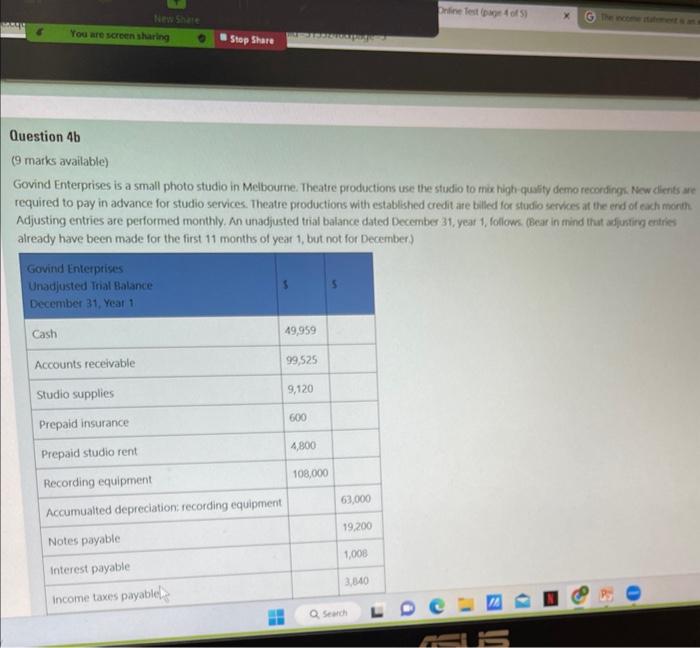

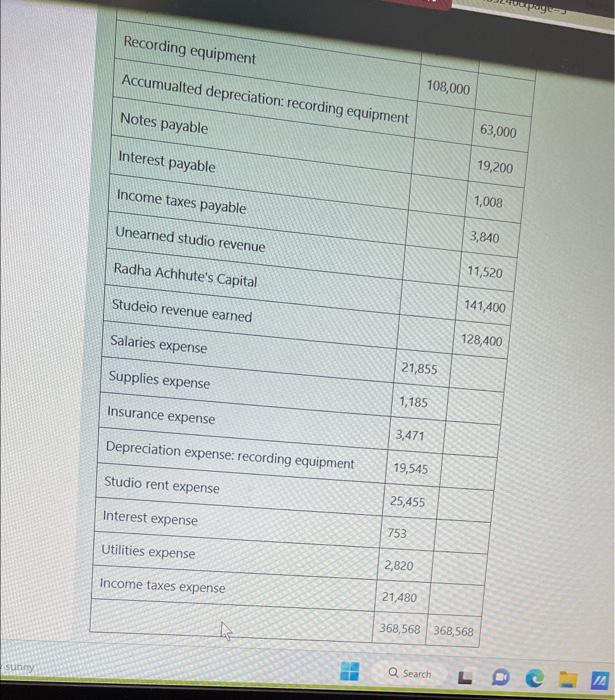

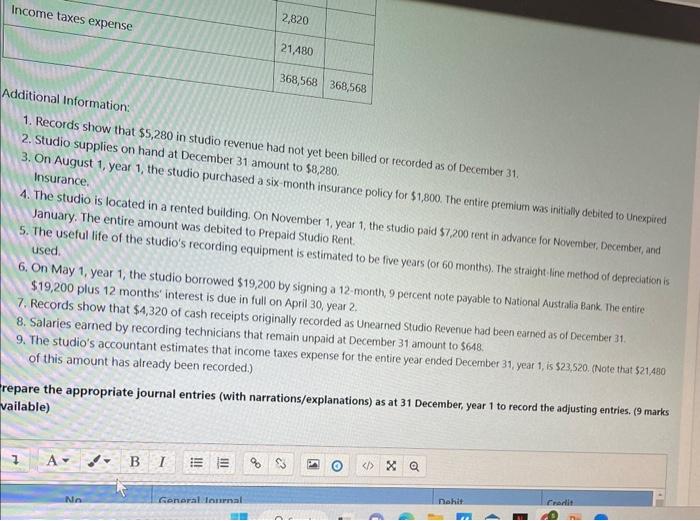

Question 4b ( 9 marks available) Govind Enterprises is a small photo studio in Melbourne. Theatre productions use the studio to mix high-quafiy demo recordingu New dients are required to pay in advance for studio services. Theatre productions with established credit are billed for studio service at the end of exh manth Adjusting entries are performed monthly. An unadjusted trial balance dated December 31, yeat 1, follown. (Bear in mind that affuntirg entries aiready have been made for the first 11 months of year 1 , but not for December) Recording equipment Accumualted depreciation: recording equipment Notes payable Interest payable Income taxes payable Unearned studio revenue Radha Achhute's Capital Studeio revenue earned Salaries expense Supplies expense Insurance expense \begin{tabular}{|l|} \hline Depreciation expense: \\ \hline Studio rent expense \\ \hline \end{tabular} Interest expense Utilities expense Income taxes expense 1. Records show that $5,280 in studio revenue had not yet been billed or recorded as of December 31 . 2. Studio supplies on hand at December 31 amount to $8,280. 3. On August Insurance. 4. The studio is located in a rented building. On November 1 , year 1 , the studio paid 5,200 rent in ad January. The entire amount was debited to Prepaid Studio Rent. 5. The useful life of the studio's recording equipment is estimated to be used. 6. On May 1, year 1, the studio borrowed $19,200 by signing a 12 -month, 9 percent note payable to National Australia Bank. The entire $19,200 plus 12 months' interest is due in full on April 30, year 2 . 7. Records show that $4,320 of cash receipts originally recorded as Unearned Studio Revenue had been earned as of December 31. 8. Salaries earned by recording technicians that remain unpaid at December 31 amount to $648. 9. The studio's accountant estimates that income taxes expense for the entire year ended December 31, year 1, is $23,520. (Note that $21,480 of this amount has already been recorded.) repare the appropriate journal entries (with narrations/explanations) as at 31 December, year 1 to record the adjusting entries. (9 marks vailable)