Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 0 If the bond yield in the U . S . is higher ( e . g . , one - year maturity

Question

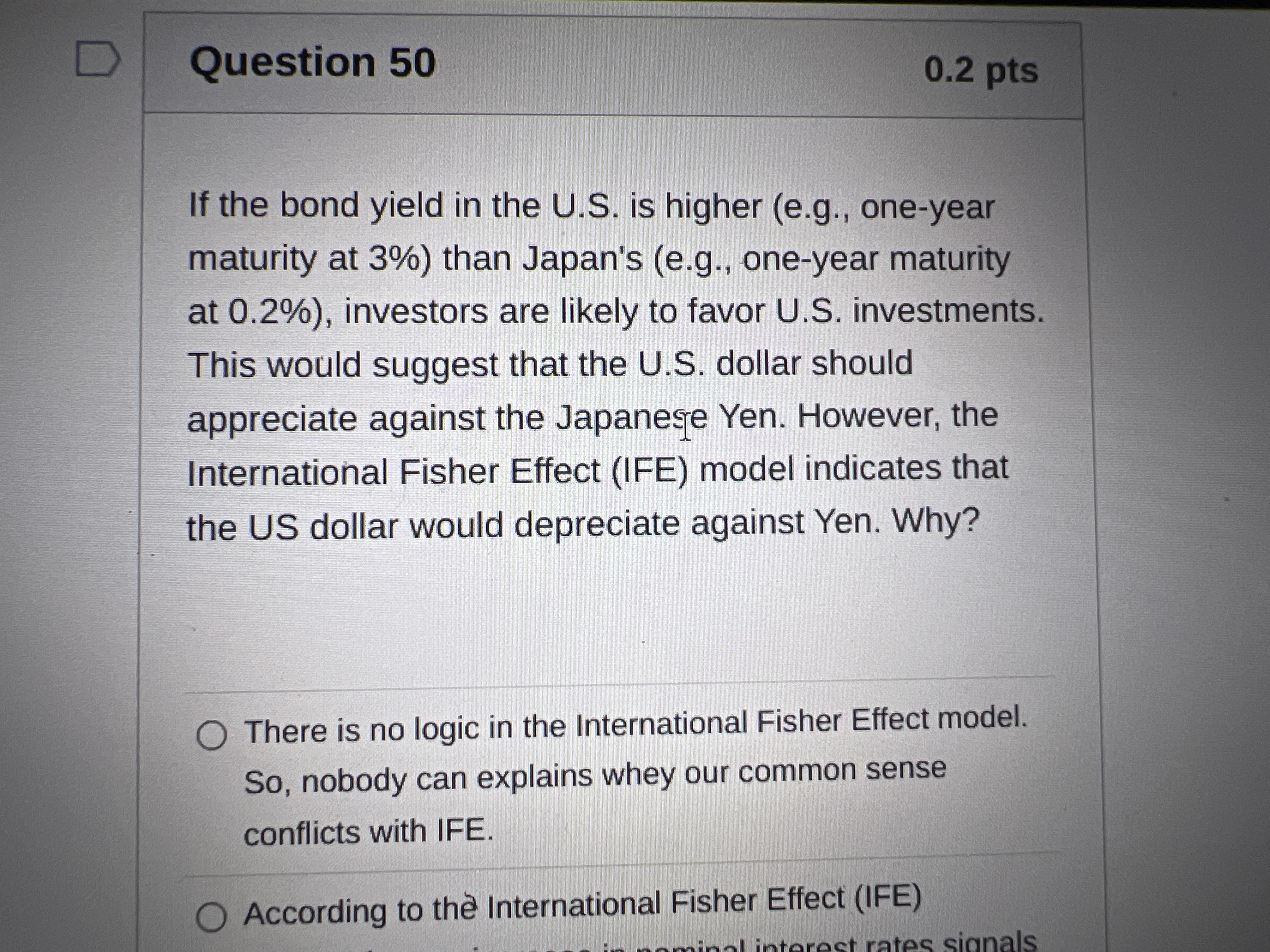

If the bond yield in the US is higher eg oneyear maturity at than Japan's eg oneyear maturity at investors are likely to favor US investments. This would suggest that the US dollar should appreciate against the Japanee Yen. However, the International Fisher Effect IFE model indicates that the US dollar would depreciate against Yen. Why?

There is no logic in the International Fisher Effect model. So nobody can explains whey our common sense conflicts with IFE.

According to the International Fisher Effect IFE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started