Answered step by step

Verified Expert Solution

Question

1 Approved Answer

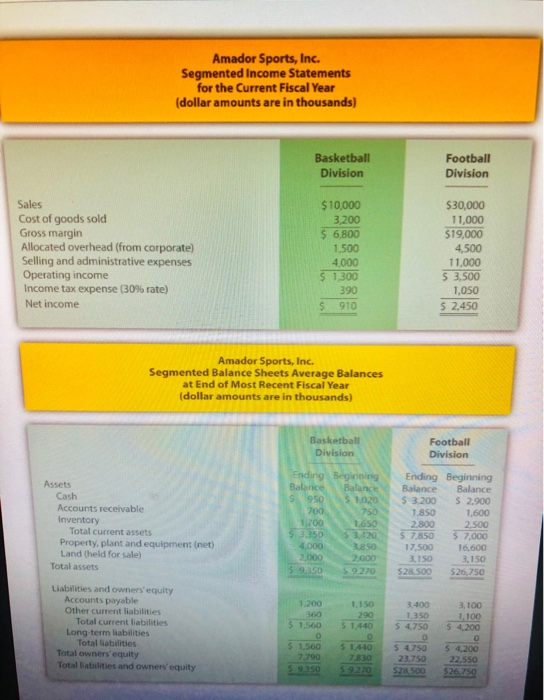

Question 41 ? Managerial Accounting PROBLEMS (COontinued) Operating Profit Margin, Asset Turnover, and ROI Average operating assets are calculated below. Note that land held for

