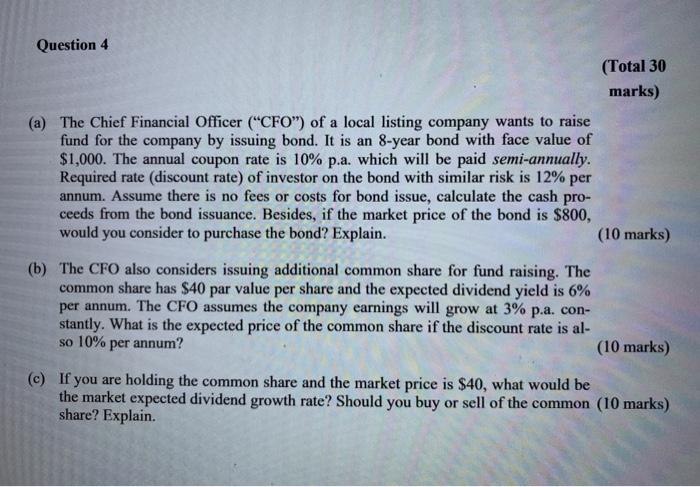

Question 4 (Total 30 marks) (a) The Chief Financial Officer (CFO") of a local listing company wants to raise fund for the company by issuing bond. It is an 8-year bond with face value of $1,000. The annual coupon rate is 10% p.a. which will be paid semi-annually. Required rate (discount rate) of investor on the bond with similar risk is 12% per annum. Assume there is no fees or costs for bond issue, calculate the cash pro- ceeds from the bond issuance. Besides, if the market price of the bond is $800, would you consider to purchase the bond? Explain. (10 marks) (b) The CFO also considers issuing additional common share for fund raising. The common share has $40 par value per share and the expected dividend yield is 6% per annum. The CFO assumes the company earnings will grow at 3% p.a. con- stantly. What is the expected price of the common share if the discount rate is al- so 10% per annum? (10 marks) (c) If you are holding the common share and the market price is $40, what would be the market expected dividend growth rate? Should you buy or sell of the common (10 marks) share? Explain. Question 4 (Total 30 marks) (a) The Chief Financial Officer (CFO") of a local listing company wants to raise fund for the company by issuing bond. It is an 8-year bond with face value of $1,000. The annual coupon rate is 10% p.a. which will be paid semi-annually. Required rate (discount rate) of investor on the bond with similar risk is 12% per annum. Assume there is no fees or costs for bond issue, calculate the cash pro- ceeds from the bond issuance. Besides, if the market price of the bond is $800, would you consider to purchase the bond? Explain. (10 marks) (b) The CFO also considers issuing additional common share for fund raising. The common share has $40 par value per share and the expected dividend yield is 6% per annum. The CFO assumes the company earnings will grow at 3% p.a. con- stantly. What is the expected price of the common share if the discount rate is al- so 10% per annum? (10 marks) (c) If you are holding the common share and the market price is $40, what would be the market expected dividend growth rate? Should you buy or sell of the common (10 marks) share? Explain