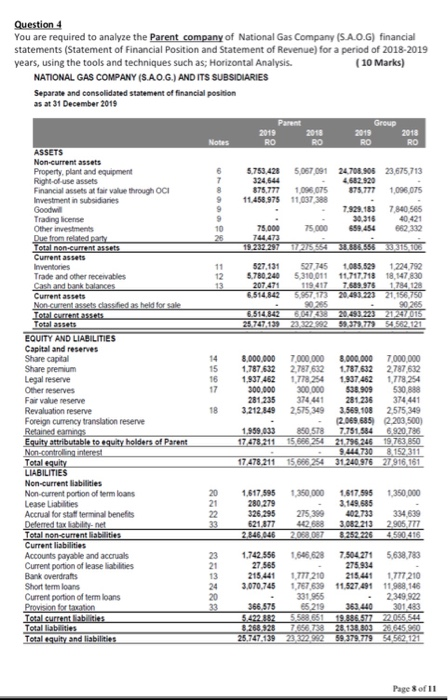

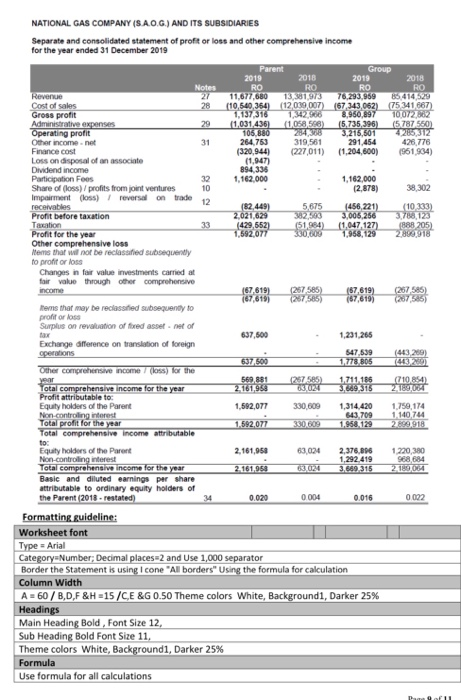

Question 4 You are required to analyze the Parent company of National Gas Company (S.A.0.6) financial statements (Statement of Financial Position and Statement of Revenue) for a period of 2018-2019 years, using the tools and techniques such as; Horizontal Analysis. (10 Marks) NATIONAL GAS COMPANY (S.A.O.G.) AND ITS SUBSIDIARIES Separate and consolidated statement of financial position as at 31 December 2019 Parent Group 2019 2018 2018 Notes RO RO RO RO ASSETS Non-current assets Property, plant and equipment 6 5.753.428 5,057 091 24.708.905 23,675,713 Right-of use assets 324.644 Financial assets at fair value through OCI 8 875.777 1,096,075 875.777 1,096,075 Investment in subsidiaries 9 11.458.975 11,037 388 Goodwill 7.929.183 7,840,565 Trading license 30.315 40.421 Other investments 75,000 75.000 659.454 662 332 Due from related party 26 744 472 Total non-current assets 112232287 12255554 3888.558 3815105 Current assets Inventories 11 527,131 527 745 1,065,529 1224 792 Trade and other receivables 12 5.780.240 5,310,011 11717.713 18,147,830 Cash and bank balances 207 471 119 417 7.589.975 1784 128 Current assets 6.514.842 5,567,173 20.493.223 21.156,750 Non-current assets classified as held for sale 90265 90 265 TotalResets BOB 20.093723 22237015 Total assets 25.747,139 23.322.982 59.370.773 545624121 EQUITY AND LIABILITIES Capital and reserves Share capital 14 8,000,000 7,000,000 8.000.000 7.000.000 Share premium 15 1,787.632 2,787 632 1.787,632 2,787 632 Legal reserve 16 1.937 462 1.778.254 1.937.462 1.778.254 Other reserves 17 300.000 300.000 538.909 530,888 Fair value reserve 281.235 374 441 281.236 374 441 Revaluation reserve 18 3.212.849 2,575 349 3.569,108 2,575349 Foreign currency translation reserve (2.069,685) 2,203,500) Retained eaming 1.959.033 850 578 7.751.584 6.920.786 Equity attributable to equity holders of Parent 17 478 211 15.686 254 21 795 246 19763850 Non-controlling interest 9.444730 8.152311 Total equity 17.478.211 15666 254 31.240.976 27916 161 LIABILITIES Non-current liabilities Non-current portion of term loans 20 1,617,595 1,350,000 1.617.595 1,350,000 Lease Liabilities 21 280.279 3.149.585 Accrual for staff terminal benefits 22 326295 275,399 402.733 334.639 Deferred tax liability-net 33 621.377 412.688 3.082.213 2.905 777 Total noncurrent liabilities 2.846 046 2068 087 8.252.226 4.580 416 Current liabilities Accounts payable and accruals 23 1.742.556 1.646 628 7.504 271 5,638 783 Current portion of lease liabilities 21 27.565 275.934 Bank overdrafts 13 215,441 TTT 210 215,441 1,777210 Short term loans 24 3,070,745 1,787,639 11.527 491 11.988 146 Current portion of term loans 20 331955 2349.922 Provision for