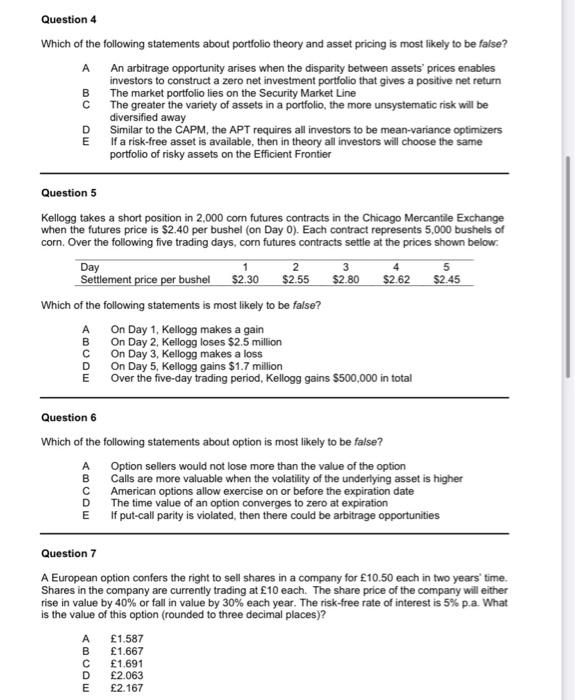

Question 4 Which of the following statements about portfolio theory and asset pricing is most likely to be false? A An arbitrage opportunity arises when the disparity between assets' prices enables investors to construct a zero net investment portfolio that gives a positive net return B The market portfolio lies on the Security Market Line C The greater the variety of assets in a portfolio, the more unsysternatic risk will be diversified away D Similar to the CAPM, the APT requires all investors to be mean-variance optimizers E If a risk-free asset is available, then in theory all investors will choose the same portfolio of risky assets on the Efficient Frontier Question 5 Kellogg takes a short position in 2,000 com futures contracts in the Chicago Mercantle Exchange when the futures price is $2.40 per bushel (on Day 0). Each contract represents 5,000 bushels of corn. Over the following five trading days, corn futures contracts settle at the prices shown below: Which of the following statements is most likely to be false? A On Day 1, Kellogg makes a gain B On Day 2, Kellogg loses $2.5 million C On Day 3, Kellogg makes a loss D On Day 5, Kellogg gains $1.7 million E Over the five-day trading period, Kellogg gains $500,000 in total Question 6 Which of the following statements about option is most likely to be false? A Option sellers would not lose more than the value of the option B Calls are more valuable when the volatiitity of the underlying asset is higher C American options allow exercise on or before the expiration date D The time value of an option converges to zero at expiration E If put-call parity is violated, then there could be arbitrage opportunities Question 7 A European option confers the right to sell shares in a company for 10.50 each in two years' time. Shares in the company are currently trading at 10 each. The share price of the company will either rise in value by 40% or fall in value by 30% each year. The risk-free rate of interest is 5% p.a. What is the value of this option (rounded to three decimal places)? ABCDE1.5871.6671.6912.0632.167