Answered step by step

Verified Expert Solution

Question

1 Approved Answer

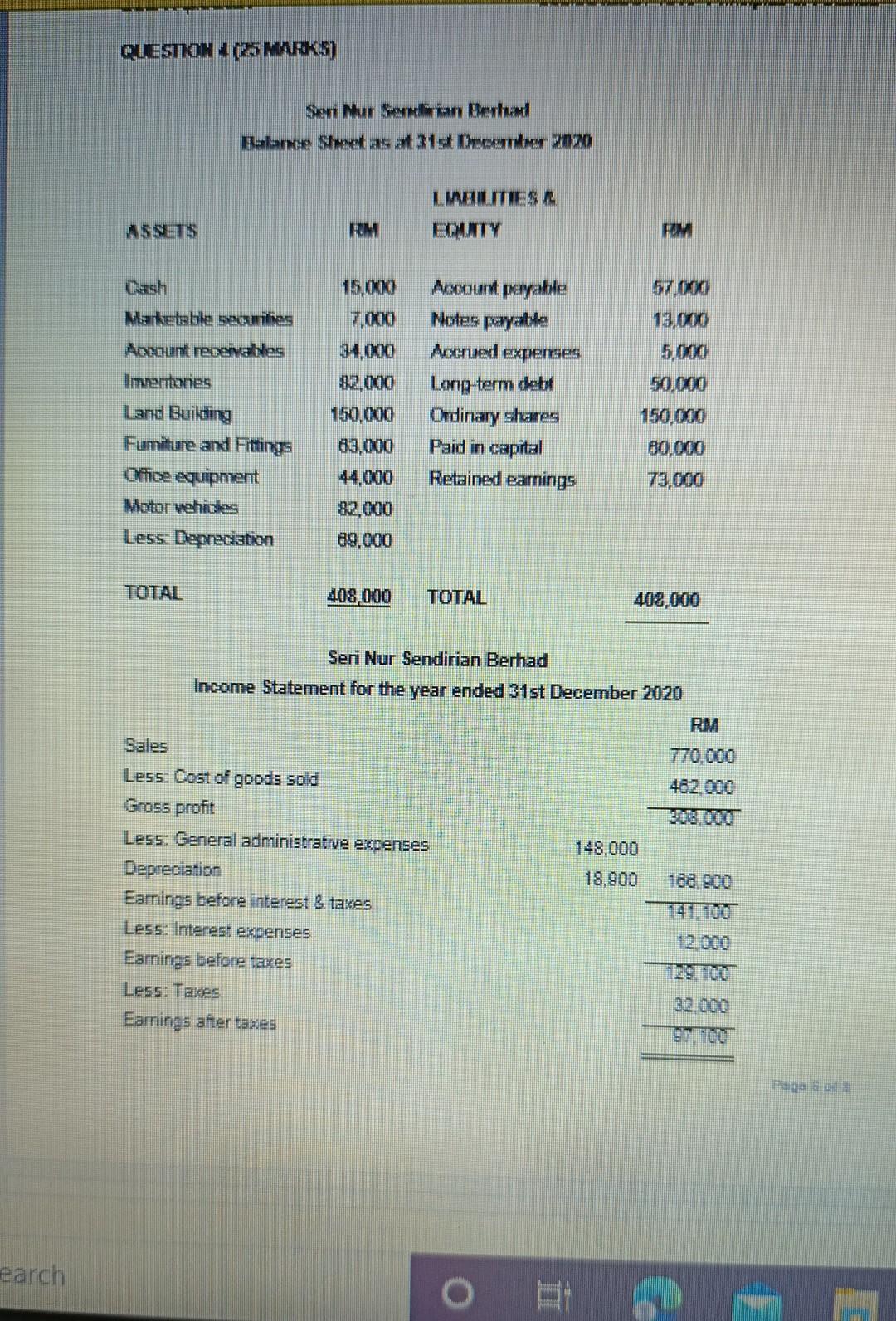

QUESTION 4 (USMARKS) Seni Muran Berhad LIMBILITIES ASSETS RM FM 57,000 15,000 7.000 Cash Marketable segues Anunt negalves Inventones Land Building Fumiture and Fittings Office

