the smallest amount that is greater than 50 percent likely of being realized, d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts