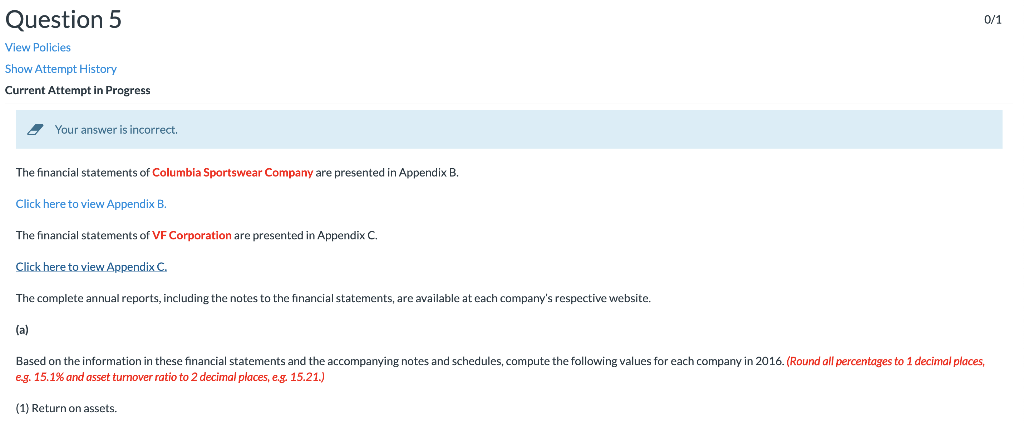

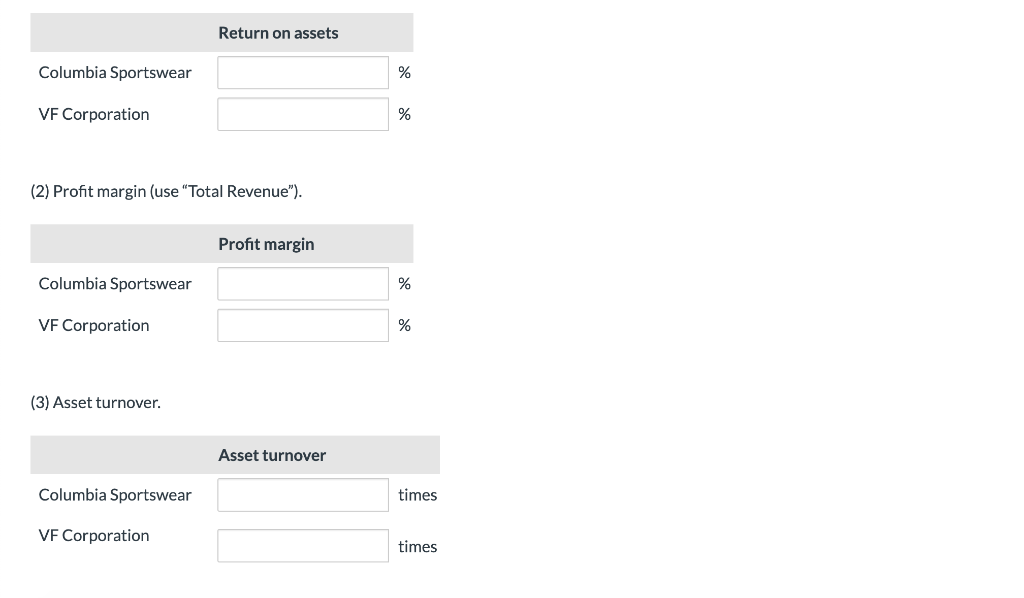

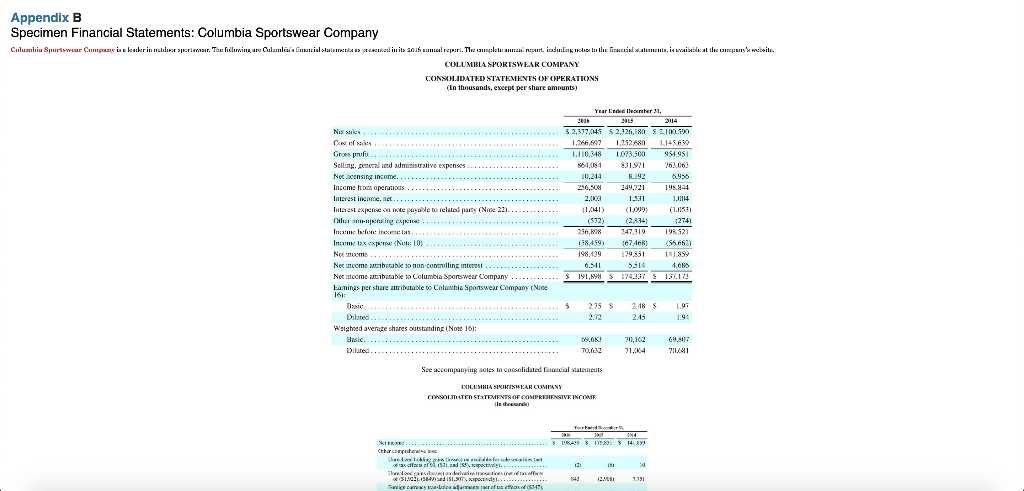

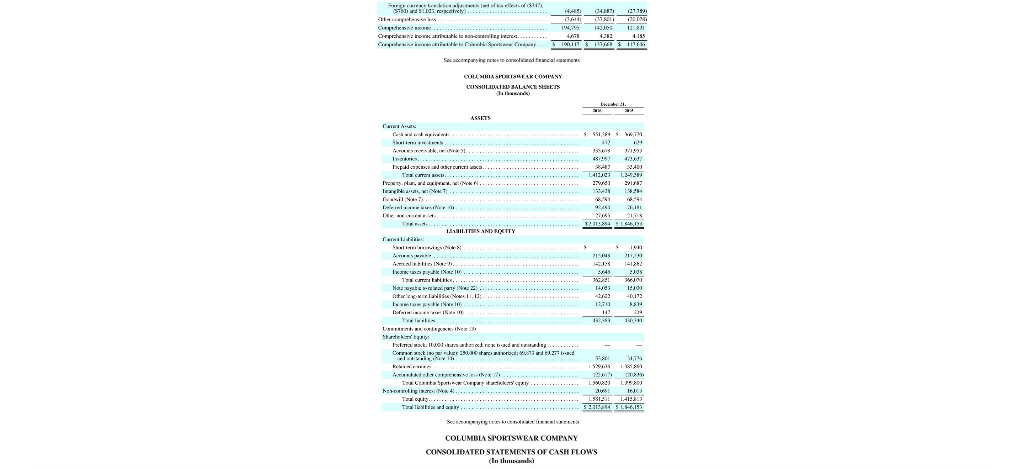

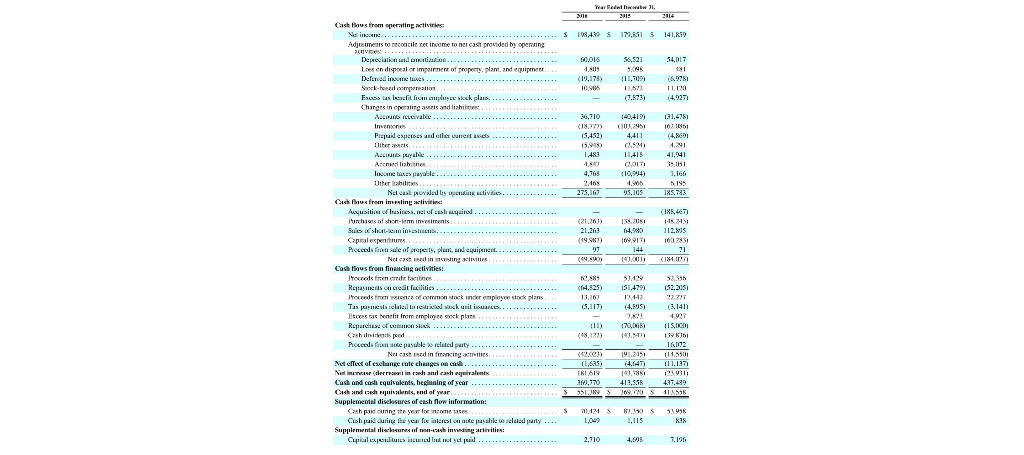

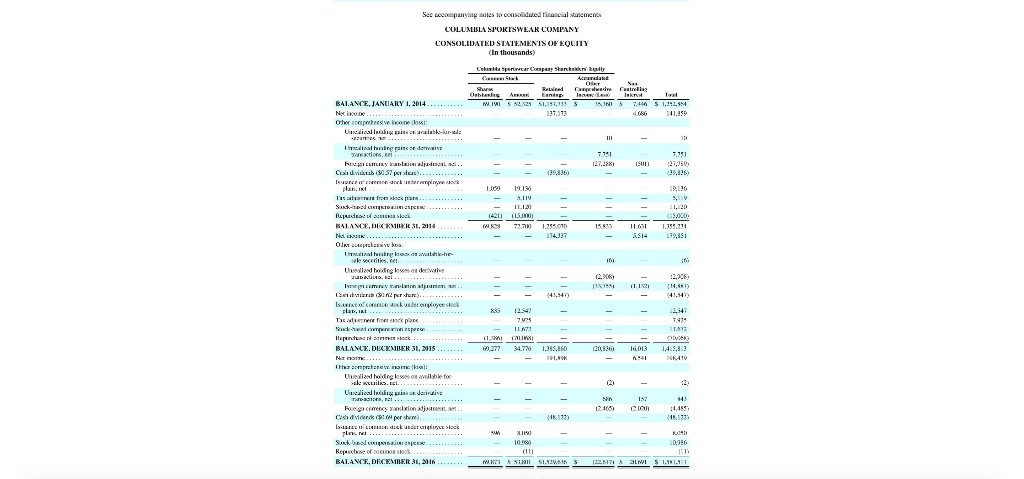

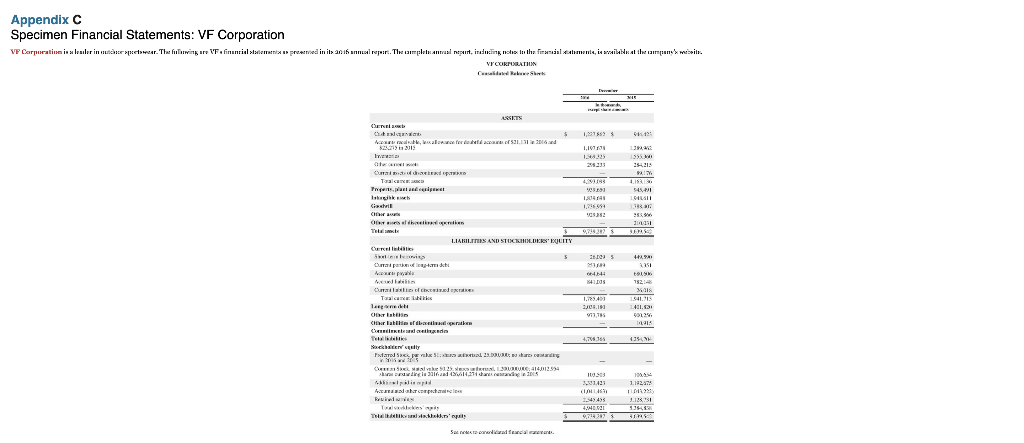

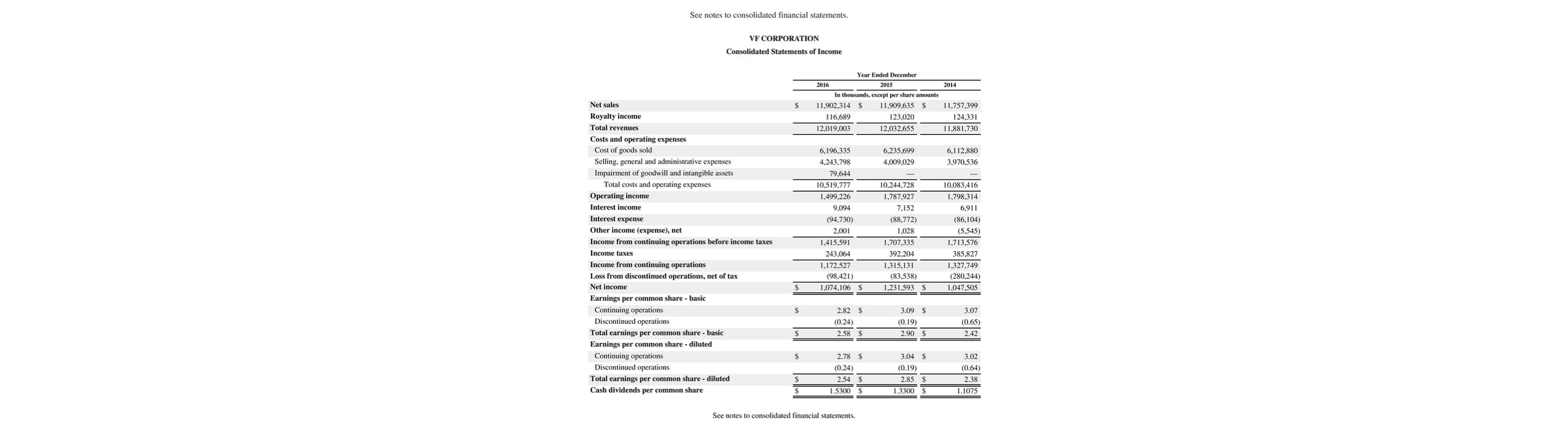

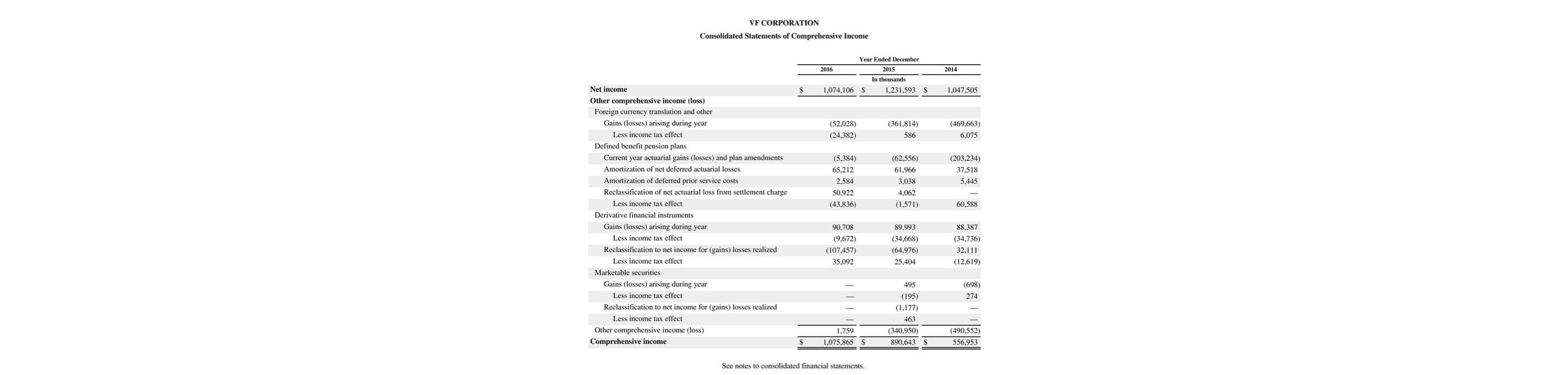

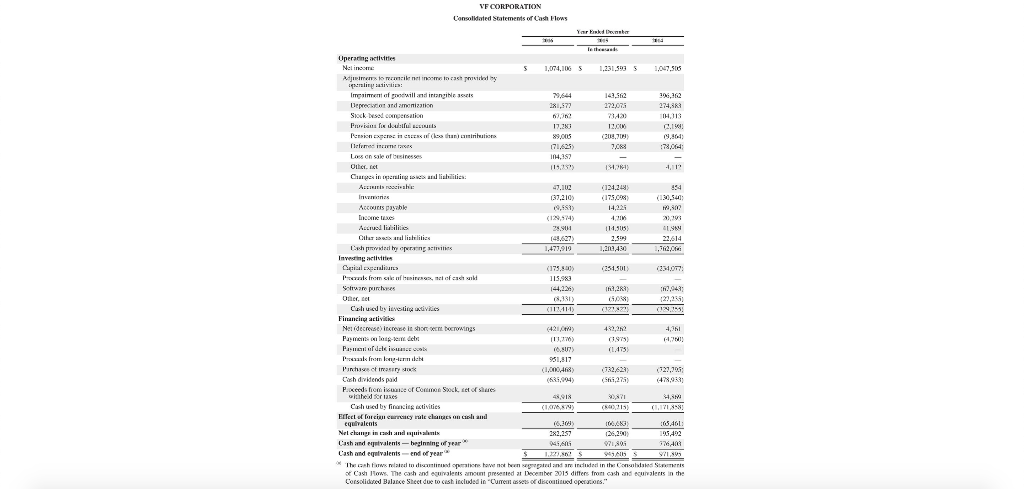

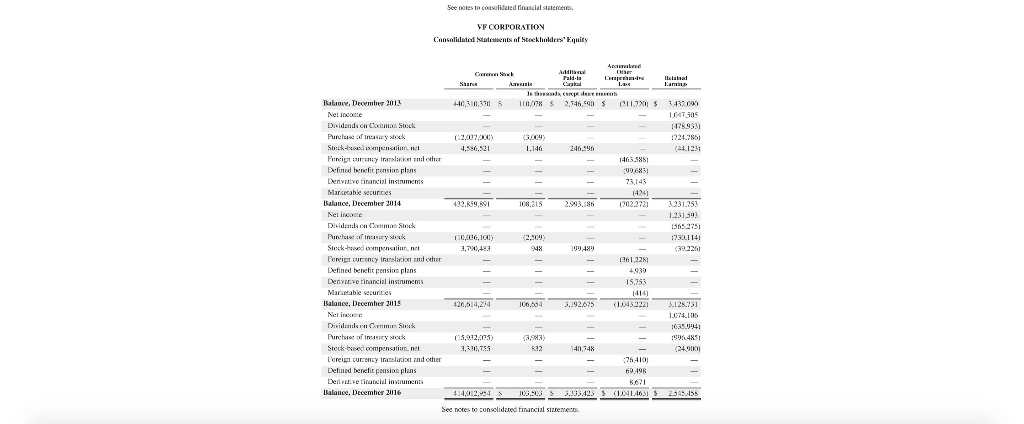

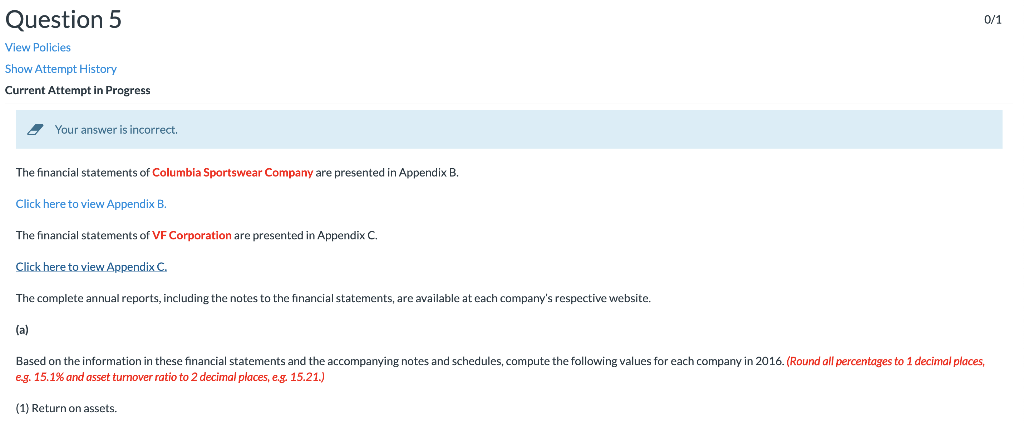

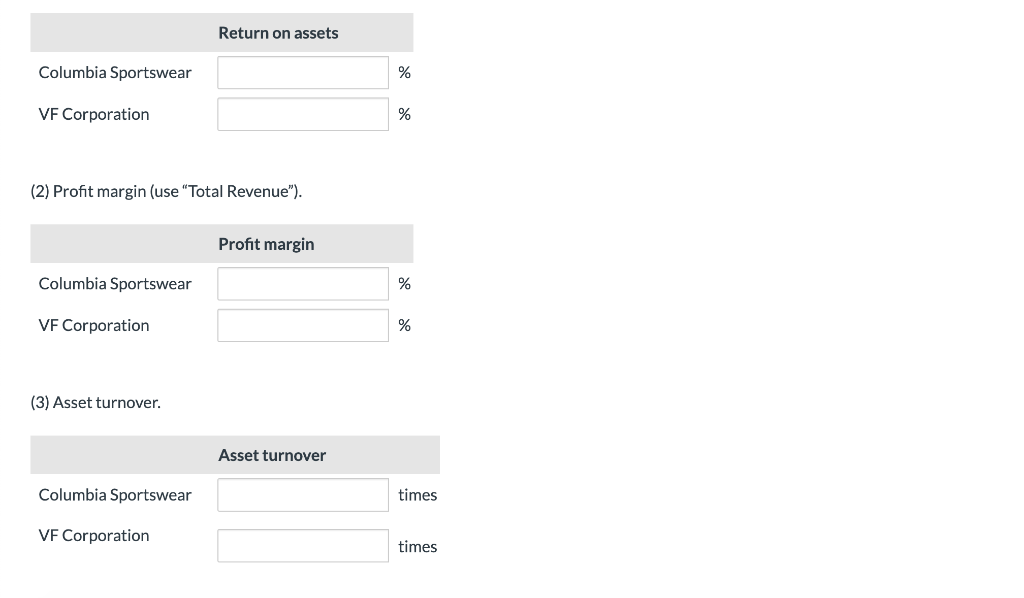

