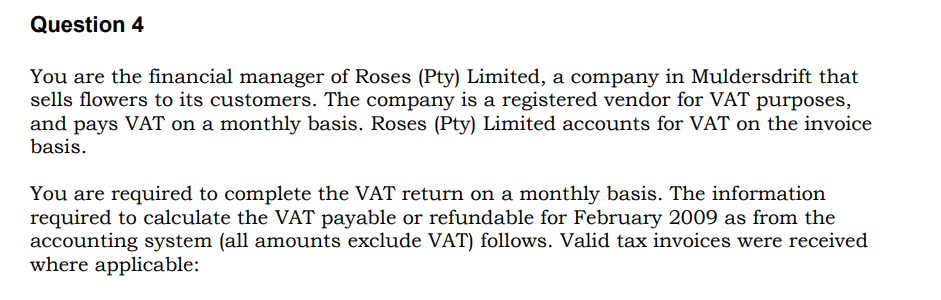

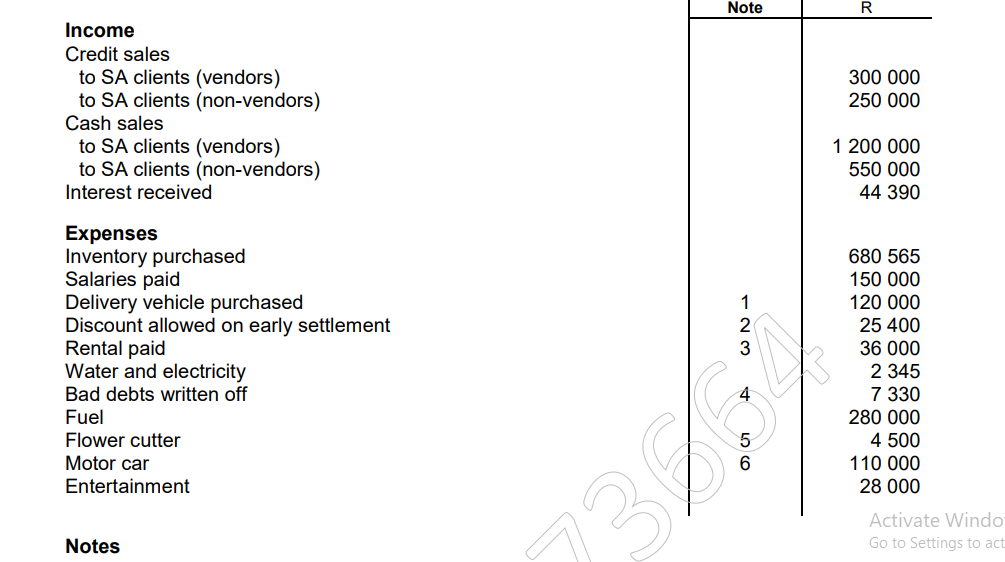

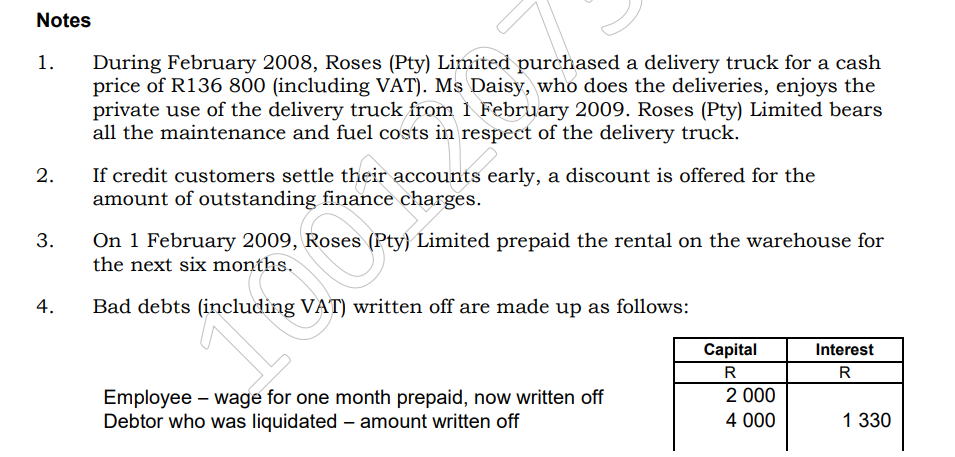

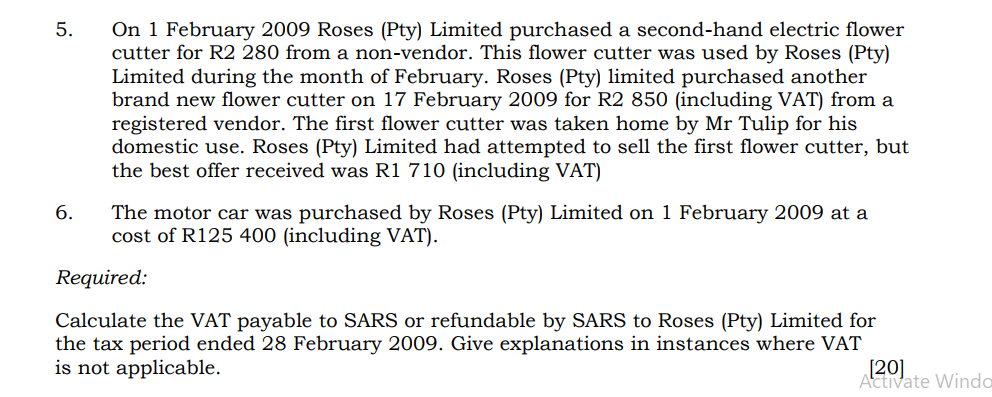

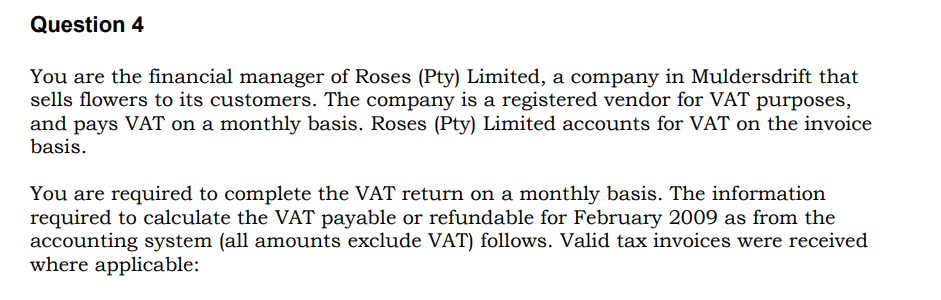

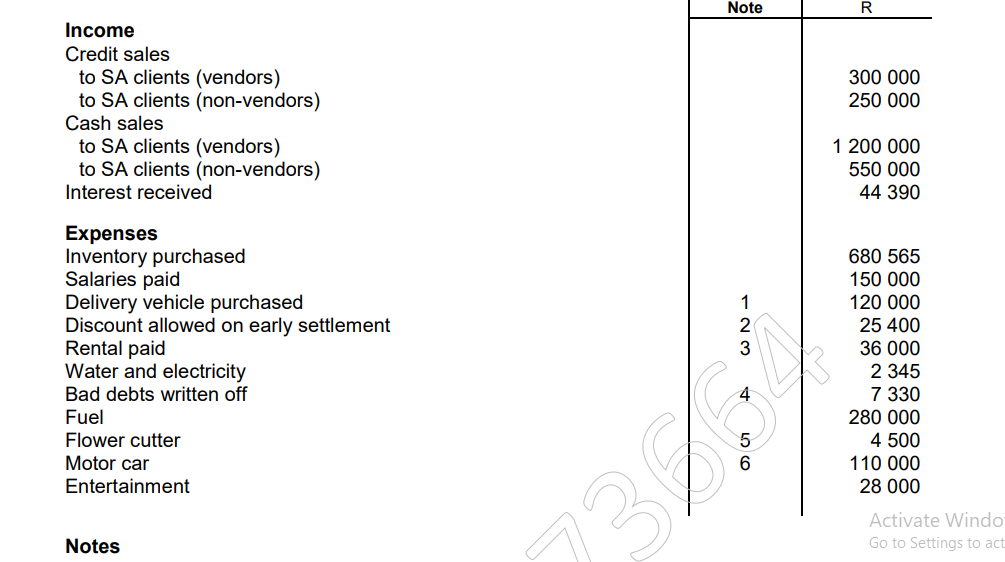

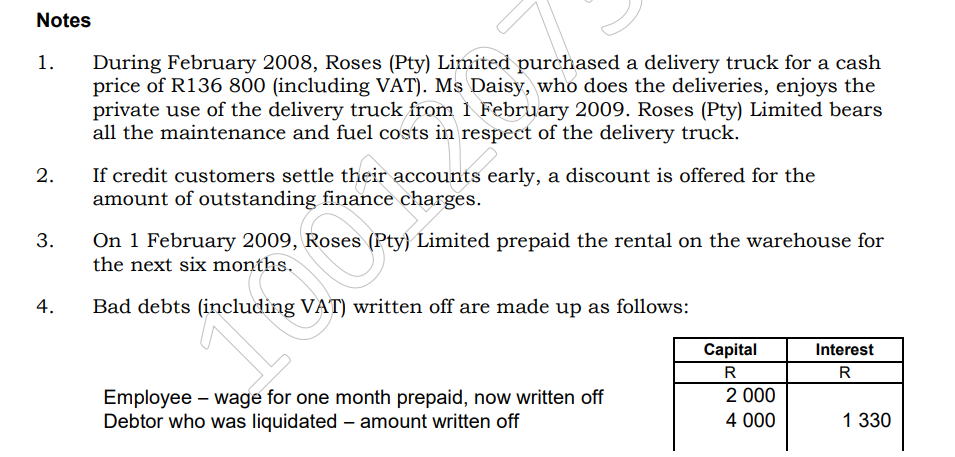

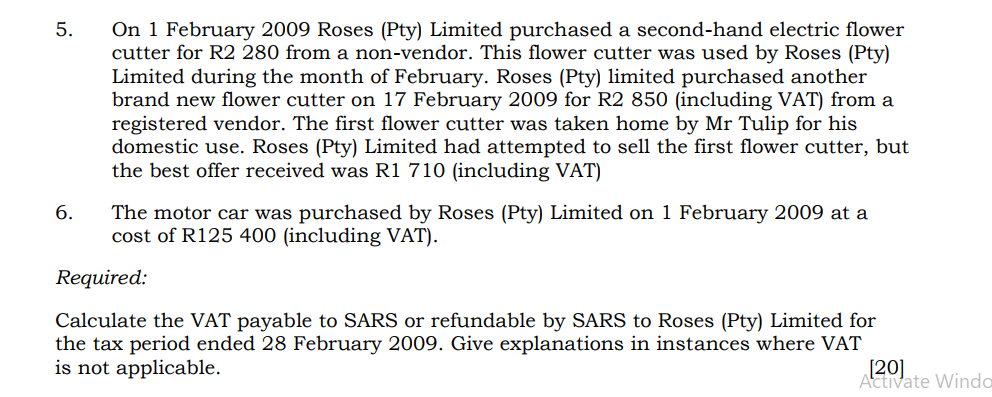

Question 4 You are the financial manager of Roses (Pty) Limited, a company in Muldersdrift that sells flowers to its customers. The company is a registered vendor for VAT purposes, and pays VAT on a monthly basis. Roses (Pty) Limited accounts for VAT on the invoice basis. You are required to complete the VAT return on a monthly basis. The information required to calculate the VAT payable or refundable for February 2009 as from the accounting system (all amounts exclude VAT) follows. Valid tax invoices were received where applicable: Note R 300 000 250 000 Income Credit sales to SA clients (vendors) to SA clients (non-vendors) Cash sales to SA clients (vendors) to SA clients (non-vendors) Interest received 1 200 000 550 000 44 390 1 2 3 Expenses Inventory purchased Salaries paid Delivery vehicle purchased Discount allowed on early settlement Rental paid Water and electricity Bad debts written off Fuel Flower cutter Motor car Entertainment 680 565 150 000 120 000 25 400 36 000 2 345 7 330 280 000 5 4 500 A 6 110 000 28 000 Activate Windo Go to Settings to act Notes Notes 