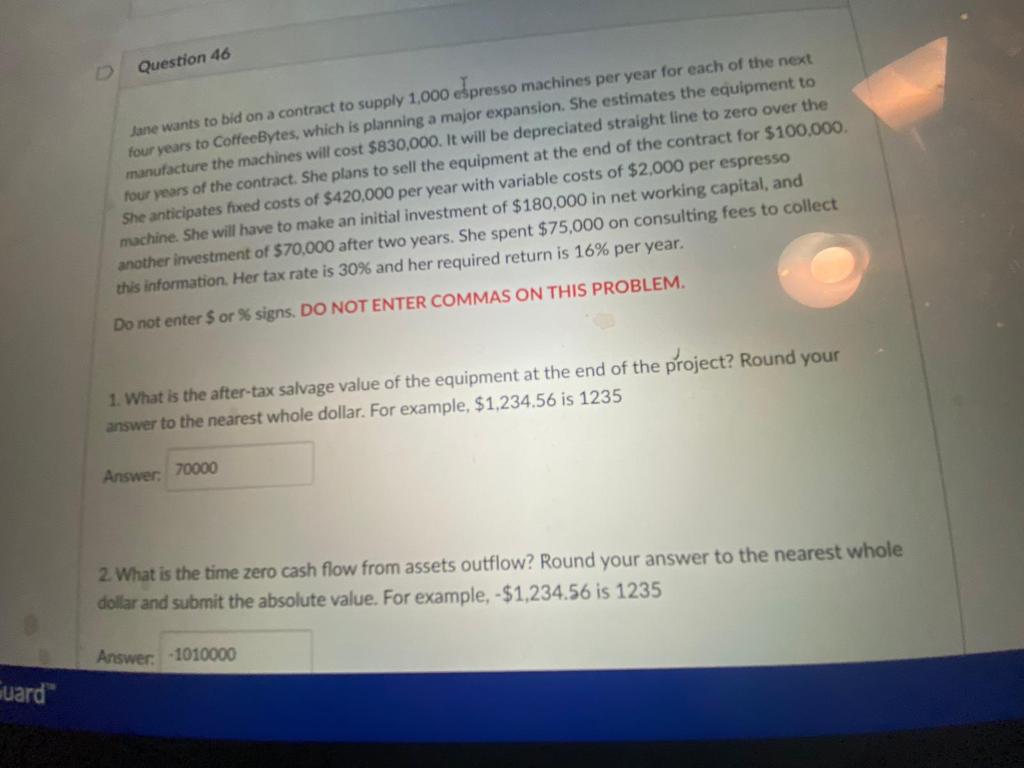

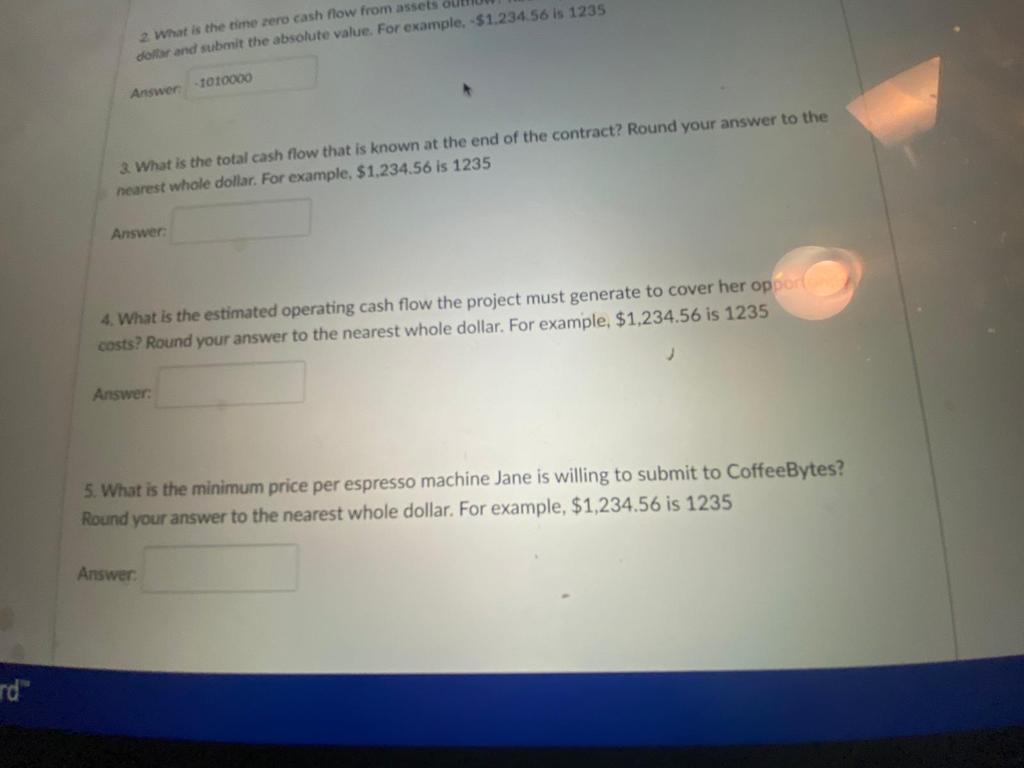

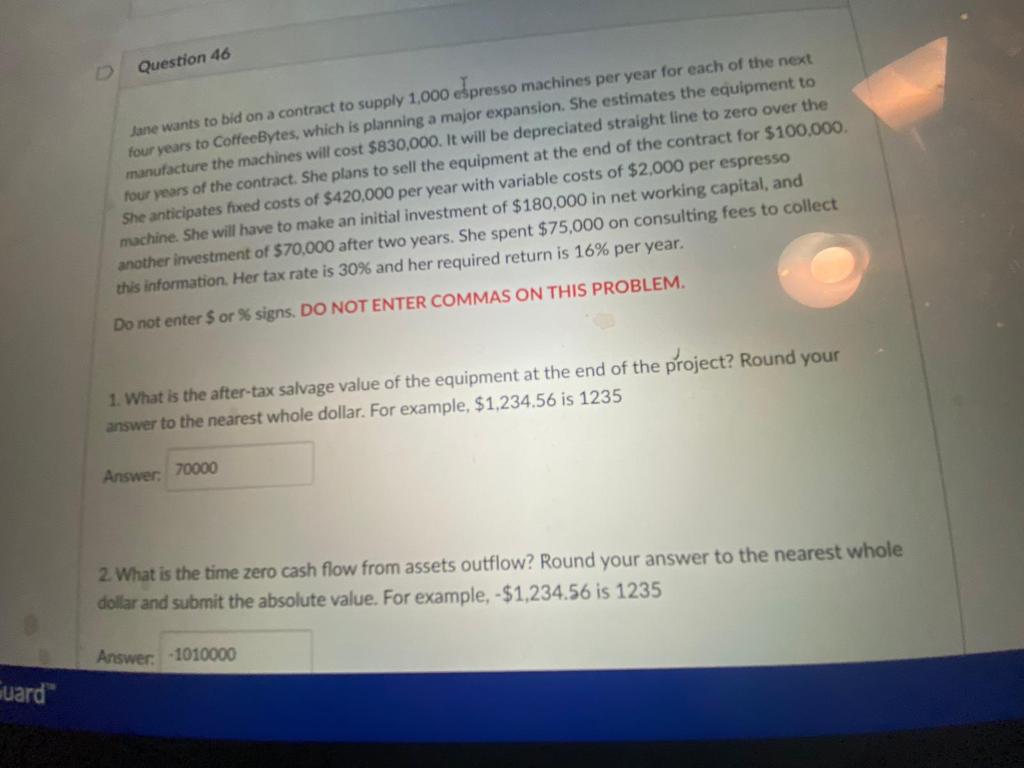

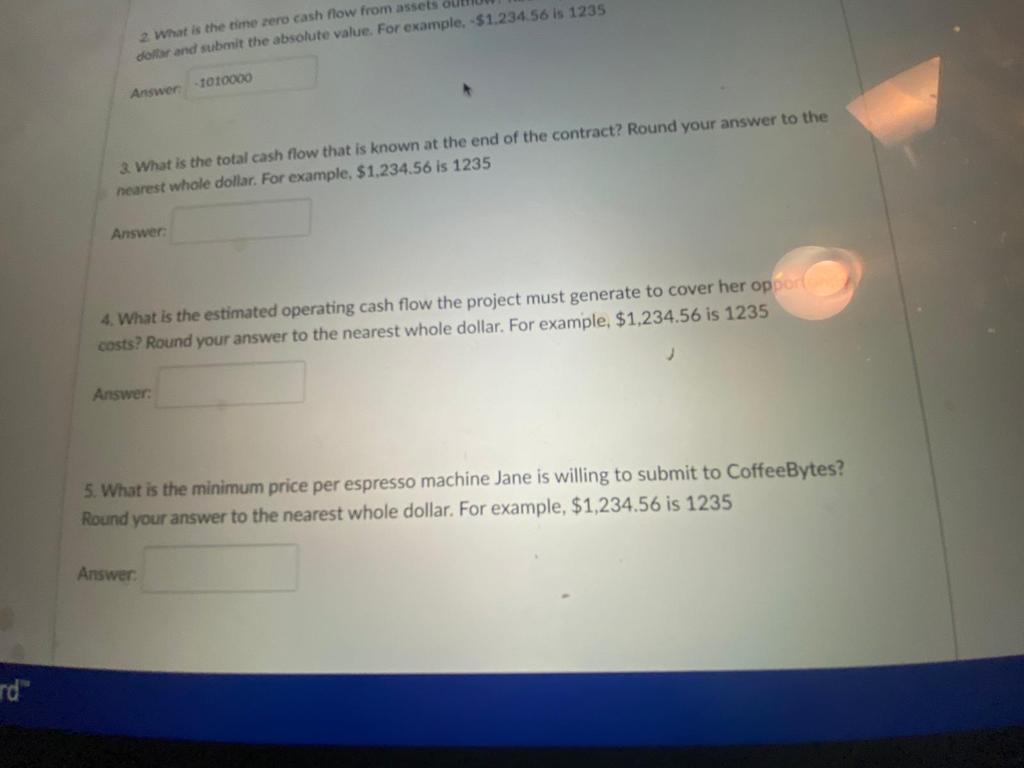

Question 46 Jane wants to bid on a contract to supply 1,000 espresso machines per year for each of the next four years to CoffeeBytes, which is planning a major expansion. She estimates the equipment to manufacture the machines will cost $830,000. It will be depreciated straight line to zero over the four years of the contract. She plans to sell the equipment at the end of the contract for $100.000, She anticipates fixed costs of $420,000 per year with variable costs of $2,000 per espresso machine. She will have to make an initial investment of $180,000 in net working capital, and another investment of $70,000 after two years. She spent $75,000 on consulting fees to collect this information. Her tax rate is 30% and her required return is 16% per year. Do not enter $ or signs, DO NOT ENTER COMMAS ON THIS PROBLEM. 1. What is the after-tax salvage value of the equipment at the end of the project? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer: 70000 2. What is the time zero cash flow from assets outflow? Round your answer to the nearest whole dollar and submit the absolute value. For example, - $1,234.56 is 1235 Answer: -1010000 Fuard 2 What is the time rero cash flow from assets out dolor and submit the absolute value. For example, $1.234 56 is 1235 1000000 Answer 3. What is the total cash flow that is known at the end of the contract? Round your answer to the nearest whole dollar. For example, $1.234.56 is 1235 Answer: 4. What is the estimated operating cash flow the project must generate to cover her opport costs? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer: 5. What is the minimum price per espresso machine Jane is willing to submit to CoffeeBytes? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer rd" Question 46 Jane wants to bid on a contract to supply 1,000 espresso machines per year for each of the next four years to CoffeeBytes, which is planning a major expansion. She estimates the equipment to manufacture the machines will cost $830,000. It will be depreciated straight line to zero over the four years of the contract. She plans to sell the equipment at the end of the contract for $100.000, She anticipates fixed costs of $420,000 per year with variable costs of $2,000 per espresso machine. She will have to make an initial investment of $180,000 in net working capital, and another investment of $70,000 after two years. She spent $75,000 on consulting fees to collect this information. Her tax rate is 30% and her required return is 16% per year. Do not enter $ or signs, DO NOT ENTER COMMAS ON THIS PROBLEM. 1. What is the after-tax salvage value of the equipment at the end of the project? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer: 70000 2. What is the time zero cash flow from assets outflow? Round your answer to the nearest whole dollar and submit the absolute value. For example, - $1,234.56 is 1235 Answer: -1010000 Fuard 2 What is the time rero cash flow from assets out dolor and submit the absolute value. For example, $1.234 56 is 1235 1000000 Answer 3. What is the total cash flow that is known at the end of the contract? Round your answer to the nearest whole dollar. For example, $1.234.56 is 1235 Answer: 4. What is the estimated operating cash flow the project must generate to cover her opport costs? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer: 5. What is the minimum price per espresso machine Jane is willing to submit to CoffeeBytes? Round your answer to the nearest whole dollar. For example, $1,234.56 is 1235 Answer rd