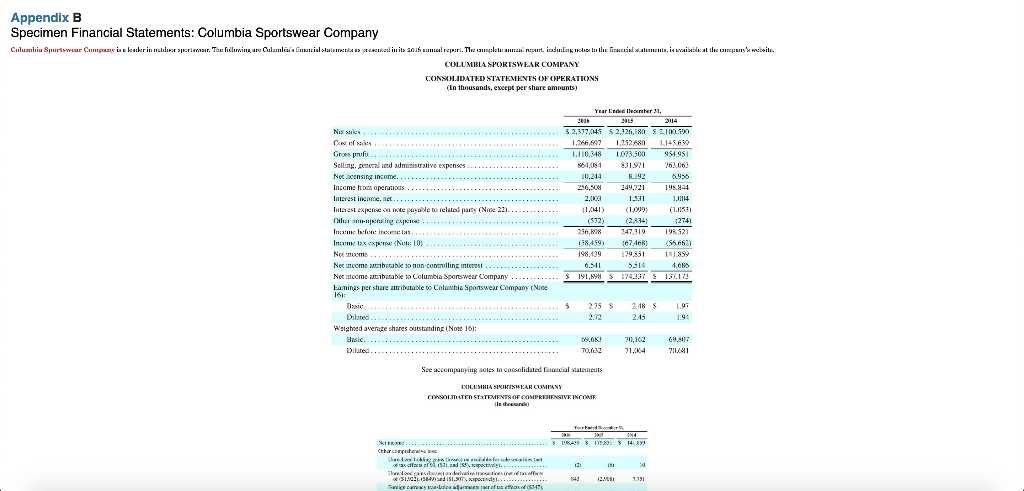

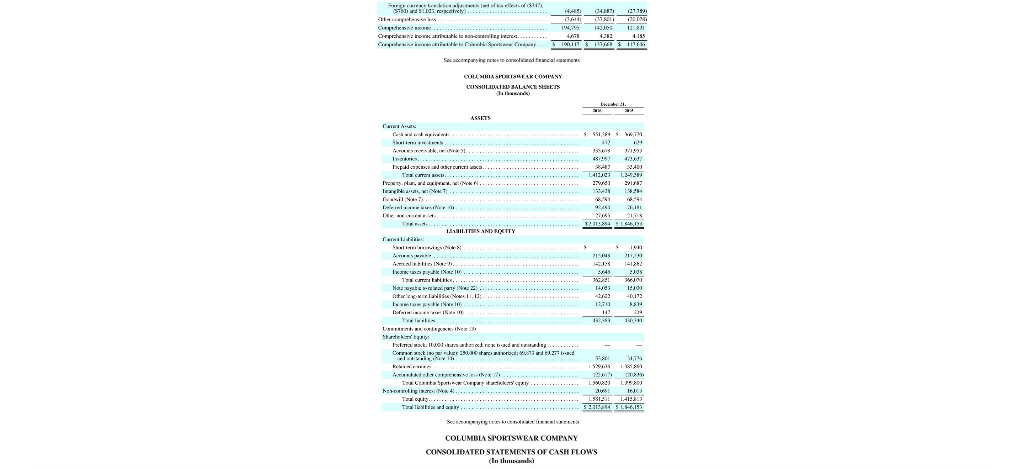

