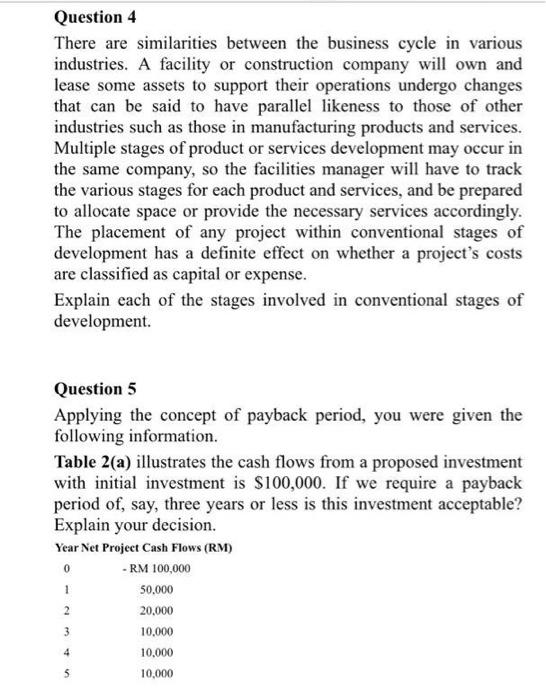

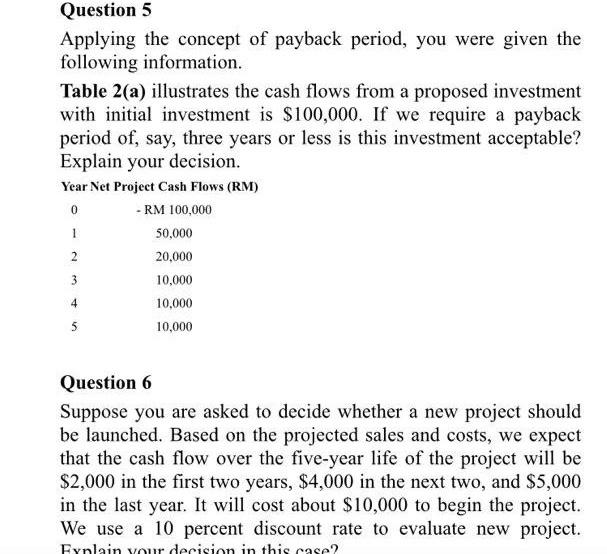

Question 4 There are similarities between the business cycle in various industries. A facility or construction company will own and lease some assets to support their operations undergo changes that can be said to have parallel likeness to those of other industries such as those in manufacturing products and services. Multiple stages of product or services development may occur in the same company, so the facilities manager will have to track the various stages for each product and services, and be prepared to allocate space or provide the necessary services accordingly. The placement of any project within conventional stages of development has a definite effect on whether a project's costs are classified as capital or expense. Explain each of the stages involved in conventional stages of development. Question 5 Applying the concept of payback period, you were given the following information. Table 2(a) illustrates the cash flows from a proposed investment with initial investment is $100,000. If we require a payback period of, say, three years or less is this investment acceptable? Explain your decision. Year Net Project Cash Flows (RM) 0 - RM 100,000 50,000 20,000 10,000 10,000 10,000 1 2 3 4 5 Question 5 Applying the concept of payback period, you were given the following information. Table 2(a) illustrates the cash flows from a proposed investment with initial investment is $100,000. If we require a payback period of, say, three years or less is this investment acceptable? Explain your decision. Year Net Project Cash Flows (RM) - RM 100,000 50,000 20,000 10,000 10,000 5 10,000 0 1 2 3 4 Question 6 Suppose you are asked to decide whether a new project should be launched. Based on the projected sales and costs, we expect that the cash flow over the five-year life of the project will be $2,000 in the first two years, $4,000 in the next two, and $5,000 in the last year. It will cost about $10,000 to begin the project. We use a 10 percent discount rate to evaluate new project. Fynlain your decision in this case 2 Question 7 Suppose you are asked to decide whether a new project should be launched. Based on the projected sales and costs, we expect that the cash flow over the five-year life of the project will be $2,000 in the first two years, $4,000 in the next two, and $5,000 in the last year. It will cost about $10,000 to begin the project. We use a 10 percent discount rate to evaluate new project. Explain your decision in this case? Question 8 In markets theory, all the projects that add to company's value and increase shareholders' wealth should be invested in. However, most companies practice capital rationing as a way to chooe the best projects were the existing capital limitations. What are the advantages and isadvantages of capital nationing? Ye Net Plejected ar Cash Flows (RM) Question 9 The analysis of the financial performance is to determine the meaning and significance of the financial data to check the performance in past, forecast for the future business performance and verifying the financial strength of the organisation. Therefore, there are two procedural groups. Describe each of the group. Question 10 You have been appointed as a Project Manager for Maya Construction Company. The company is about to select a group of independent projects competing for the company's capital budget of $6.0 million. The firm recognized that its cost of capital is 14%. The company Chief Executive Officer (CEO) has given vou the summarized key information (refer to Table 4.1)