Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 43 parts a, b and c Question 43 Using the information in the table above, prepare Briefly describ R&D in 2003 and a. b.

question 43 parts a, b and c

Question 43

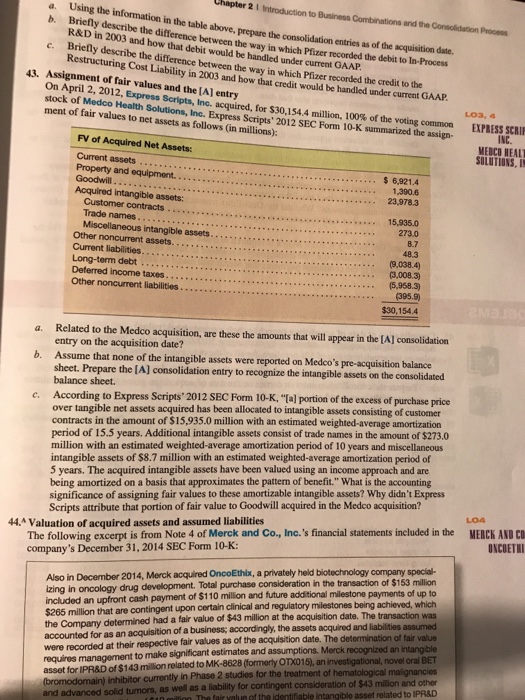

Using the information in the table above, prepare Briefly describ R&D in 2003 and a. b. the consolidation entries as of the acquisition date. the way in which Pfizer recorded the debit to In-Process be the difference between how that debit would be handled under current GAAP descibe the difference between the way in which Pfizer recorded the credit to the Restructuring Cost Liability in 2003 and how that credit would be handled under current GAAP 43. Assignment of fair values and the [A] entry on April 2, 2012 Express Scripts, Inc. acquired for S30 i54.4 mill n l00% of the voting enon stock of Medco Health Solutions, Inc. Express Scripts' 2012 SEC Form 10-K summarized the assign- ment of fair values to net assets as follows (in millions): Loa, 4 Enssn? INC. MEDCO HEA SOLUTIONS, FV of Acquired Net Assets: Current assets 6,921.4 1.390.6 ...1 Acquired intangible assets: contracts ...15,935.0 273.0 8.7 48.3 (9,038.4) (3,008.3) (5,958.3) 395.9) Trade names Miscellaneous intangible assets.. Other noncurrent assets. Current liabilities Long-term debt Deferred income taxes Other noncurrent liabilities $30,154.4 a. Related to the Medco acquisition, are these the amounts that will appear in the [A] consolidation entry on the acquisition date? Assume that none of the intangible assets were reported on Medco's pre-acquisition balance b. sheet Prepare the IAJ consolidation entry to recogenize the intangble sets on the consoidated balance sheet. e. According to Express Scripts' 2012 SEC Form 10-K. "Tal portion of the excess of purchase price has been allocated to intangible assets consisting of customer over tangible net assets acquired contracts in the amount of $15,935.0 million with an estimated weighted-average amortization period of 15.5 years. Additional intangible assets consist of trade names in the amount of $273.0 million with an estimated weighted-average amortization period of 10 years and miscellaneous intangible assets of $8.7 million with an estimated weighted-average amortization period of 5 years. The acquired intangible assets have been valued using an income approach and are being amortized on a basis that approximates the pattern of benefit." What is the accounting significance of assigning fair values to these amortizable intangible assets? Why didn't Express Scripts attribute that portion of fair value to Goodwill acquired in the Medco acquisition? LO4 The following excerpt is from Note 4 of Merck and Co, Inc.'s financial statements included in the company's December 31, 2014 SEC Form 10-K: MERCK AND C 44.4 Valuation of acquired assets and assumed liabilities Also in December 2014, Merck acquired OncoEthix, a privately held biotechnology company special- zing in oncology drug development. Total purchase consideration in the transaction of $153 million ncluded an upfront cash payment of $110 million and future additional milestone payments of up to $265 million that are contingent upon certain clinical the Company determined had a fair value of $43 million at the acquisition date. The t accounted for as an acquisition of a business; accordingly, the assets acquired and liabl were recorded at their respective fair values as of the acquisition date. The determination of requires management to make significant estimates and assumptions. Merck recognized an intangble asset forlPR&D of $1 43 millon related to MK-8629?onmenyomoaan (bromodomain) inhibitor currently in Phase 2 studies for the treatment of hematological maignancies and advanced solid tumors, as well as a liability for and regulatory milestones being achieved, which ities assumed