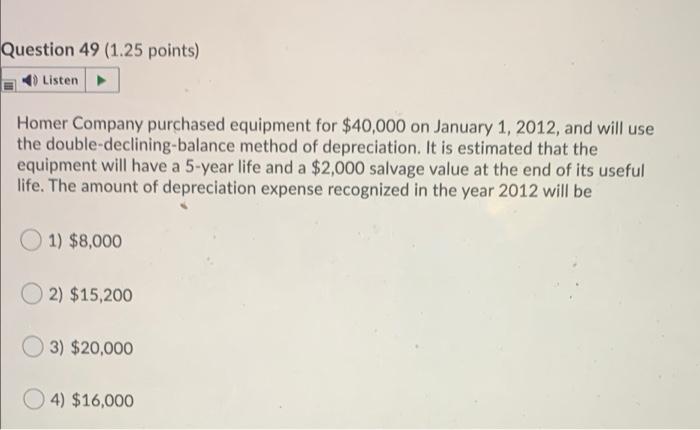

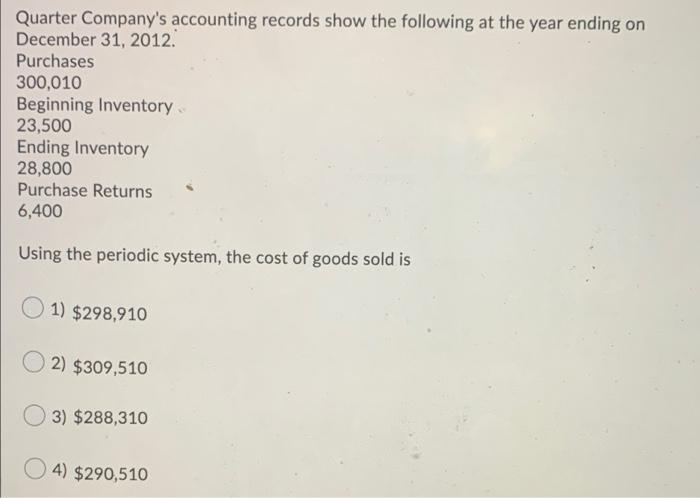

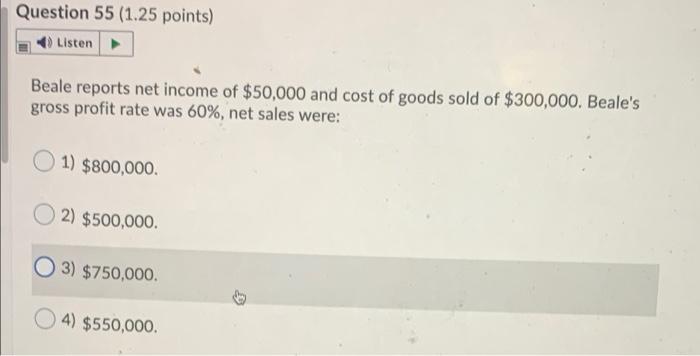

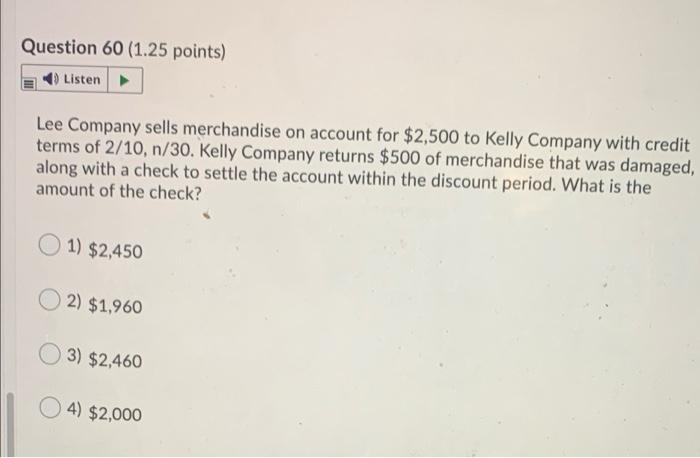

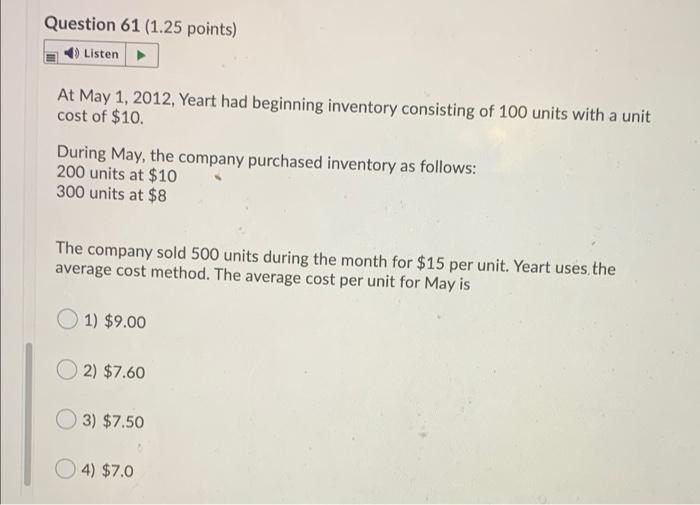

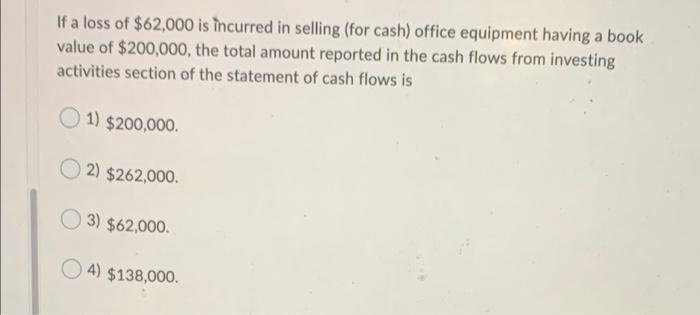

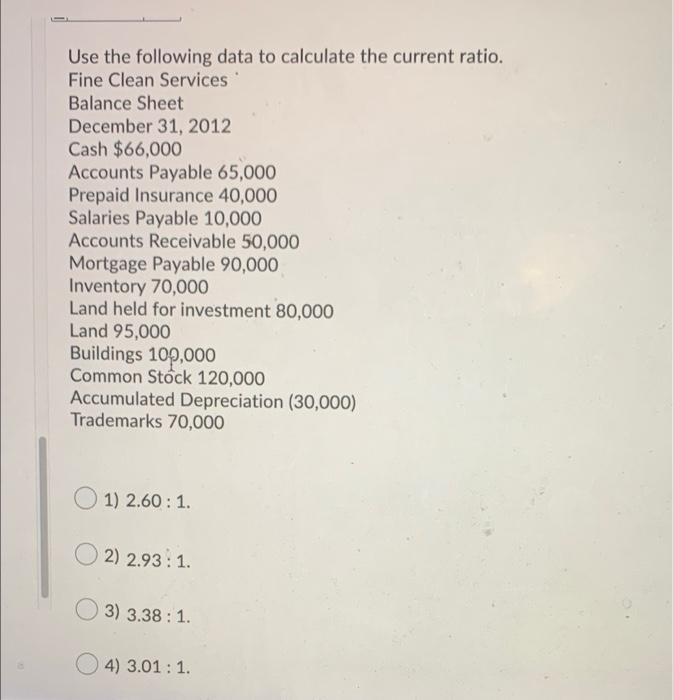

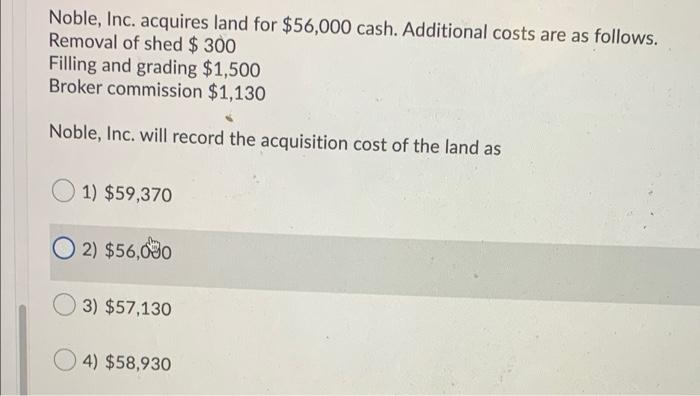

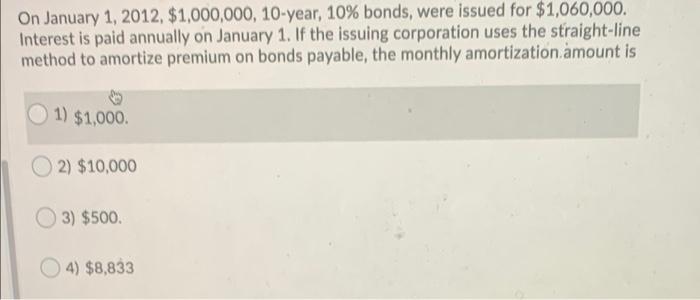

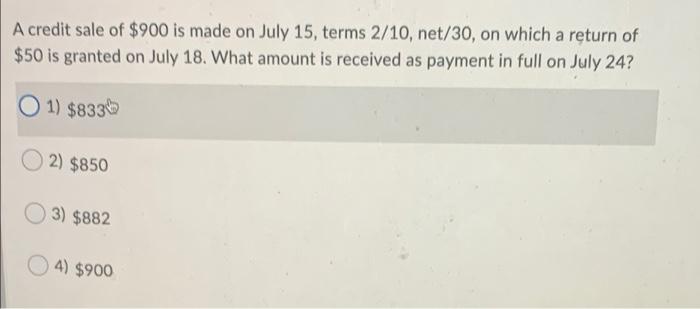

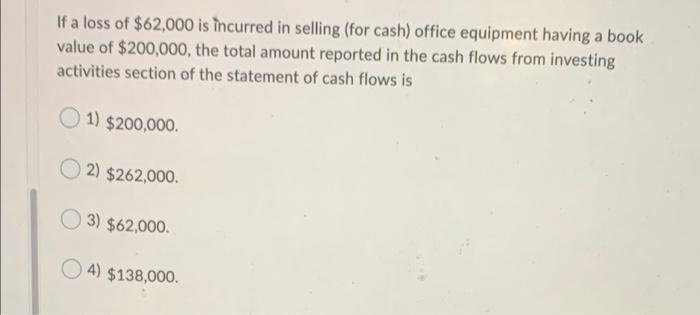

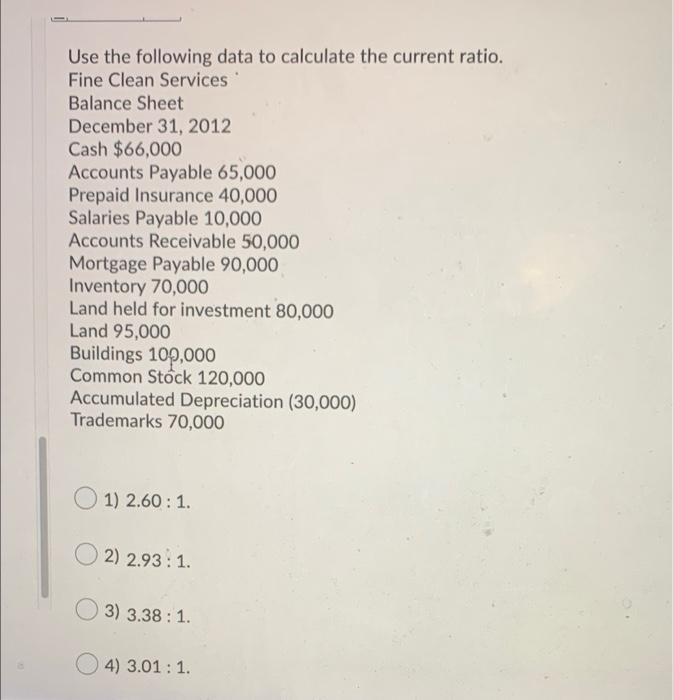

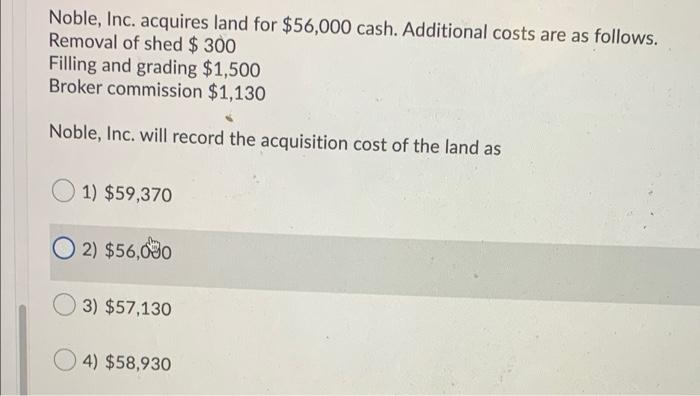

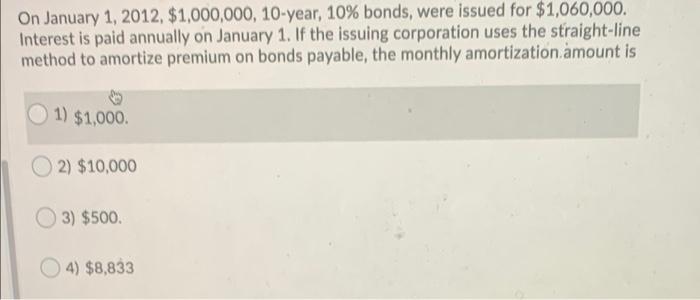

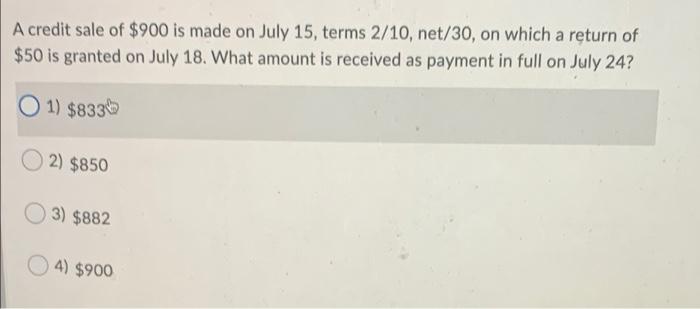

Question 49 (1.25 points) Listen Homer Company purchased equipment for $40,000 on January 1, 2012, and will use the double-declining balance method of depreciation. It is estimated that the equipment will have a 5-year life and a $2,000 salvage value at the end of its useful