Question 41 ? Managerial Accounting

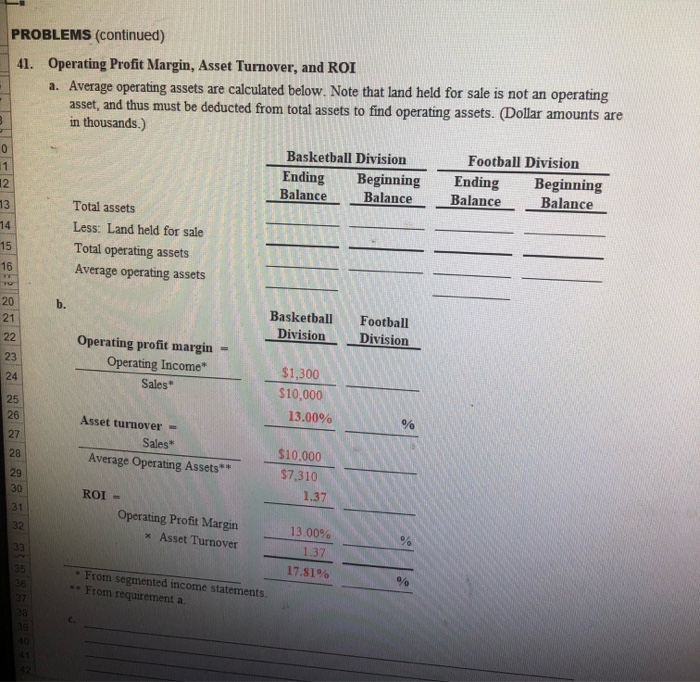

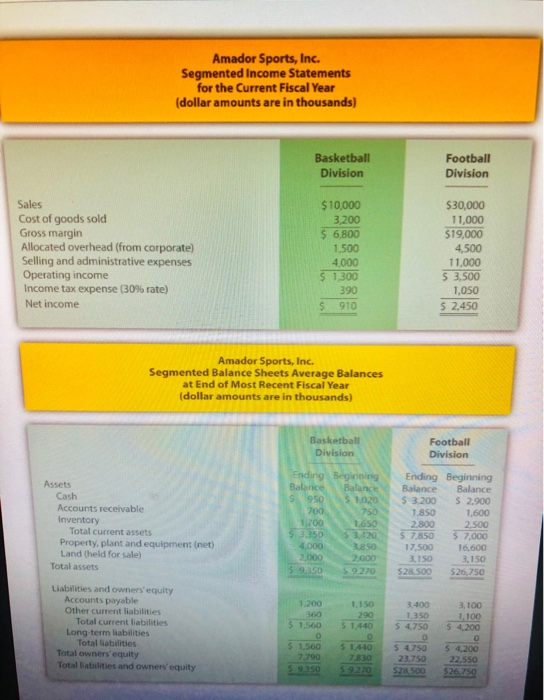

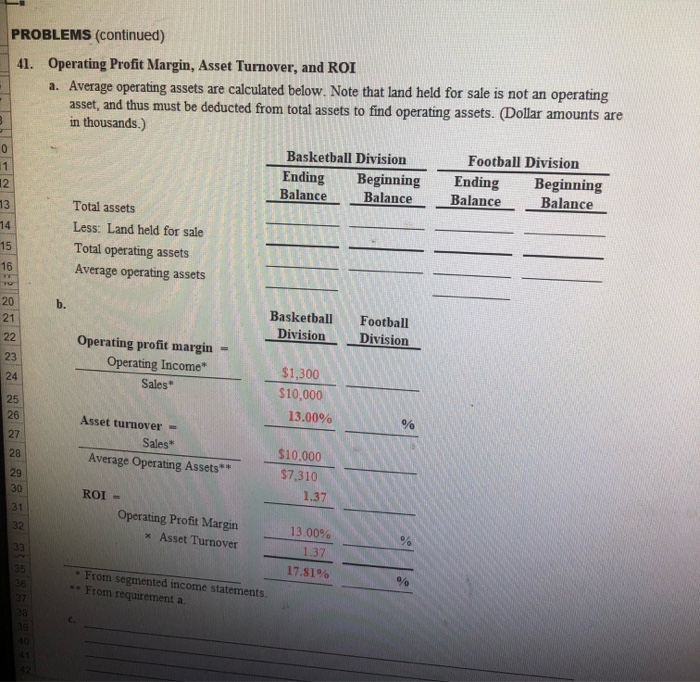

PROBLEMS (COontinued) Operating Profit Margin, Asset Turnover, and ROI Average operating assets are calculated below. Note that land held for sale is not an operating asset, and thus must be deducted from total assets to find operating assets. (Dollar amounts are thousands.) 41. a. in Football Division Basketball Division 0 Beginning Balance Ending Balance Ending Balance Beginning Balance 1 12 Total assets 13 Less: Land held for sale 14 Total operating assets 15 Average operating assets 16 20 h. Basketball Division Football 21 Division 22 Operating profit margin Operating Income 23 $1,300 $10,000 24 Sales* 25 13.00% 26 Asset turnover 27 Sales* $10,000 28 Average Operating Assets $7,310 29 1.37 30 ROI 31 Operating Profit Margin 13.00% 32 x Asset Turnover 1.37 33 17.81% 35 From segmented income statements. From requirement a 36 37 39 40 41 42 Teturn on investment or residual income? Explain. think is best in deciding whether to accept a new 41 Operating Profit Margin, Asset Turnover, and Return on Investment (ROI). Financial information for Amador Sports, Inc., for the most recent fiscal year appears as follows. All dollar amounts are in thousands. Spts Gegmarded inene St ara eang Se ntnd w asrent Required: a. Calculate average operating assets for each division. (Hint: land held for sale is not an operating asset.) b. Calculate operating profit margin, asset turnover, and return on investment for each division. Ouornting Profit Margin. Asset Turnover, Return on Investment (ROD, and Residual Income (R). ficcal ear appears as follows. All dollar c. What does this information tell us about each division? heaTas Amador Sports, Inc. Segmented Income Statements for the Current Fiscal Year (dollar amounts are in thousands) Basketball Division Football Division $10,000 3,200 $ 6,800 Sales $30,000 Cost of goods sold Gross margin Allocated overhead (from corporate) Selling and administrative expenses Operating income Income tax expense (30% rate) 11,000 $19,000 1.500 4,500 4,000 11.000 $ 1,300 $ 3,500 390 1,050 Net income S 2,450 910 Amador Sports, Inc. Segmented Balance Sheets Average Balances at End of Most Recent Fiscal Year (dollar amounts are in thousands) Basketball Football Division Division Ending Begirining Balance Balarice 950 S1,020 700 Ending Beginning Balance S 3,200 Assets Cash Accounts receivable Inventory Total current assets Property, plant and equipment (net) Land (held for sale) Balance $ 2,900 750 1650 s 3,120 1,850 1,600 2,500 $ 7,000 1700 $3350 4,000 2,000 $ 9.350 2.800 S 7.850 3.850 17,500 16,600 2000 3,150 3,150 Total assets $28.500 S9270 $26,750 Liabilities and owners' equity Accounts payable Other current liabilities Total current liabilities Long term liabilities Total liabilitie Total owners equity 1.200 1,150 3.400 3,100 360 290 1,350 1,100 S 4,200 $ 1,560 S 1440 S 4750 $ 1,560 S 1440 S 4.750 S 4,200 7.790 7830 23.750 22,550 Total iabilities and owners equity s 9350 $26,750 59270 $28.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started