Answered step by step

Verified Expert Solution

Question

1 Approved Answer

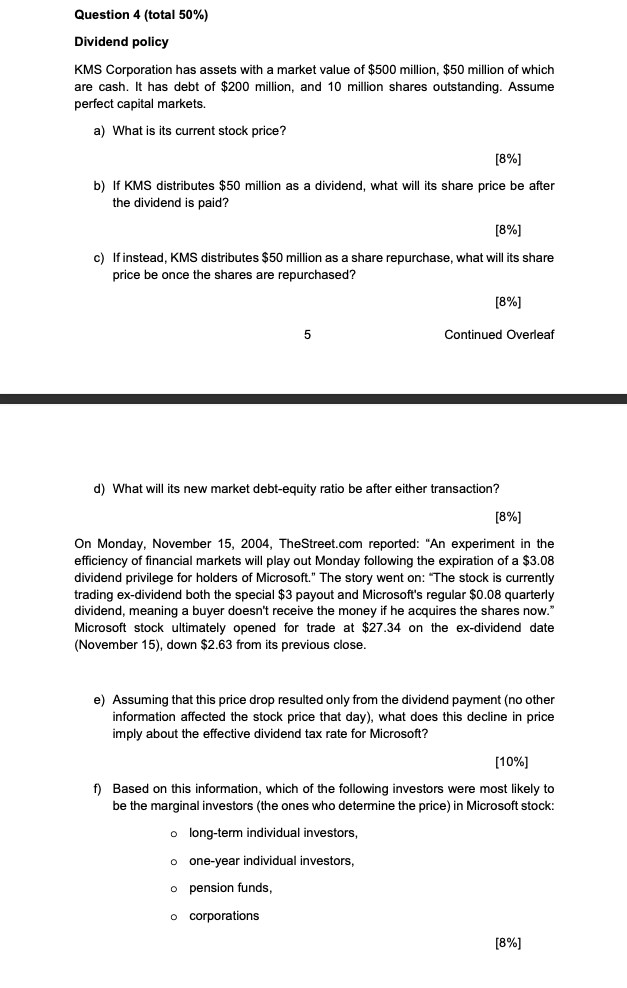

Question 4 ( total 5 0 % ) Dividend policy KMS Corporation has assets with a market value of $ 5 0 0 million, $

Question total

Dividend policy

KMS Corporation has assets with a market value of $ million, $ million of which

are cash. It has debt of $ million, and million shares outstanding. Assume

perfect capital markets.

a What is its current stock price?

b If KMS distributes $ million as a dividend, what will its share price be after

the dividend is paid?

c If instead, KMS distributes $ million as a share repurchase, what will its share

price be once the shares are repurchased?

d What will its new market debtequity ratio be after either transaction?

On Monday, November

TheStreet.com reported: An experiment in the

efficiency of financial markets will play out Monday following the expiration of a $

dividend privilege for holders of Microsoft." The story went on: "The stock is currently

trading exdividend both the special $ payout and Microsoft's regular $ quarterly

dividend, meaning a buyer doesn't receive the money if he acquires the shares now."

Microsoft stock ultimately opened for trade at $ on the exdividend date

November down $ from its previous close.

e Assuming that this price drop resulted only from the dividend payment no other

information affected the stock price that day what does this decline in price

imply about the effective dividend tax rate for Microsoft?

f Based on this information, which of the following investors were most likely to

be the marginal investors the ones who determine the price in Microsoft stock:

longterm individual investors,

oneyear individual investors,

pension funds,

corporations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started