Answered step by step

Verified Expert Solution

Question

1 Approved Answer

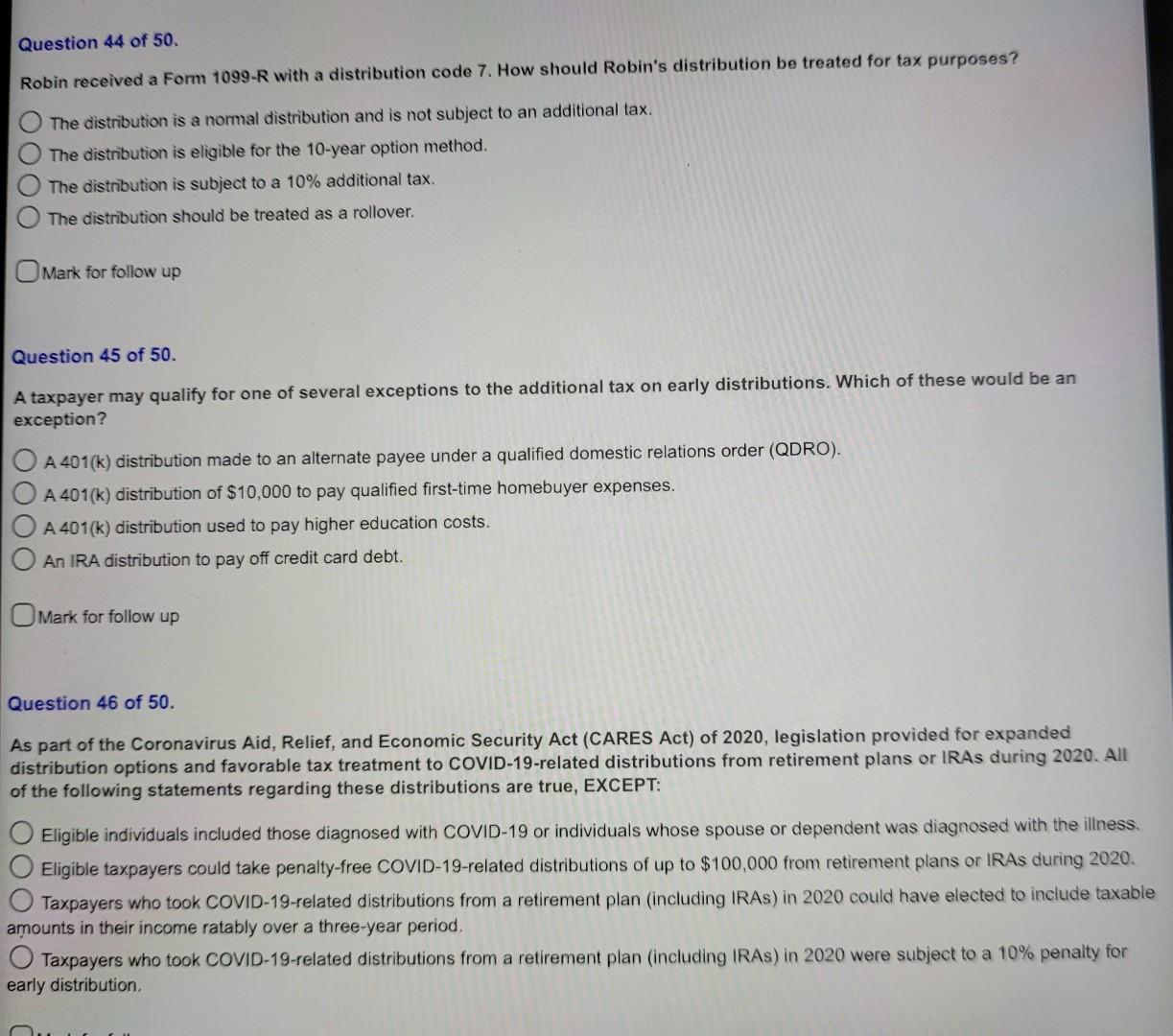

Question 44 of 50 . Robin received a Form 1099-R with a distribution code 7 . How should Robin's distribution be treated for tax purposes?

Question 44 of 50 . Robin received a Form 1099-R with a distribution code 7 . How should Robin's distribution be treated for tax purposes? The distribution is a normal distribution and is not subject to an additional tax. The distribution is eligible for the 10-year option method. The distribution is subject to a 10% additional tax. The distribution should be treated as a rollover. Mark for follow up Question 45 of 50. A taxpayer may qualify for one of several exceptions to the additional tax on early distributions. Which of these would be an exception? A 401(k) distribution made to an alternate payee under a qualified domestic relations order (QDRO). A 401(k) distribution of $10,000 to pay qualified first-time homebuyer expenses. A 401(k) distribution used to pay higher education costs. An IRA distribution to pay off credit card debt. Mark for follow up Question 46 of 50 . As part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) of 2020, legislation provided for expanded distribution options and favorable tax treatment to COVID-19-related distributions from retirement plans or IRAs during 2020. All of the following statements regarding these distributions are true, EXCEPT: Eligible individuals included those diagnosed with COVID-19 or individuals whose spouse or dependent was diagnosed with the illness. Eligible taxpayers could take penalty-free COVID-19-related distributions of up to $100,000 from retirement plans or IRAs during 2020. Taxpayers who took COVID-19-related distributions from a retirement plan (including IRAs) in 2020 could have elected to include taxable amounts in their income ratably over a three-year period. Taxpayers who took COVID-19-related distributions from a retirement plan (including IRAs) in 2020 were subject to a 10% penalty for early distribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started