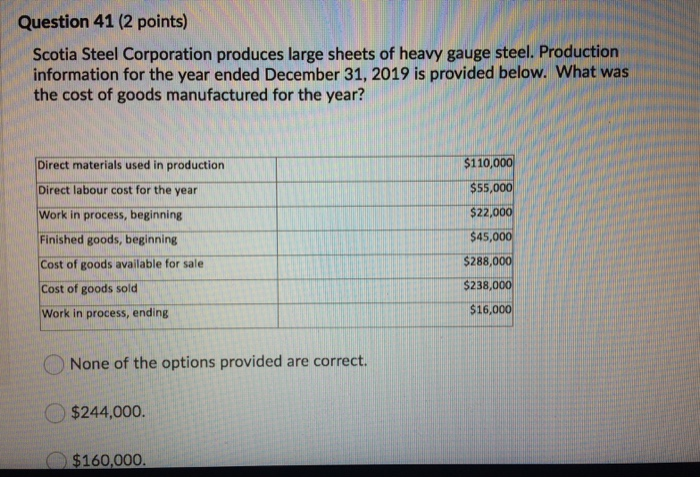

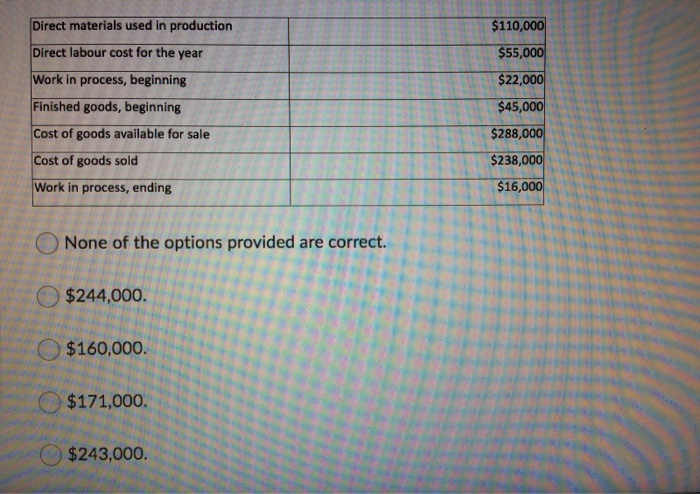

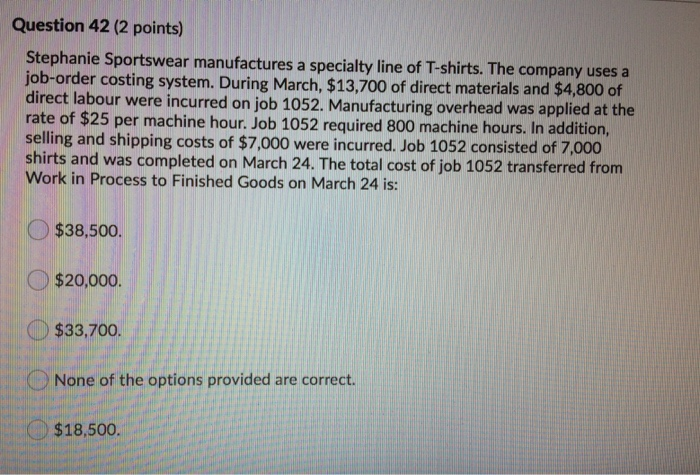

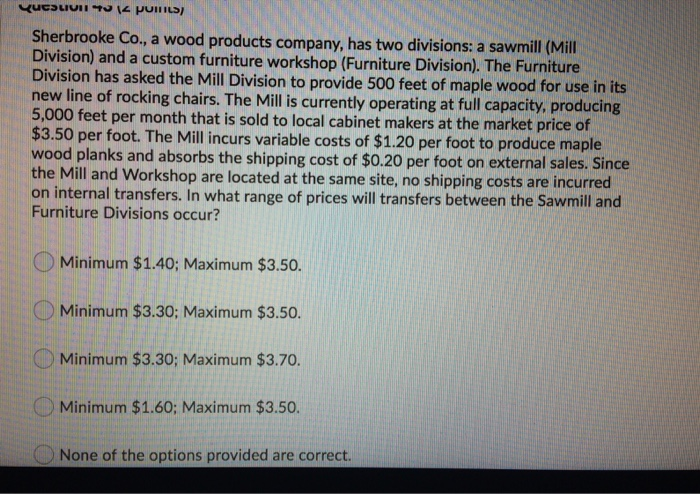

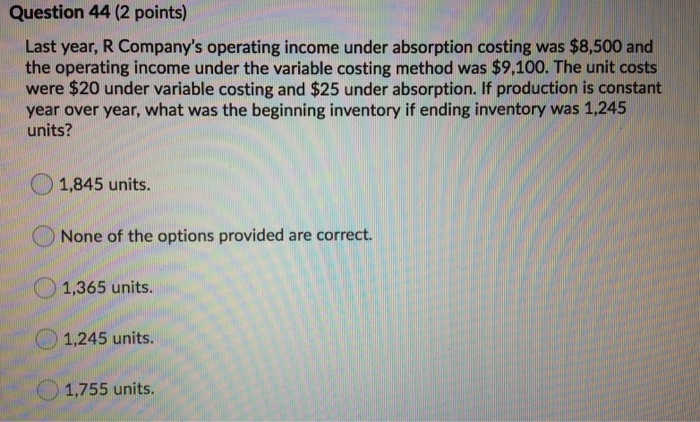

Question 41 (2 points) Scotia Steel Corporation produces large sheets of heavy gauge steel. Production information for the year ended December 31, 2019 is provided below. What was the cost of goods manufactured for the year? Direct materials used in production Direct labour cost for the year Work in process, beginning Finished goods, beginning Cost of goods available for sale Cost of goods sold Work in process, ending $110,000 $55,000 $22,000 $45,000 $288,000 $238,000 $16,000 None of the options provided are correct. $244,000. $160,000. Direct materials used in production Direct labour cost for the year Work in process, beginning Finished goods, beginning Cost of goods available for sale Cost of goods sold $110,000 $55,000 $22,000 $45,000 $288,000 $238,000 Work in process, ending Work in process, enam $ 16,000 None of the options provided are correct. $244,000 $160,000. $171,000. $243,000. Question 42 (2 points) Stephanie Sportswear manufactures a specialty line of T-shirts. The company uses a job-order costing system. During March, $13,700 of direct materials and $4,800 of direct labour were incurred on job 1052. Manufacturing overhead was applied at the rate of $25 per machine hour. Job 1052 required 800 machine hours. In addition, selling and shipping costs of $7,000 were incurred. Job 1052 consisted of 7,000 shirts and was completed on March 