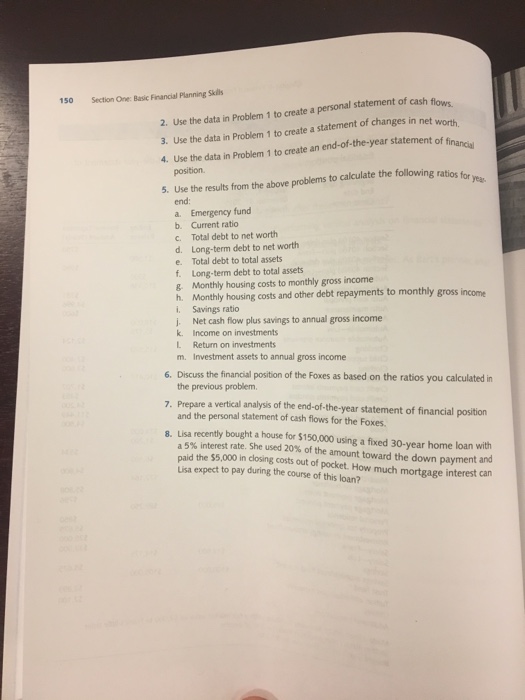

Question 4,5,and 6

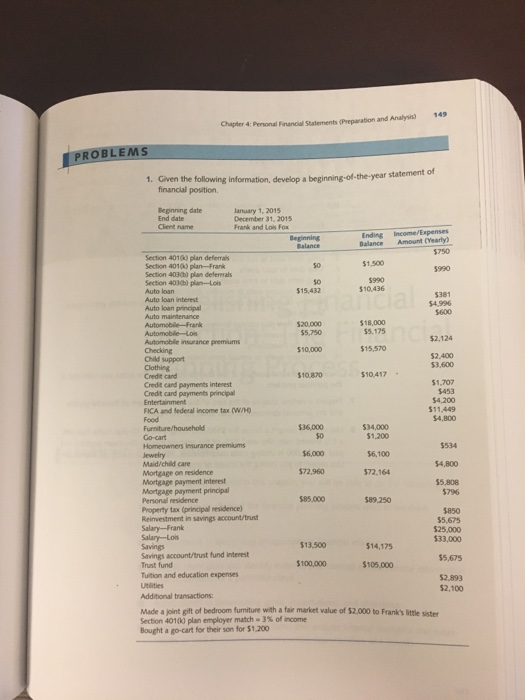

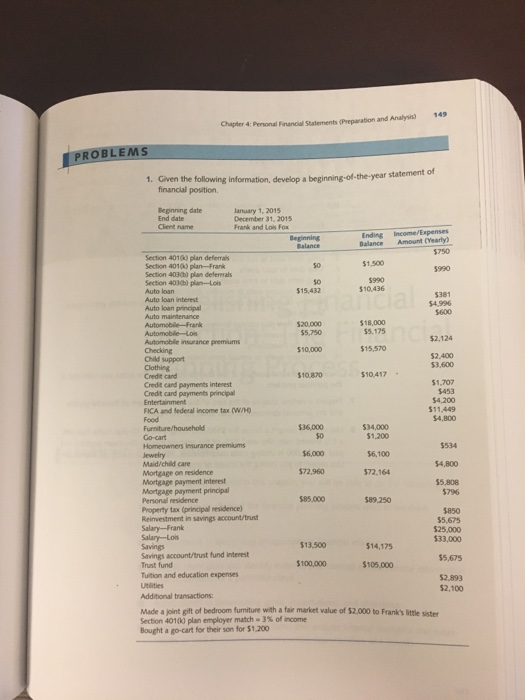

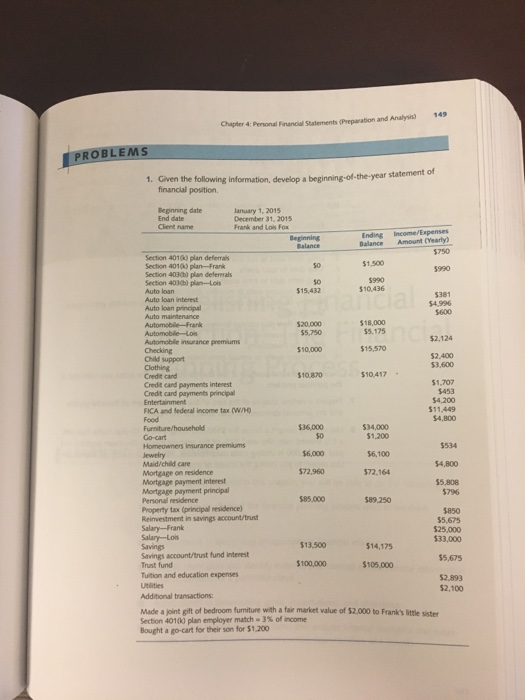

Chapter 4: Pensonal Financial Statements (Preparation and Analysits) 149 PROBLEMS 1. Given the following information, develop a beginning-of-the-year statement of financial position. January 1, 2015 December 31, 2015 Frank and Lois Fox Beginning date Income/Expenses Amount (Yearly) $750 Ending Section 401) plan deferrals Section 4010) plan-Frank Section 403(b) plan defererals Section 4030b) plan-Lois Auto loan Auto loan interest Balance $1,500 $990 990 5o $15,432 510,436 381 Auto loan principal 18,000 $5,175 $5,750 $2,124 Automoble insurance premiums $10,000 $15,570 2.400 53,600 Child support $10.870 $10,417 Credt cand Credt card payments interest Credit card payments principal $1.707 $453 FICA and federal income tax (Wh0 11,449 $4,800 34,000 $1,200 %,100 572.164 $534 54,800 $5,808 Maid/child care Mortgage on residence Mortgage payment interest Mortgage paryment principal Personal residence Property tax (principal nesidence) Reinvestment in savings account/trust Salary-Frank 572,960 $89,250 $850 $5,675 $25,000 33,000 $13,500 514,175 Savings account/trust fund interest Trust fund $5,675 $100,000 $106,000 Tuition and education expenses $2,893 $2,100 Additional transactions: Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's ittle sister Section 401(k) plan employer match-3% of rome Bought a go-cart for their son for $1,200 Chapter 4: Pensonal Financial Statements (Preparation and Analysits) 149 PROBLEMS 1. Given the following information, develop a beginning-of-the-year statement of financial position. January 1, 2015 December 31, 2015 Frank and Lois Fox Beginning date Income/Expenses Amount (Yearly) $750 Ending Section 401) plan deferrals Section 4010) plan-Frank Section 403(b) plan defererals Section 4030b) plan-Lois Auto loan Auto loan interest Balance $1,500 $990 990 5o $15,432 510,436 381 Auto loan principal 18,000 $5,175 $5,750 $2,124 Automoble insurance premiums $10,000 $15,570 2.400 53,600 Child support $10.870 $10,417 Credt cand Credt card payments interest Credit card payments principal $1.707 $453 FICA and federal income tax (Wh0 11,449 $4,800 34,000 $1,200 %,100 572.164 $534 54,800 $5,808 Maid/child care Mortgage on residence Mortgage payment interest Mortgage paryment principal Personal residence Property tax (principal nesidence) Reinvestment in savings account/trust Salary-Frank 572,960 $89,250 $850 $5,675 $25,000 33,000 $13,500 514,175 Savings account/trust fund interest Trust fund $5,675 $100,000 $106,000 Tuition and education expenses $2,893 $2,100 Additional transactions: Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's ittle sister Section 401(k) plan employer match-3% of rome Bought a go-cart for their son for $1,200