1. During February 2008, Roses (Pty) Limited purchased a delivery truck for a cash price of R136 800 (including VAT). Ms Daisy, who does the deliveries, enjoys the private use of the delivery truck from 1 February 2009. Roses (Pty) Limited bears all the maintenance and fuel costs in respect of the delivery truck. 2. 3. If credit customers settle their accounts early, a discount is offered for the amount of outstanding finance charges. On 1 February 2009, Roses (Pty) Limited prepaid the rental on the warehouse for the next six months. Bad debts (including VAT) written off are made up as follows: 4. Interest R Capital R 2 000 4 000 Employee - wage for one month prepaid, now written off Debtor who was liquidated - amount written off 1 330 5. On 1 February 2009 Roses (Pty) Limited purchased a second-hand electric flower cutter for R2 280 from a non-vendor. This flower cutter was used by Roses (Pty) Limited during the month of February. Roses (Pty) limited purchased another brand new flower cutter on 17 February 2009 for R2 850 (including VAT) from a registered vendor. The first flower cutter was taken home by Mr Tulip for his domestic use. Roses (Pty) Limited had attempted to sell the first flower cutter, but the best offer received was R1 710 (including VAT) The motor car was purchased by Roses (Pty) Limited on 1 February 2009 at a cost of R125 400 (including VAT). 