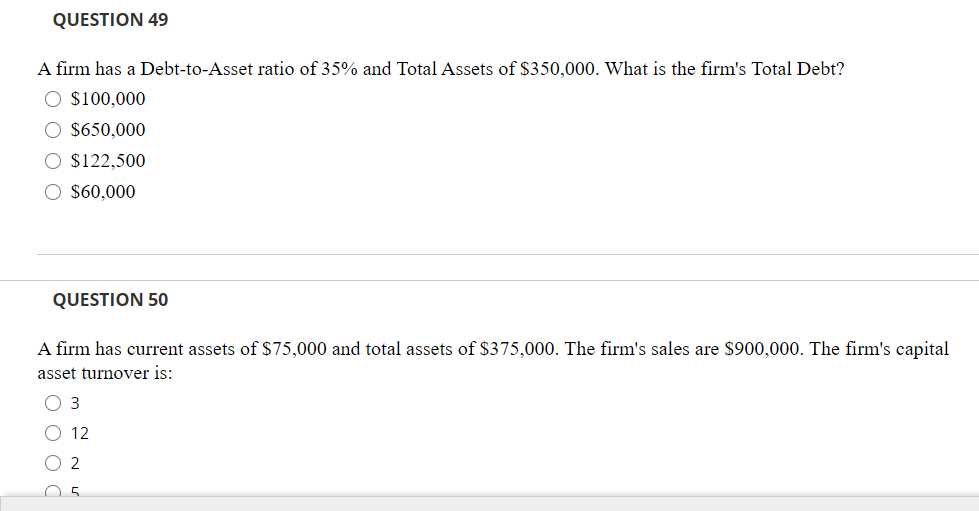

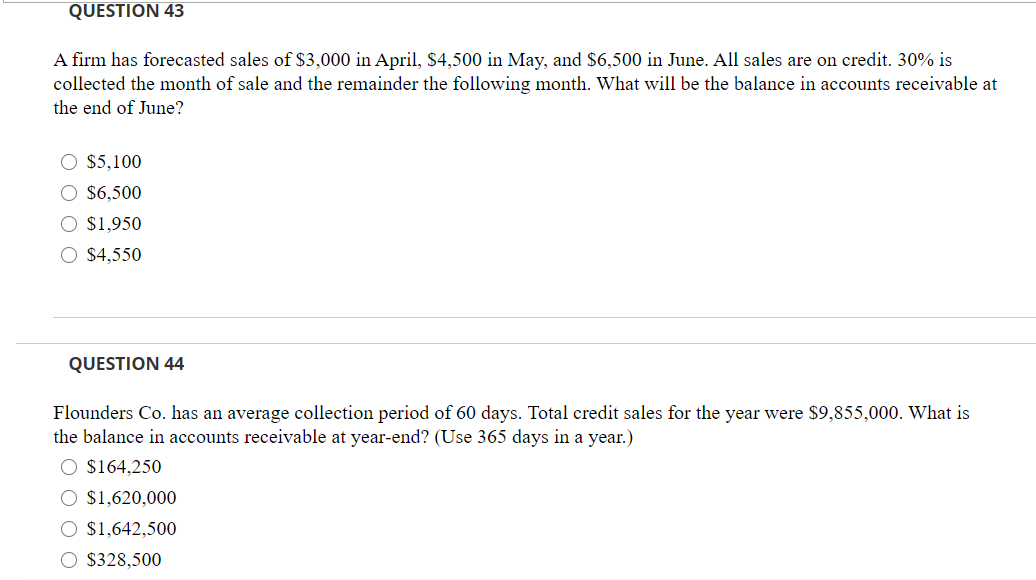

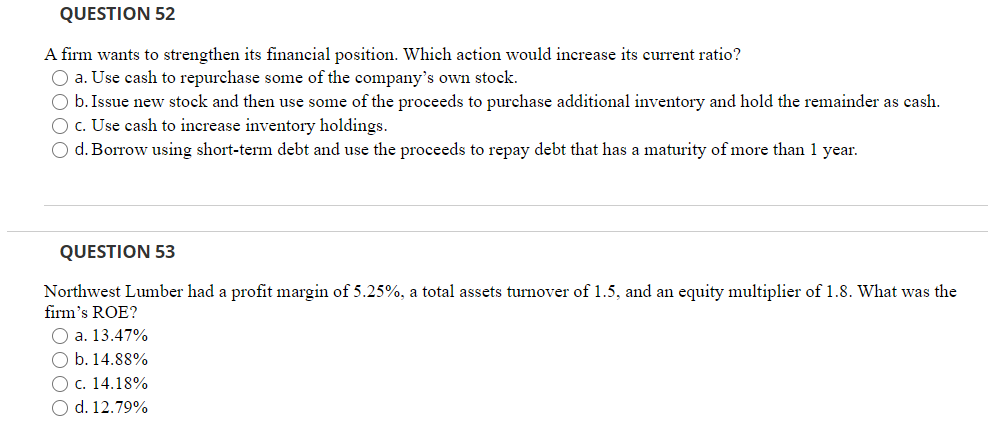

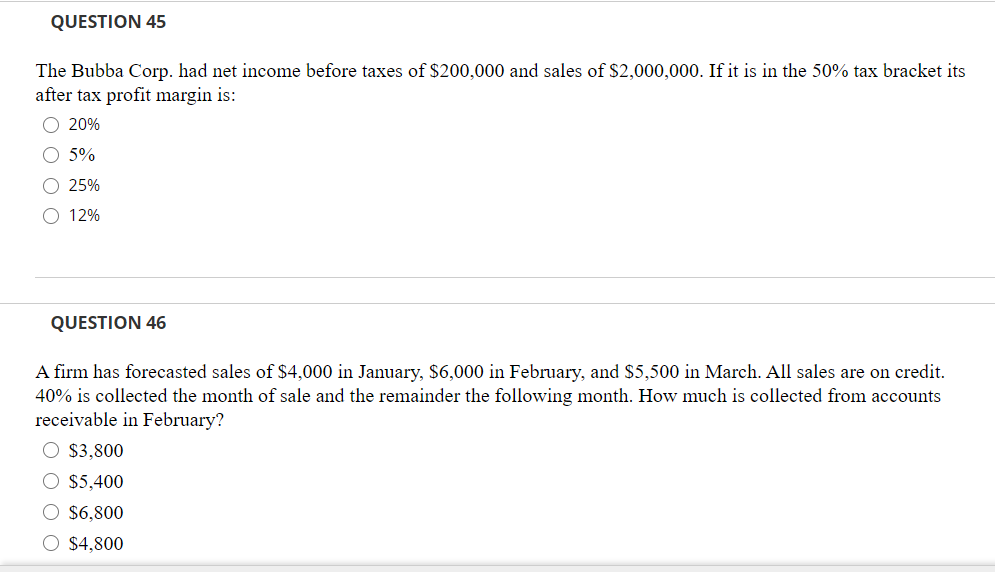

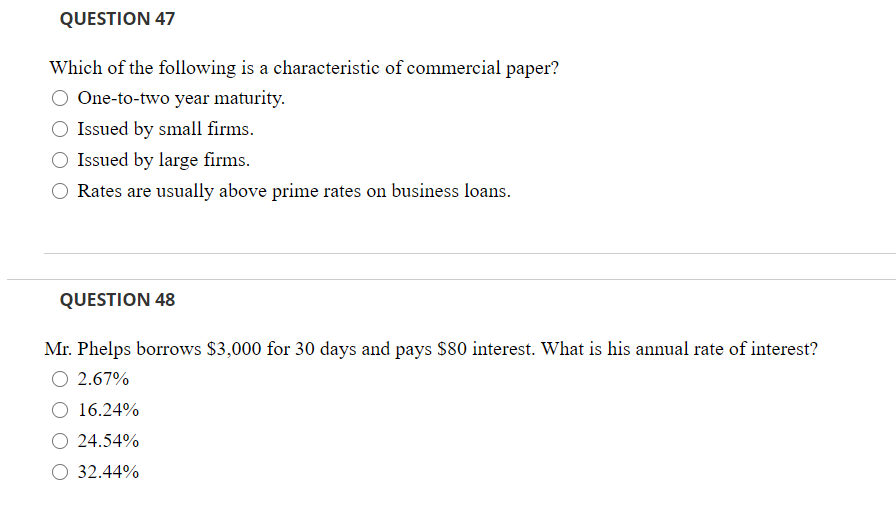

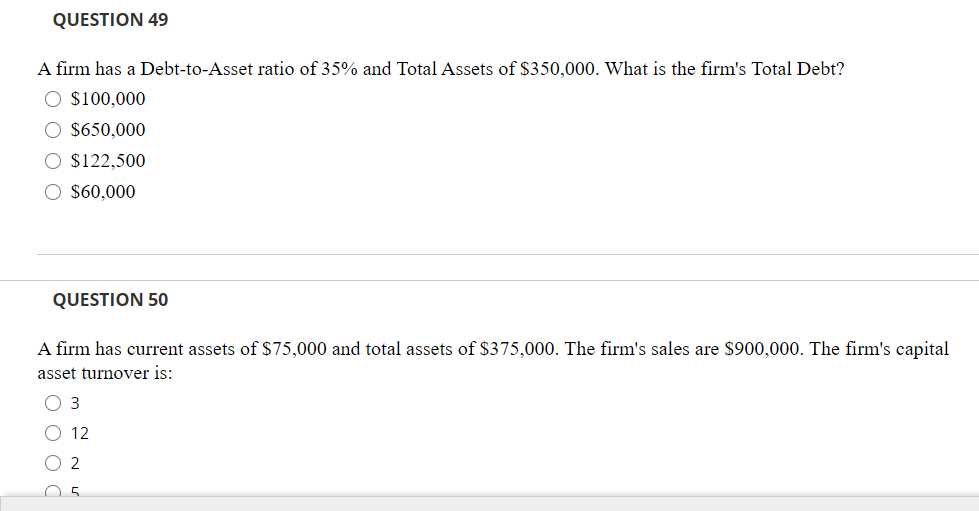

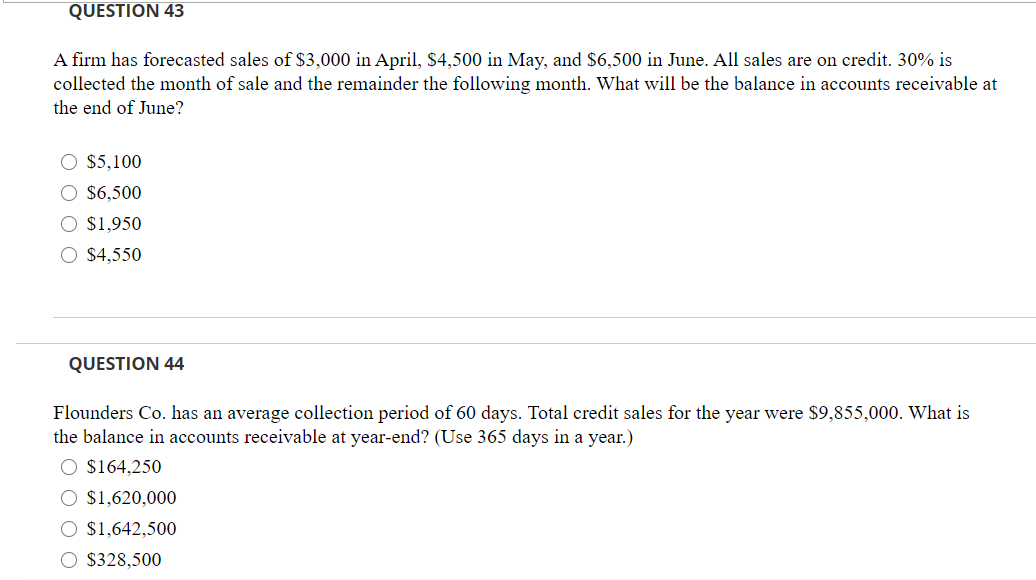

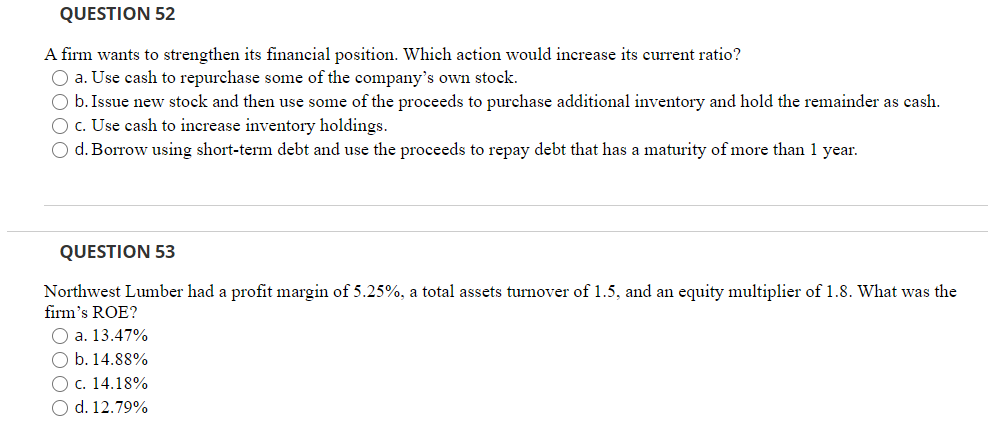

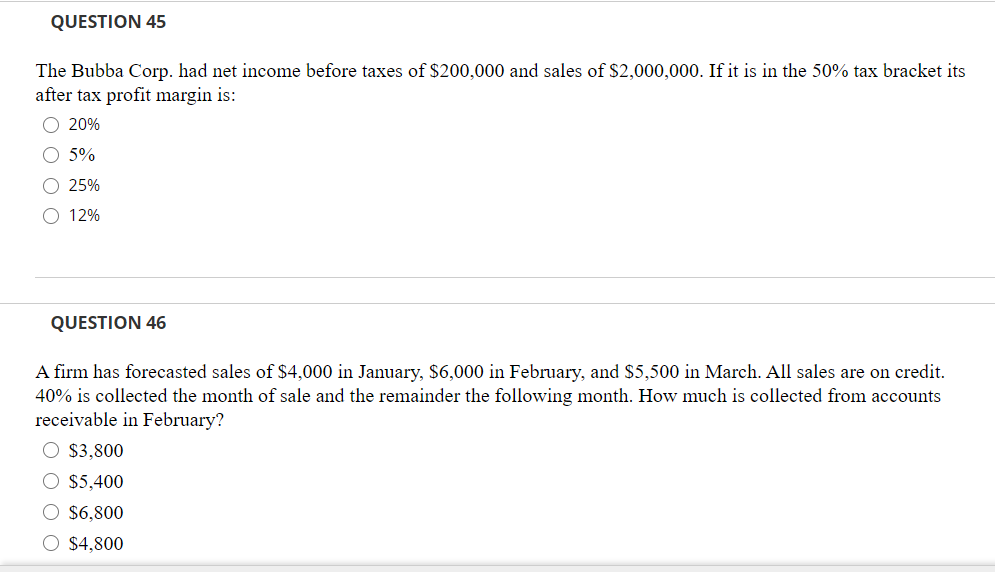

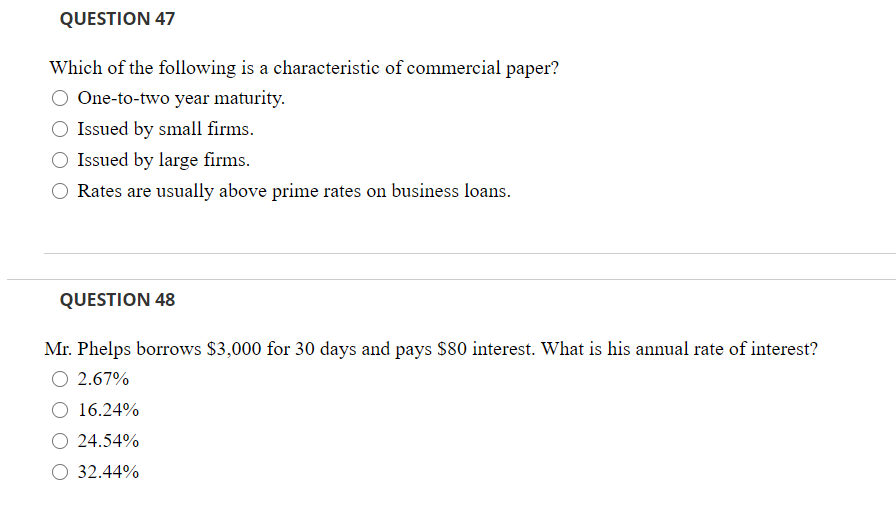

QUESTION 49 A firm has a Debt-to-Asset ratio of 35% and Total Assets of $350,000. What is the firm's Total Debt? O $100,000 $650,000 $122,500 O $60,000 QUESTION 50 A firm has current assets of $75,000 and total assets of $375,000. The