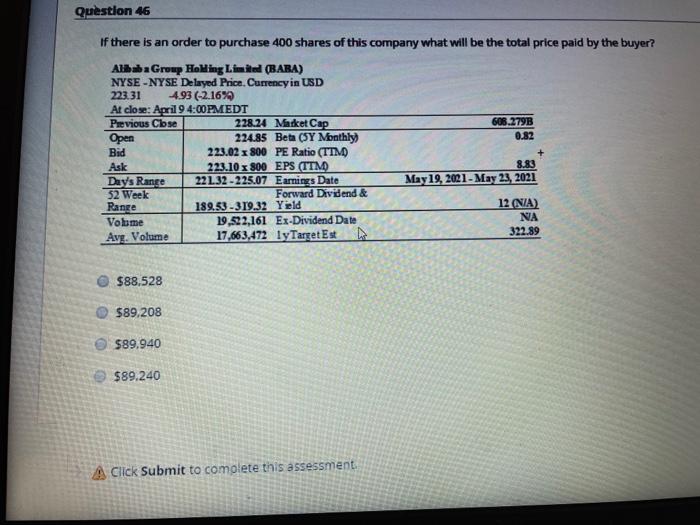

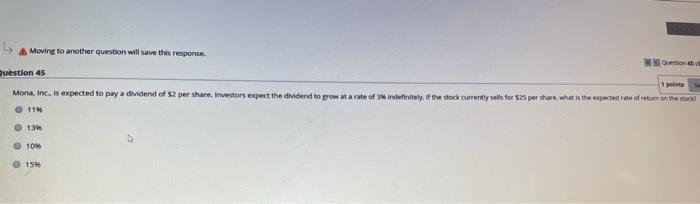

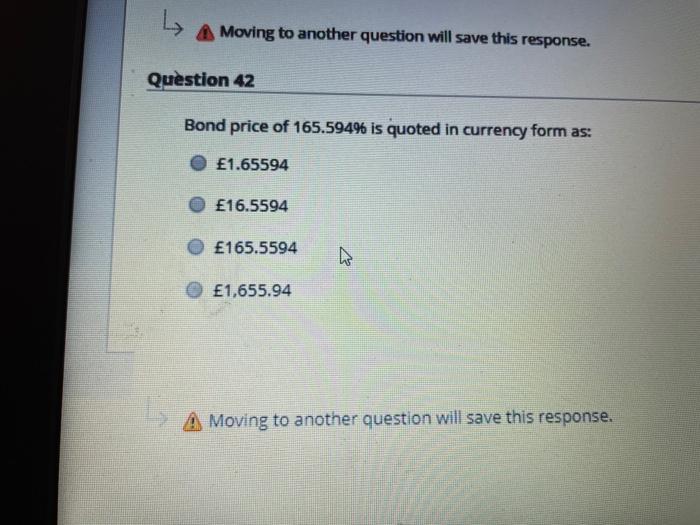

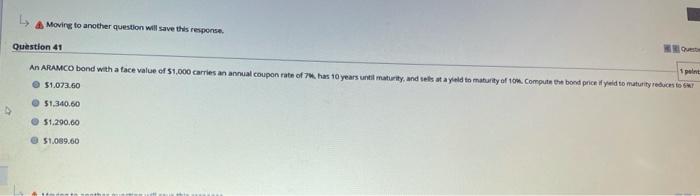

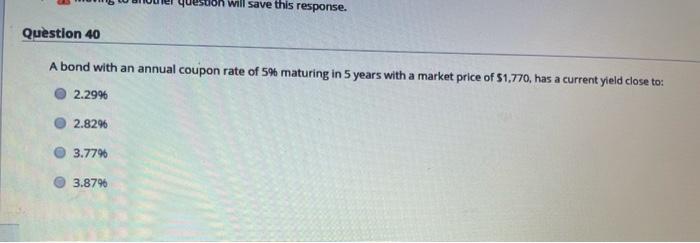

Question 46 If there is an order to purchase 400 shares of this company what will be the total price paid by the buyer? Alibaba Group Holding Limited (BABA) NYSE - NYSE Delayed Price. Currency in USD 223.31 4.93 (-2.16% At close: April 9 4:00PMEDT Previous Cbse 228.24 Macket Cap 608.279B Open 224.85 Beta (5Y Monthly 0.82 Bid 223.02 - 800 PE Ratio (TTM) Ask 223.10 x 800 EPS (TTM 8.83 Day's Range 22L32 -225.07 Earnings Date May 19, 2021 - May 23, 2021 52 Week Forward Dividend & Range 189.53-319.32 Yield 12 (NA) Volume 19,522,161 Ex-Dividend Date NA 322.89 Avg. Volume 17,663,472 1yTarget Est $88,528 $89.208 $89.940 $89.240 A Click Submit to complete this assessment. Moving to another question will save this response Won Question 45 Mona, Inc. is expected to play a dividend of $2 per share. Investors expect the dividend to grow a rate of indefinitely. If the stock currently sells for $25 per share what is the expected para o return on the Moon @ 114 point 134 104 15 Moving to another question will save this response Won Question 45 Mona, Inc. is expected to pay a dividend of $2 per share. Investors expect the dividend to grow state of inderty. If the stock currently sets for 25 per share what the rected to un nuwe 11 1 10W 15 Q 6) Moving to another question will save this response Moving to another question will save this response Question as Mona, Inc. is expected to pay a dividend of $2 per share. Investors expect the dividend to grow state of indefinitely the stock currently on for 85 per here what the expected to our on the whole 114 1 1 points 10 15 Moving to another question will save this response. Moving to another question will save this response. Question 42 Bond price of 165.59496 is quoted in currency form as: 1.65594 16.5594 165.5594 w 1,655.94 A Moving to another question will save this response. Moving to another question will save this response Question 41 AN ARAMCO bond with a face value of 51.000 carries an annual coupon rate of 78. has 10 years une maturity, and als stayed to maturity of tom. Compute the bond price if yuld to maturity reduces to $1.073.60 51.340.60 51.290.00 51.089.00 will save this response. Question 40 A bond with an annual coupon rate of 5% maturing in 5 years with a market price of 51,770, has a current yield close to: 2.2996 2.8296 3.7796 3.8796