6. Required: Calculate the VAT payable to SARS or refundable by SARS to Roses (Pty) Limited for the tax period ended 28 February 2009. Give explanations in instances where VAT is not applicable. [20] Activate Windo Question 4 You are the financial manager of Roses (Pty) Limited, a company in Muldersdrift that sells flowers to its customers. The company is a registered vendor for VAT purposes, and pays VAT on a monthly basis. Roses (Pty) Limited accounts for VAT on the invoice basis. You are required to complete the VAT return on a monthly basis. The information required to calculate the VAT payable or refundable for February 2009 as from the accounting system (all amounts exclude VAT) follows. Valid tax invoices were received where applicable: Note R 300 000 250 000 Income Credit sales to SA clients (vendors) to SA clients (non-vendors) Cash sales to SA clients (vendors) to SA clients (non-vendors) Interest received 1 200 000 550 000 44 390 1 2 3 Expenses Inventory purchased Salaries paid Delivery vehicle purchased Discount allowed on early settlement Rental paid Water and electricity Bad debts written off Fuel Flower cutter Motor car Entertainment 680 565 150 000 120 000 25 400 36 000 2 345 7 330 280 000 5 4 500 A 6 110 000 28 000 Activate Windo Go to Settings to act Notes Notes 1. During February 2008, Roses (Pty) Limited purchased a delivery truck for a cash price of R136 800 (including VAT). Ms Daisy, who does the deliveries, enjoys the private use of the delivery truck from 1 February 2009. Roses (Pty) Limited bears all the maintenance and fuel costs in respect of the delivery truck. 2. 3. If credit customers settle their accounts early, a discount is offered for the amount of outstanding finance charges. On 1 February 2009, Roses (Pty) Limited prepaid the rental on the warehouse for the next six months. Bad debts (including VAT) written off are made up as follows: 4. Interest R Capital R 2 000 4 000 Employee - wage for one month prepaid, now written off Debtor who was liquidated - amount written off 1 330 5. On 1 February 2009 Roses (Pty) Limited purchased a second-hand electric flower cutter for R2 280 from a non-vendor. This flower cutter was used by Roses (Pty) Limited during the month of February. Roses (Pty) limited purchased another brand new flower cutter on 17 February 2009 for R2 850 (including VAT) from a registered vendor. The first flower cutter was taken home by Mr Tulip for his domestic use. Roses (Pty) Limited had attempted to sell the first flower cutter, but the best offer received was R1 710 (including VAT) The motor car was purchased by Roses (Pty) Limited on 1 February 2009 at a cost of R125 400 (including VAT). 6. Required: Calculate the VAT payable to SARS or refundable by SARS to Roses (Pty) Limited for the tax period ended 28 February 2009. Give explanations in instances where VAT is not applicable. [20] Activate Windo