firm's sales are $900,000. The firm's capital asset turnover is: O 3 12 O2 QUESTION 43 A firm has forecasted sales of $3,000 in April, $4,500 in May, and $6,500 in June. All sales are on credit. 30% is collected the month of sale and the remainder the following month. What will be the balance in accounts receivable at the end of June? $5,100 $6,500 O $1,950 O $4,550 QUESTION 44 Flounders Co. has an average collection period of 60 days. Total credit sales for the year were $9,855,000. What is the balance in accounts receivable at year-end? (Use 365 days in a year.) O $164,250 O $1,620,000 O $1,642,500 O $328,500 QUESTION 52 A firm wants to strengthen its financial position. Which action would increase its current ratio? O a. Use cash to repurchase some of the company's own stock. O b. Issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash. c. Use cash to increase inventory holdings. d. Borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than 1 year. QUESTION 53 Northwest Lumber had a profit margin of 5.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. What was the firm's ROE? O a. 13.47% O b. 14.88% O c. 14.18% O d. 12.79% QUESTION 45 The Bubba Corp. had net income before taxes of $200,000 and sales of $2,000,000. If it is in the 50% tax bracket its after tax profit margin is: O 20% O 5% O 25% O 12% QUESTION 46 A firm has forecasted sales of $4,000 in January, $6,000 in February, and $5,500 in March. All sales are on credit. 40% is collected the month of sale and the remainder the following month. How much is collected from accounts receivable in February? $3,800 O $5,400 $6,800 $4,800 QUESTION 47 Which of the following is a characteristic of commercial paper? One-to-two year maturity. Issued by small firms. Issued by large firms. Rates are usually above prime rates on business loans. QUESTION 48 Mr. Phelps borrows $3,000 for 30 days and pays $80 interest. What is his annual rate of interest? 2.67% O 16.24% 24.54% 32.44%