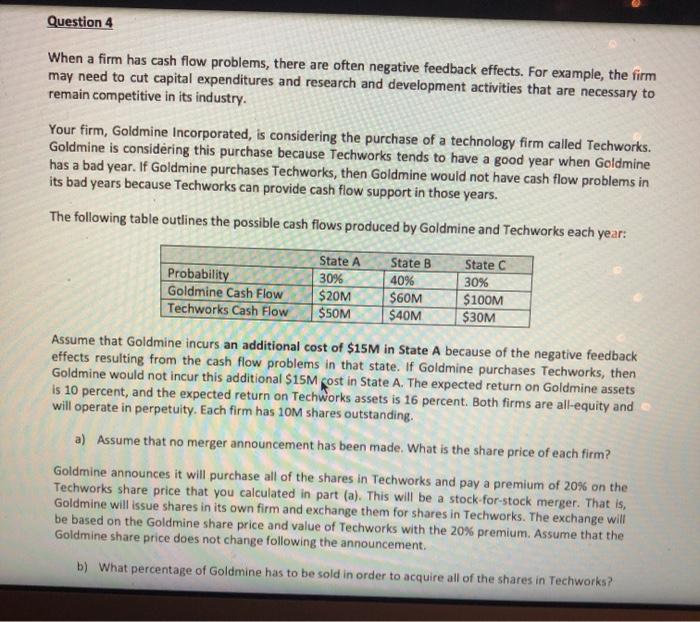

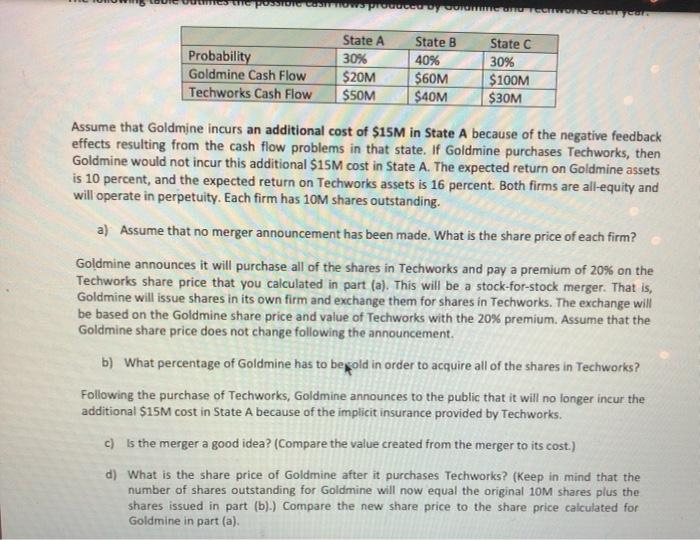

Question 4 When a firm has cash flow problems, there are often negative feedback effects. For example, the firm may need to cut capital expenditures and research and development activities that are necessary to remain competitive in its industry. Your firm, Goldmine Incorporated, is considering the purchase of a technology firm called Techworks. Goldmine is considering this purchase because Techworks tends to have a good year when Goldmine has a bad year. If Goldmine purchases Techworks, then Goldmine would not have cash flow problems in its bad years because Techworks can provide cash flow support in those years. The following table outlines the possible cash flows produced by Goldmine and Techworks each year: Probability Goldmine Cash Flow Techworks Cash Flow State A 30% $20M $50M State B 40% $60M $40M State C 30% $100M $30M Assume that Goldmine incurs an additional cost of $15M in State A because of the negative feedback effects resulting from the cash flow problems in that state. If Goldmine purchases Techworks, then Goldmine would not incur this additional $15M post in State A. The expected return on Goldmine assets is 10 percent, and the expected return on TechWorks assets is 16 percent. Both firms are all-equity and will operate in perpetuity. Each firm has 10M shares outstanding. a) Assume that no merger announcement has been made. What is the share price of each firm? Goldmine announces it will purchase all of the shares in Techworks and pay a premium of 20% on the Techworks share price that you calculated in part (a). This will be a stock-for-stock merger. That is, Goldmine will issue shares in its own firm and exchange them for shares in Techworks. The exchange will be based on the Goldmine share price and value of Techworks with the 20% premium. Assume that the Goldmine share price does not change following the announcement. b) What percentage of Goldmine has to be sold in order to acquire all of the shares in Techworks? Posso Comowe producereyoondon Concerto Probability Goldmine Cash Flow Techworks Cash Flow State A 30% $20M $SOM State B 40% $60M $40M State C 30% $100M $30M Assume that Goldmine incurs an additional cost of $15M in State A because of the negative feedback effects resulting from the cash flow problems in that state. If Goldmine purchases Techworks, then Goldmine would not incur this additional $15M cost in State A. The expected return on Goldmine assets is 10 percent, and the expected return on Techworks assets is 16 percent. Both firms are all-equity and will operate in perpetuity. Each firm has 10M shares outstanding. a) Assume that no merger announcement has been made. What is the share price of each firm? Goldmine announces it will purchase all of the shares in Techworks and pay a premium of 20% on the Techworks share price that you calculated in part (a). This will be a stock-for-stock merger. That is, Goldmine will issue shares in its own firm and exchange them for shares in Techworks. The exchange will be based on the Goldmine share price and value of Techworks with the 20% premium. Assume that the Goldmine share price does not change following the announcement. b) What percentage of Goldmine has to be gold in order to acquire all of the shares in Techworks? Following the purchase of Techworks, Goldmine announces to the public that it will no longer incur the additional $15M cost in State A because of the implicit insurance provided by Techworks. c) is the merger a good idea? (Compare the value created from the merger to its cost.) d) What is the share price of Goldmine after it purchases Techworks? (Keep in mind that the number of shares outstanding for Goldmine will now equal the original 10M shares plus the shares issued in part (b).) Compare the new share price to the share