Answered step by step

Verified Expert Solution

Question

1 Approved Answer

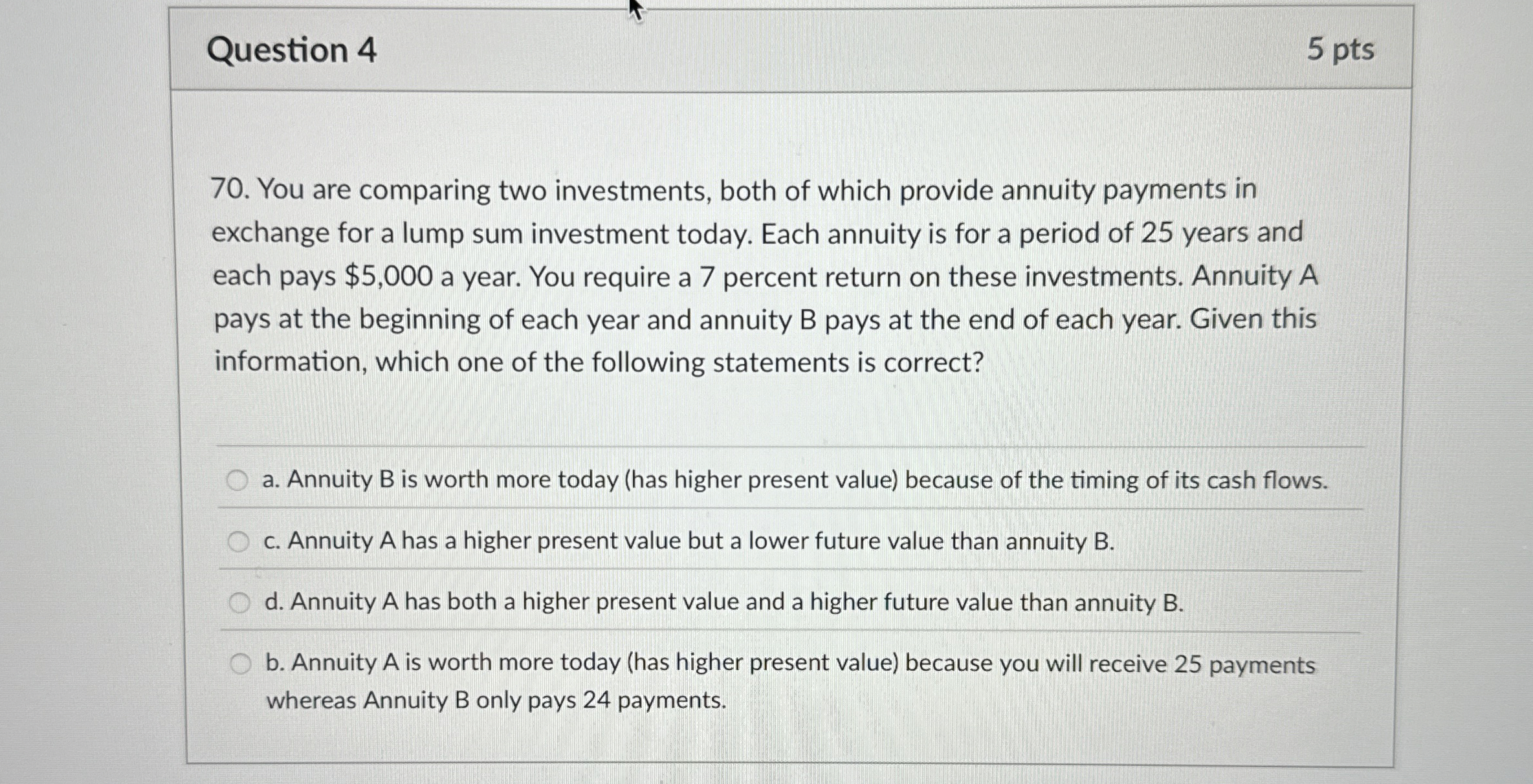

Question 4 You are comparing two investments, both of which provide annuity payments in exchange for a lump sum investment today. Each annuity is for

Question

You are comparing two investments, both of which provide annuity payments in

exchange for a lump sum investment today. Each annuity is for a period of years and

each pays $ a year. You require a percent return on these investments. Annuity

pays at the beginning of each year and annuity pays at the end of each year. Given this

information, which one of the following statements is correct?

a Annuity is worth more today has higher present value because of the timing of its cash flows.

c Annuity A has a higher present value but a lower future value than annuity

d Annuity A has both a higher present value and a higher future value than annuity

b Annuity is worth more today has higher present value because you will receive payments

whereas Annuity B only pays payments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started