Answered step by step

Verified Expert Solution

Question

1 Approved Answer

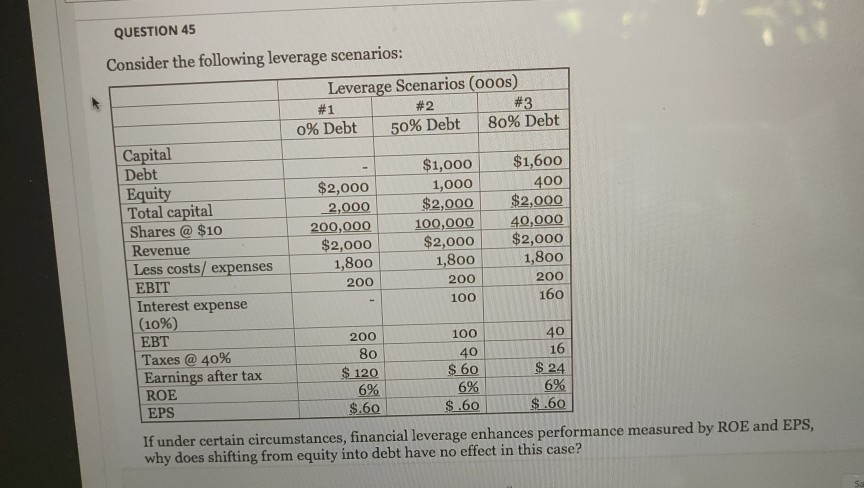

QUESTION 45 Consider the following leverage scenarios: Leverage Scenarios (ooos) #1 #2 #3 0% Debt 50% Debt 80% Debt Capital Debt $1,000 $1,600 Equity $2,000

QUESTION 45 Consider the following leverage scenarios: Leverage Scenarios (ooos) #1 #2 #3 0% Debt 50% Debt 80% Debt Capital Debt $1,000 $1,600 Equity $2,000 1,000 400 Total capital 2,000 $2,000 $2,000 Shares @ $10 200,000 100,000 40,000 Revenue $2,000 $2,000 $2,000 Less costs/ expenses 1,800 1,800 1,800 EBIT 200 200 200 Interest expense 100 160 (10%) EBT 200 100 40 Taxes @ 40% 40 16 Earnings after tax $ 120 $ 60 $ 24 ROE 6% 6% EPS $.60 $.60 $.60 If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case? 80 6% 5.60 EPS $.60 If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case? a. the company hasn't repurchased enough shares of stock with borrowed money the money the company is earning on its capital is exactly what it costs to borrow I OC ROCE is too high d. ROCE is equal to the after tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started