Answered step by step

Verified Expert Solution

Question

1 Approved Answer

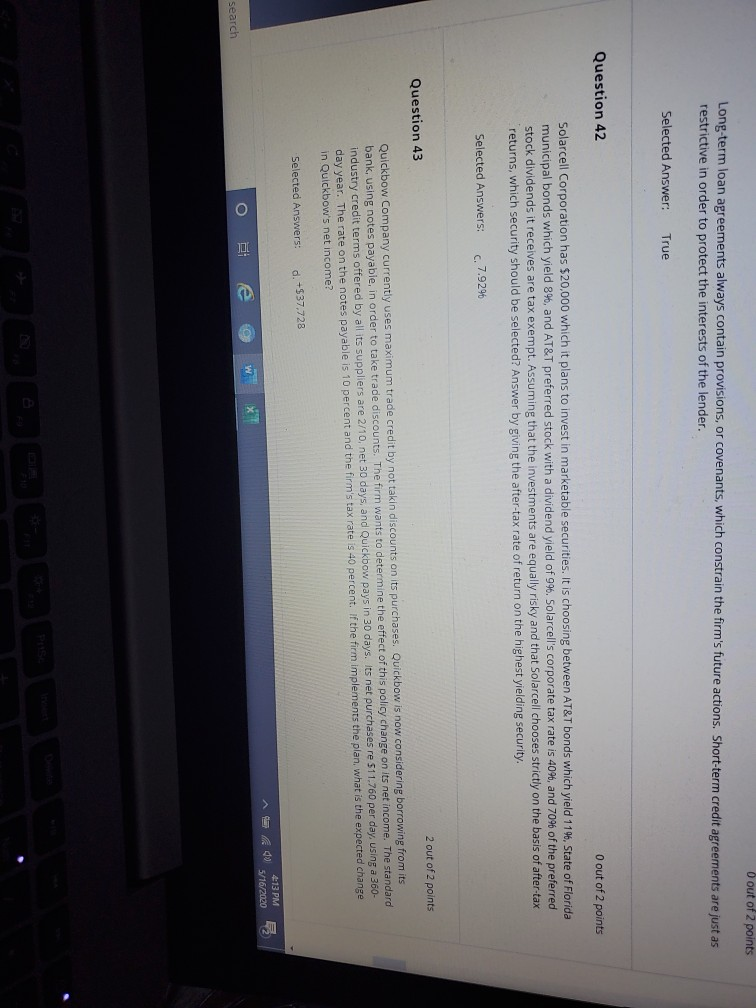

Question 42 0 out of 2 points Long-term loan agreements always contain provisions, or covenants, which constrain the firm's future actions. Short-term credit agreements are

Question 42

0 out of 2 points Long-term loan agreements always contain provisions, or covenants, which constrain the firm's future actions. Short-term credit agreements are just as restrictive in order to protect the interests of the lender. Selected Answer: True Question 42 O out of 2 points Solarcell Corporation has $20,000 which it plans to invest in marketable securities. It is choosing between AT&T bonds which yield 1196, State of Florida municipal bonds which yield 8%, and AT&T preferred stock with a dividend yield of 996. Solarcell's corporate tax rate is 40%, and 70% of the preferred stock dividends it receives are tax exempt. Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns, which security should be selected? Answer by giving the after-tax rate of return on the highest yielding security. Selected Answers: c. 7.9296 2 out of 2 points Question 43 Quickbow Company currently uses maximum trade credit by not takin discounts on its purchases. Quickbow is now considering borrowing from its bank, using notes payable, in order to take trade discounts. The firm wants to determine the effect of this policy change on its net income. The standard industry credit terms offered by all its suppliers are 2/10, net 30 days, and Quickbow pays in 30 days. Its net purchases re 511.760 per day, using a 360- day year. The rate on the notes payable is 10 percent and the firm's tax rate is 40 percent. If the firm implements the plan, what is the expected change in Quickbow's net income? Selected Answers: d. -$37.728 4:13 PM 5/16/2020 w searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started