Answered step by step

Verified Expert Solution

Question

1 Approved Answer

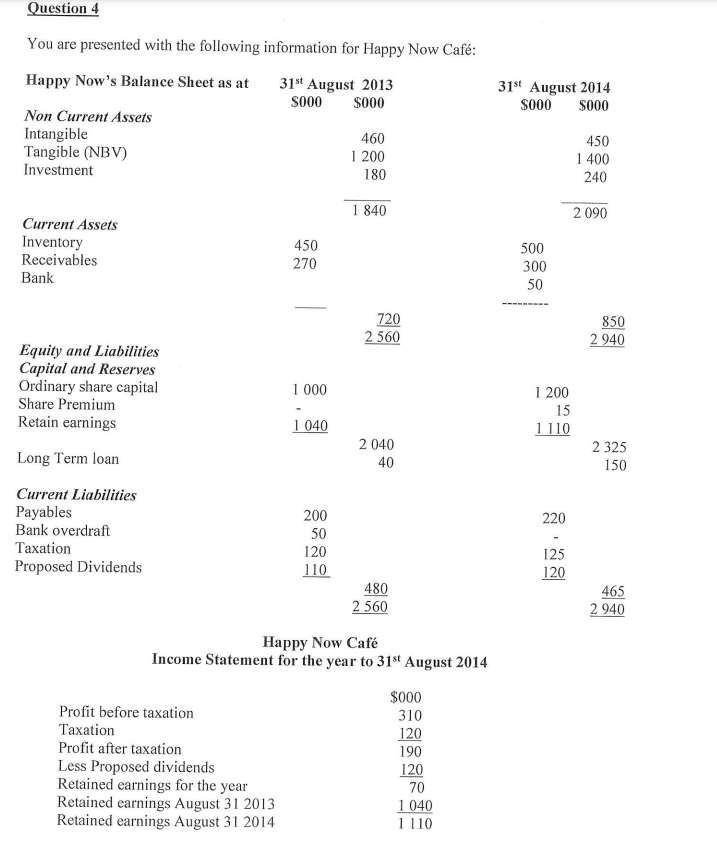

Question 4 You are presented with the following information for Happy Now Caf: Happy Now's Balance Sheet as at 31st August 2013 $000 $000

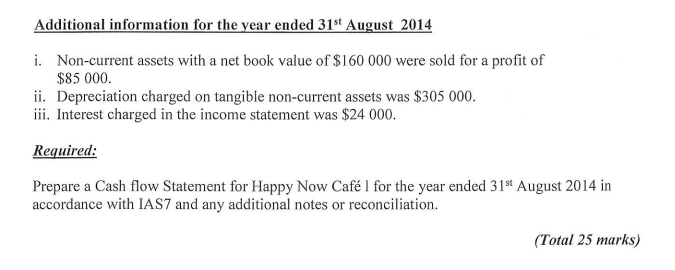

Question 4 You are presented with the following information for Happy Now Caf: Happy Now's Balance Sheet as at 31st August 2013 $000 $000 Non Current Assets Intangible Tangible (NBV) Investment 460 31st August 2014 $000 $000 450 1 200 180 1400 240 1 840 2 090 Current Assets Inventory Receivables Bank 450 270 500 300 Equity and Liabilities 720 2560 50 40 1 200 15 1110 Capital and Reserves Ordinary share capital 1 000 Share Premium Retain earnings 1 040 2 040 Long Term loan Current Liabilities Payables 200 Bank overdraft 50 Taxation 120 Proposed Dividends 110 480 2 560 Happy Now Caf Income Statement for the year to 31st August 2014 Profit before taxation Taxation Profit after taxation Less Proposed dividends Retained earnings for the year Retained earnings August 31 2013 Retained earnings August 31 2014 $000 310 120 190 120 70 1040 1110 220 - 125 850 2 940 2325 150 120 465 2940 Additional information for the year ended 31st August 2014 i. Non-current assets with a net book value of $160 000 were sold for a profit of $85 000. ii. Depreciation charged on tangible non-current assets was $305 000. iii. Interest charged in the income statement was $24 000. Required: Prepare a Cash flow Statement for Happy Now Caf I for the year ended 31st August 2014 in accordance with IAS7 and any additional notes or reconciliation. (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started