life. The amount of depreciation expense recognized in the year 2012 will be 1) $8,000 2) $15,200 3) $20,000 4) $16,000 Quarter Company's accounting records show the following at the year ending on December 31, 2012. Purchases 300,010 Beginning Inventory 23,500 Ending Inventory 28,800 Purchase Returns 6,400 Using the periodic system, the cost of goods sold is 1) $298,910 2) $309,510 3) $288,310 4) $290,510 Question 55 (1.25 points) Listen Beale reports net income of $50,000 and cost of goods sold of $300,000. Beale's gross profit rate was 60%, net sales were: 1) $800,000. O2) $ 2) $500,000 O3) $750,000 4) $550,000 Question 60 (1.25 points) Listen Lee Company sells merchandise on account for $2,500 to Kelly Company with credit terms of 2/10, n/30. Kelly Company returns $500 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check? 1) $2,450 2) $1,960 3) $2,460 4) $2,000 Question 61 (1.25 points) Listen At May 1, 2012, Yeart had beginning inventory consisting of 100 units with a unit cost of $10. During May, the company purchased inventory as follows: 200 units at $10 300 units at $8 The company sold 500 units during the month for $15 per unit. Yeart uses the average cost method. The average cost per unit for May is 1) $9.00 2) $7.60 3) $7.50 4) $7.0 If a loss of $62,000 is incurred in selling (for cash) office equipment having a book value of $200,000, the total amount reported in the cash flows from investing activities section of the statement of cash flows is 1) $200,000 2) $262,000. 3) $62,000. 4) $138,000 Use the following data to calculate the current ratio. Fine Clean Services Balance Sheet December 31, 2012 Cash $66,000 Accounts Payable 65,000 Prepaid Insurance 40,000 Salaries Payable 10,000 Accounts Receivable 50,000 Mortgage Payable 90,000 Inventory 70,000 Land held for investment 80,000 Land 95,000 Buildings 100,000 Common Stock 120,000 Accumulated Depreciation (30,000) Trademarks 70,000 1) 2.60 : 1. 2) 2.93 : 1. 3) 3.38: 1. 4) 3.01: 1. Noble, Inc. acquires land for $56,000 cash. Additional costs are as follows. Removal of shed $ 300 Filling and grading $1,500 Broker commission $1,130 Noble, Inc. will record the acquisition cost of the land as 1) $59,370 2) $56,020 3) $57,130 4) $58,930 On January 1, 2012, $1,000,000, 10-year, 10% bonds, were issued for $1,060,000. Interest is paid annually on January 1. If the issuing corporation uses the straight-line method to amortize premium on bonds payable, the monthly amortization amount is 1) $1,000. 2) $10,000 3) $500. 4) $8,833 A credit sale of $900 is made on July 15, terms 2/10, net/30, on which a return of $50 is granted on July 18. What amount is received as payment in full on July 24? 1) $8336 2) $850 3) $882 4) $900