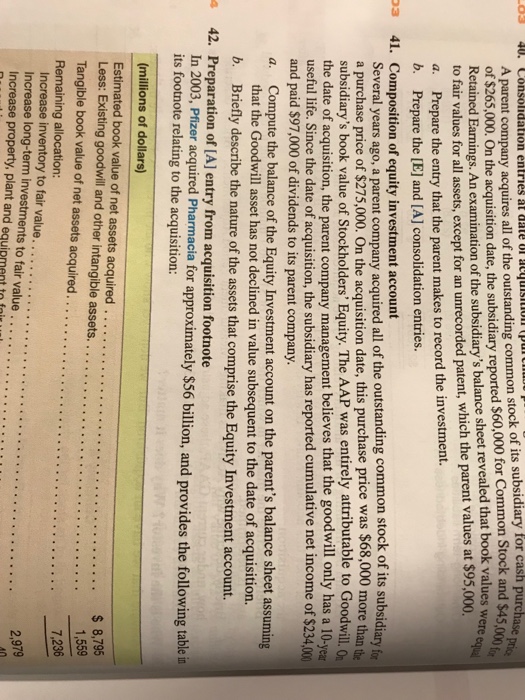

ing common stock of its subsidiary for cash A parent company acquires all of the outstandi of $265,000. On the acquisition date, the subsidiary reported $60,000 for Common Stock and $4 Retained Earnings. An examination of the subsidiary's balance sheet reveal to fair values for all assets, except for an unrecorded patent, which the parent values at $95,000 a. Prepare the entry that the parent makes to record the investment. b. Prepare the [E] and [A] consolidation entries. ed that book values 41. Composition of equity investment account Several years ago, a parent company acquired all of the outstanding common stock of its subsidiary a purchase price of $275,000. On the acquisition date, this purchase price was $68,000 more than subsidiary's book value of Stockholders' Equity. The AAP was entirely attributable to Goodwill the date of acquisition, the parent company management believes that the goodwill only has a 10- useful life. Since the date of acquisition, the subsidiary has reported cumulative net income of $234,00 and paid $97,000 of dividends to its parent company. a. Compute the balance of the Equity Investment account on the parent's balance sheet assuming that the Goodwill asset has not declined in value subsequent to the date of acquisition. Briefly describe the nature of the assets that comprise the Equity Investment account. b. 42. Preparation of [A] entry from acquisition footnote In 2003, Pfizer acquired Pharmacia for approximately $56 billion, and provides the following table its footnote relating to the acquisition: (millions of dollars) Estimated book value of net assets acquired Less: Existing goodwill and other intangible assets. . . . . . . . Tangible book value of net assets acquired........ . . Remaining allocation: 8,795 7,236 Increase inventory to fair value Increase long-term investments to fair value Increase property, plant and equipment to fais 2,979 40 ing common stock of its subsidiary for cash A parent company acquires all of the outstandi of $265,000. On the acquisition date, the subsidiary reported $60,000 for Common Stock and $4 Retained Earnings. An examination of the subsidiary's balance sheet reveal to fair values for all assets, except for an unrecorded patent, which the parent values at $95,000 a. Prepare the entry that the parent makes to record the investment. b. Prepare the [E] and [A] consolidation entries. ed that book values 41. Composition of equity investment account Several years ago, a parent company acquired all of the outstanding common stock of its subsidiary a purchase price of $275,000. On the acquisition date, this purchase price was $68,000 more than subsidiary's book value of Stockholders' Equity. The AAP was entirely attributable to Goodwill the date of acquisition, the parent company management believes that the goodwill only has a 10- useful life. Since the date of acquisition, the subsidiary has reported cumulative net income of $234,00 and paid $97,000 of dividends to its parent company. a. Compute the balance of the Equity Investment account on the parent's balance sheet assuming that the Goodwill asset has not declined in value subsequent to the date of acquisition. Briefly describe the nature of the assets that comprise the Equity Investment account. b. 42. Preparation of [A] entry from acquisition footnote In 2003, Pfizer acquired Pharmacia for approximately $56 billion, and provides the following table its footnote relating to the acquisition: (millions of dollars) Estimated book value of net assets acquired Less: Existing goodwill and other intangible assets. . . . . . . . Tangible book value of net assets acquired........ . . Remaining allocation: 8,795 7,236 Increase inventory to fair value Increase long-term investments to fair value Increase property, plant and equipment to fais 2,979 40