24. The total cost of job 1052 transferred from Work in Process to Finished Goods on March 24 is: $38,500. $20,000 $33,700 None of the options provided are correct. $18,500. QUCSLIUI 3 14 pollies) Sherbrooke Co., a wood products company, has two divisions: a sawmill (Mill Division) and a custom furniture workshop (Furniture Division). The Furniture Division has asked the Mill Division to provide 500 feet of maple wood for use in its new line of rocking chairs. The Mill is currently operating at full capacity, producing 5,000 feet per month that is sold to local cabinet makers at the market price of $3.50 per foot. The Mill incurs variable costs of $1.20 per foot to produce maple wood planks and absorbs the shipping cost of $0.20 per foot on external sales. Since the Mill and Workshop are located at the same site, no shipping costs are incurred on internal transfers. In what range of prices will transfers between the Sawmill and Furniture Divisions occur? Minimum $1.40; Maximum $3.50. Minimum $3.30; Maximum $3.50. Minimum $3.30; Maximum $3.70. Minimum $1.60; Maximum $3.50. None of the options provided are correct. Question 44 (2 points) Last year, R Company's operating income under absorption costing was $8,500 and the operating income under the variable costing method was $9,100. The unit costs were $20 under variable costing and $25 under absorption. If production is constant year over year, what was the beginning inventory if ending inventory was 1,245 units? 1,845 units. None of the options provided are correct. 1,365 units. 1,245 units. 1,755 units