Question

Question 4 (Variable & Absorption Costing) Sussex Fashions is a small company that manufactures and sells reasonably priced clothing to the youth market. The company

Question 4 (Variable & Absorption Costing)

Sussex Fashions is a small company that manufactures and sells reasonably priced clothing to the youth market. The company takes the unique approach that all items in its Brighton store are sold at the same price. The company has managed to control its costs well and does not anticipate an increase in the selling price per unit during the 2020 year. (The companys financial year runs from January to December).

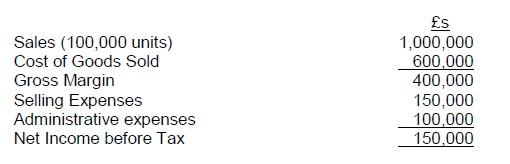

Sussex Fashions is currently preparing its budget for the 2020 year. As part of the budget exercise, the accountant has prepared a forecast income statement for the 2019 year, consisting of the actual results to July, plus five months of estimates. This income statement is set out below:

The budget committee has discussed the budget in some detail, and has agreed the following changes for the 2020 budget (compared to the 2019 forecast, above): Units sold will increase in total by 30% (although selling price per unit will remain the same as in 2019) Direct material costs per unit will increase by 20% Direct labour costs per unit will increase by 5% Variable manufacturing overheads per unit will increase by 10% Fixed manufacturing overheads will increase in total by 5% Selling expenses will increase in total by 8%, due solely to the increase in sales volumes Administrative expenses will increase in total by 6%, due solely to inflationary pressures and not to the increase in sales volumes. In 2019, Cost of Goods Sold was made up of direct materials, direct labour and manufacturing overheads in the ratio 3:2:1, respectively. 40,000 of the manufacturing overhead cost was a fixed cost.

Required:

1)Prepare the budgeted income statement for Sussex Fashions for 2020, using a variable costing format (also known as the contribution margin approach).

2) For the 2020 budget year, calculate the break-even point in units.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started