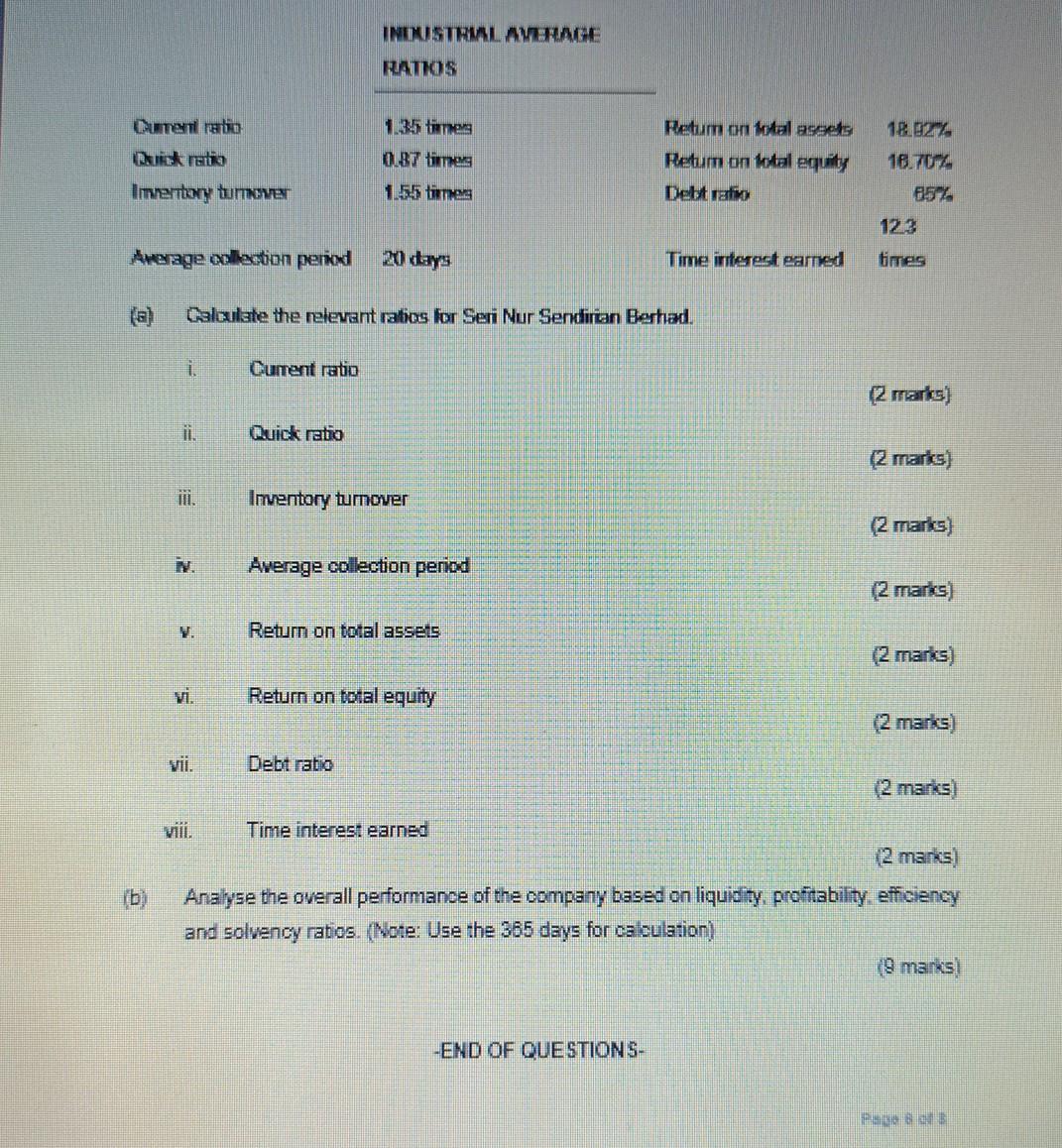

QUESTION 4 (USMARKS) Seni Muran Berhad LIMBILITIES ASSETS RM FM 57,000 15,000 7.000 Cash Marketable segues Anunt negalves Inventones Land Building Fumiture and Fittings Office equipment Motor vehicles Less Depreciation Account payable Notes payable Accrued expenses Long-term dett Ordinary shares Paid in capital Retained earnings 150,000 63.000 50,000 150,000 80,000 82,000 89,000 TOTAL 408,000 TOTAL 408,000 Seri Nur Sendirian Berhad Income Statement for the year ended 31st December 2020 RM 770.000 482,000 Sales Less: Cost of goods sold Gross profit Less: General administrative expenses Depreciation Earnings before interest & taxes Less: Interest expenses Earnings before taxes Less: Taxes Earnings after taxes 148,000 18.900 188.900 32 000 Pagal earch O BI ce INDUSTRIALAVERAGE RATKOS Qumentatio Quick ratio Imentory tumover 1.35 times 0.87 times Retum on total ages Retum un total equity Deltrato 18.02 18.70% 1.55 timer Average collection period 20 days Time interest eamed times Qaleulate the relevant rabos for Seri Nur Sendirian Berhad, i. Cument ratio (2 marks) 11. Quick ratio [2 marks] Inventory tumover (2 marks) N. Average collection period (2 marks] Return on total assets (2 marks) vi. Return on total equity (2 marks) Debt ratio (2 marks) (b) Time interest earned (2 marks] Analyse the overall performance of the company based on liquidity, profitability. effciency and solvency ratios. (Note: Use the 365 days for calculation) (9 marks) -END OF QUESTIONS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started