price calculated for Goldmine in part (a). Question 4 When a firm has cash flow problems, there are often negative feedback effects. For example, the firm may need to cut capital expenditures and research and development activities that are necessary to remain competitive in its industry. Your firm, Goldmine Incorporated, is considering the purchase of a technology firm called Techworks. Goldmine is considering this purchase because Techworks tends to have a good year when Goldmine has a bad year. If Goldmine purchases Techworks, then Goldmine would not have cash flow problems in its bad years because Techworks can provide cash flow support in those years. The following table outlines the possible cash flows produced by Goldmine and Techworks each year: Probability Goldmine Cash Flow Techworks Cash Flow State A 30% $20M $50M State B 40% $60M $40M State C 30% $100M $30M Assume that Goldmine incurs an additional cost of $15M in State A because of the negative feedback effects resulting from the cash flow problems in that state. If Goldmine purchases Techworks, then Goldmine would not incur this additional $15M post in State A. The expected return on Goldmine assets is 10 percent, and the expected return on TechWorks assets is 16 percent. Both firms are all-equity and will operate in perpetuity. Each firm has 10M shares outstanding. a) Assume that no merger announcement has been made. What is the share price of each firm? Goldmine announces it will purchase all of the shares in Techworks and pay a premium of 20% on the Techworks share price that you calculated in part (a). This will be a stock-for-stock merger. That is, Goldmine will issue shares in its own firm and exchange them for shares in Techworks. The exchange will be based on the Goldmine share price and value of Techworks with the 20% premium. Assume that the Goldmine share price does not change following the announcement. b) What percentage of Goldmine has to be sold in order to acquire all of the shares in Techworks? Posso Comowe producereyoondon Concerto Probability Goldmine Cash Flow Techworks Cash Flow State A 30% $20M $SOM State B 40% $60M $40M State C 30% $100M $30M Assume that Goldmine incurs an additional cost of $15M in State A because of the negative feedback effects resulting from the cash flow problems in that state. If Goldmine purchases Techworks, then Goldmine would not incur this additional $15M cost in State A. The expected return on Goldmine assets is 10 percent, and the expected return on Techworks assets is 16 percent. Both firms are all-equity and will operate in perpetuity. Each firm has 10M shares outstanding. a) Assume that no merger announcement has been made. What is the share price of each firm? Goldmine announces it will purchase all of the shares in Techworks and pay a premium of 20% on the Techworks share price that you calculated in part (a). This will be a stock-for-stock merger. That is, Goldmine will issue shares in its own firm and exchange them for shares in Techworks. The exchange will be based on the Goldmine share price and value of Techworks with the 20% premium. Assume that the Goldmine share price does not change following the announcement. b) What percentage of Goldmine has to be gold in order to acquire all of the shares in Techworks? Following the purchase of Techworks, Goldmine announces to the public that it will no longer incur the additional $15M cost in State A because of the implicit insurance provided by Techworks. c) is the merger a good idea? (Compare the value created from the merger to its cost.) d) What is the share price of Goldmine after it purchases Techworks? (Keep in mind that the number of shares outstanding for Goldmine will now equal the original 10M shares plus the shares issued in part (b).) Compare the new share price to the share price calculated for Goldmine in part (a)