tation 366.575 65 219 363.440 301483 Total current liabilities 5.422832 5.588.651 19.886.57722055544 Total liabilities 8.268928 7656739 28.139.803 25645.950 Total equity and liabilities 25.747,139 2302942 59.379.779 54562 121 Page 8 of 11 NATIONAL GAS COMPANY (S.A.O.G.) AND ITS SUBSIDIARIES Separate and consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2019 Parent Group 2019 2018 2019 2018 Notes RO RO RO RO Revenge 27 11,677,680 13,381,973 76,293,969 85.414529 Cost of sales 28 (10,540 364) (12.039.007) (67.343,062) 75 341 667) Gross profit 1,137318 8,960,897 10072 Administrative expenses 29 (1,031 436) 1 OSA 568) 15.735,396) (5.787 550) Operating profit 106,880 3,216,601 2285312 Other income.net 31 264 753 319,561 291,454 426,776 Finance cost (320,944) (227011) (1.204.600) (961934) Loss on disposal of an associate (1,947) Dividend income 894.336 Participation Fees 32 1,162,000 1,162,000 Share of loss) /profits from joint ventures 10 (2.878) 38,302 Impairment (loss) reversal on trade receivables 12 182,449) 5,675 (456,221) (10 333) Profit before taxation 2,021,629 982503 3,006,256 3.788,123 Taxation 33 (429,552) (51,984) (1,047,127) (888205) Profit for the year 1,592,077 330.000 1,958,129 2,890,918 Other comprehensive loss Mems that will not be reclassified subsequently to profit or loss Changes in fair value investments carried at fair value through other comprehensive income 267 585) (57,619) (267 585) (67,619) (67,619) Items that may be reclassified subsequently to profit or loss Surplus on revaluation of fired asset-net or 637,500 1,231,265 Exchange difference on translation of foreign operations 547,539 1778 805 Other comprehensive income (loss) for the 569 831 26755) 1.711.186 (710854 Total comprehensive income for the year 2161958 JU093115 21890 Profit attributable to: Equity holders of the Parent 1,592,077 330,609 1,314,420 1,750,174 Non-controlling interest 543 709 1 140 744 Total profit for the year 1.592.077 1.958,129 2899918 Total comprehensive income attributable to: Equity holders of the Parent 2,161,950 63,024 2,376,896 1.220,380 Non-controling interest 1,292.419 968 684 Total comprehensive income for the year 2.161.958 3.589 315 2169064 Basic and diluted earnings per share attributable to ordinary equity holders of the Parent (2018.restated) 34 0.020 0004 0.016 0.002 Formatting guideline: Worksheet font Type = Arial Category=Number; Decimal places=2 and Use 1,000 separator Border the Statement is using Icone "All borders" Using the formula for calculation Column Width A = 60/B,D,F&H=15/CE &G 0.50 Theme colors White, Background1, Darker 25% Headings Main Heading Bold, Font Size 12, Sub Heading Bold Font Size 11, Theme colors White, Background1, Darker 25% Formula Use formula for all calculations Palafi