fair value contingent consideration of $43 million and other iable intangible asset related to IPR&D Using the information in the table above, prepare Briefly describ R&D in 2003 and a. b. the consolidation entries as of the acquisition date. the way in which Pfizer recorded the debit to In-Process be the difference between how that debit would be handled under current GAAP descibe the difference between the way in which Pfizer recorded the credit to the Restructuring Cost Liability in 2003 and how that credit would be handled under current GAAP 43. Assignment of fair values and the [A] entry on April 2, 2012 Express Scripts, Inc. acquired for S30 i54.4 mill n l00% of the voting enon stock of Medco Health Solutions, Inc. Express Scripts' 2012 SEC Form 10-K summarized the assign- ment of fair values to net assets as follows (in millions): Loa, 4 Enssn? INC. MEDCO HEA SOLUTIONS, FV of Acquired Net Assets: Current assets 6,921.4 1.390.6 ...1 Acquired intangible assets: contracts ...15,935.0 273.0 8.7 48.3 (9,038.4) (3,008.3) (5,958.3) 395.9) Trade names Miscellaneous intangible assets.. Other noncurrent assets. Current liabilities Long-term debt Deferred income taxes Other noncurrent liabilities $30,154.4 a. Related to the Medco acquisition, are these the amounts that will appear in the [A] consolidation entry on the acquisition date? Assume that none of the intangible assets were reported on Medco's pre-acquisition balance b. sheet Prepare the IAJ consolidation entry to recogenize the intangble sets on the consoidated balance sheet. e. According to Express Scripts' 2012 SEC Form 10-K. "Tal portion of the excess of purchase price has been allocated to intangible assets consisting of customer over tangible net assets acquired contracts in the amount of $15,935.0 million with an estimated weighted-average amortization period of 15.5 years. Additional intangible assets consist of trade names in the amount of $273.0 million with an estimated weighted-average amortization period of 10 years and miscellaneous intangible assets of $8.7 million with an estimated weighted-average amortization period of 5 years. The acquired intangible assets have been valued using an income approach and are being amortized on a basis that approximates the pattern of benefit." What is the accounting significance of assigning fair values to these amortizable intangible assets? Why didn't Express Scripts attribute that portion of fair value to Goodwill acquired in the Medco acquisition? LO4 The following excerpt is from Note 4 of Merck and Co, Inc.'s financial statements included in the company's December 31, 2014 SEC Form 10-K: MERCK AND C 44.4 Valuation of acquired assets and assumed liabilities Also in December 2014, Merck acquired OncoEthix, a privately held biotechnology company special- zing in oncology drug development. Total purchase consideration in the transaction of $153 million ncluded an upfront cash payment of $110 million and future additional milestone payments of up to $265 million that are contingent upon certain clinical the Company determined had a fair value of $43 million at the acquisition date. The t accounted for as an acquisition of a business; accordingly, the assets acquired and liabl were recorded at their respective fair values as of the acquisition date. The determination of requires management to make significant estimates and assumptions. Merck recognized an intangble asset forlPR&D of $1 43 millon related to MK-8629?onmenyomoaan (bromodomain) inhibitor currently in Phase 2 studies for the treatment of hematological maignancies and advanced solid tumors, as well as a liability for and regulatory milestones being achieved, which ities assumed fair value contingent consideration of $43 million and other iable intangible asset related to IPR&DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started