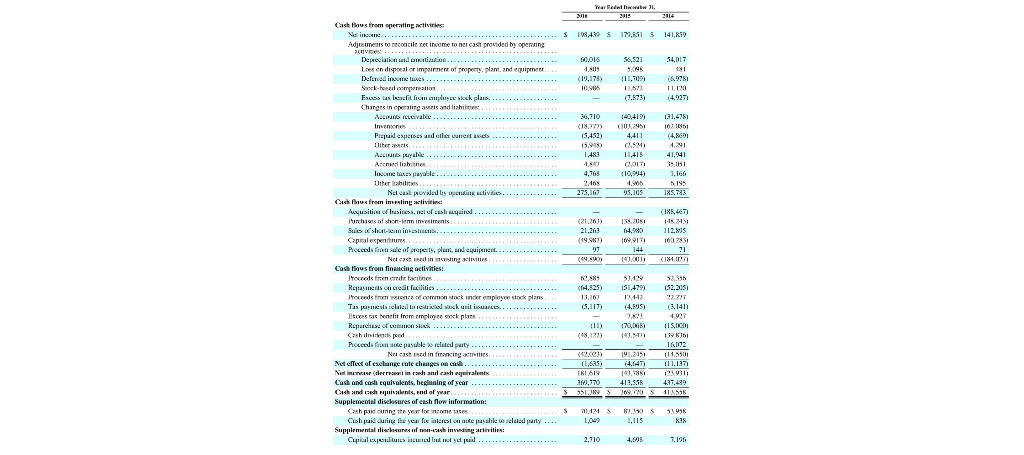

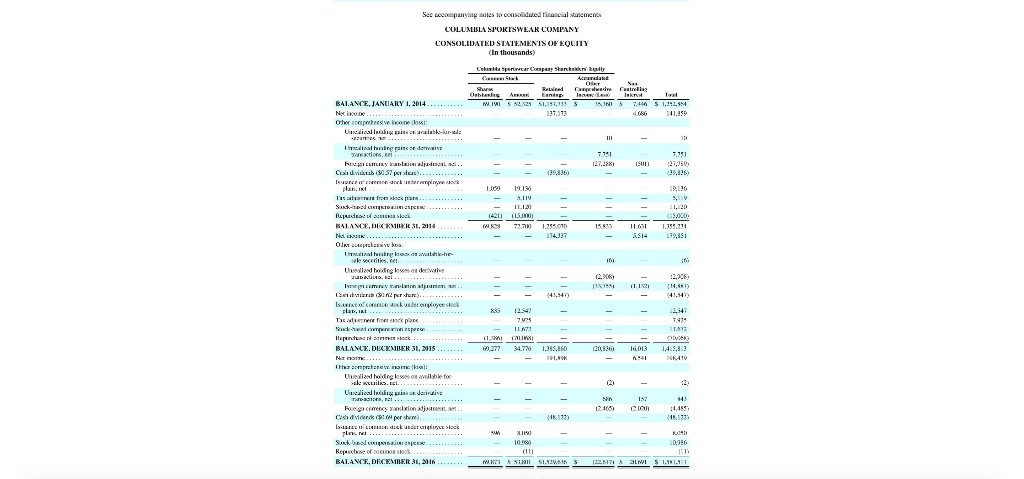

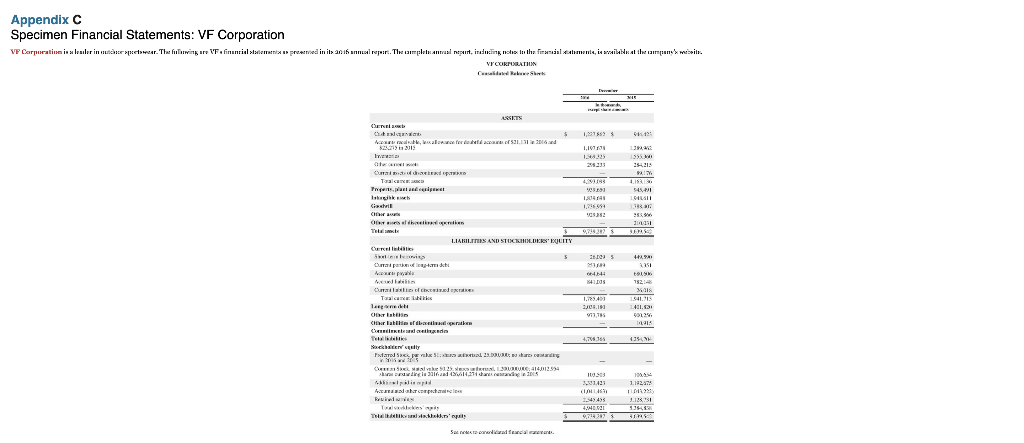

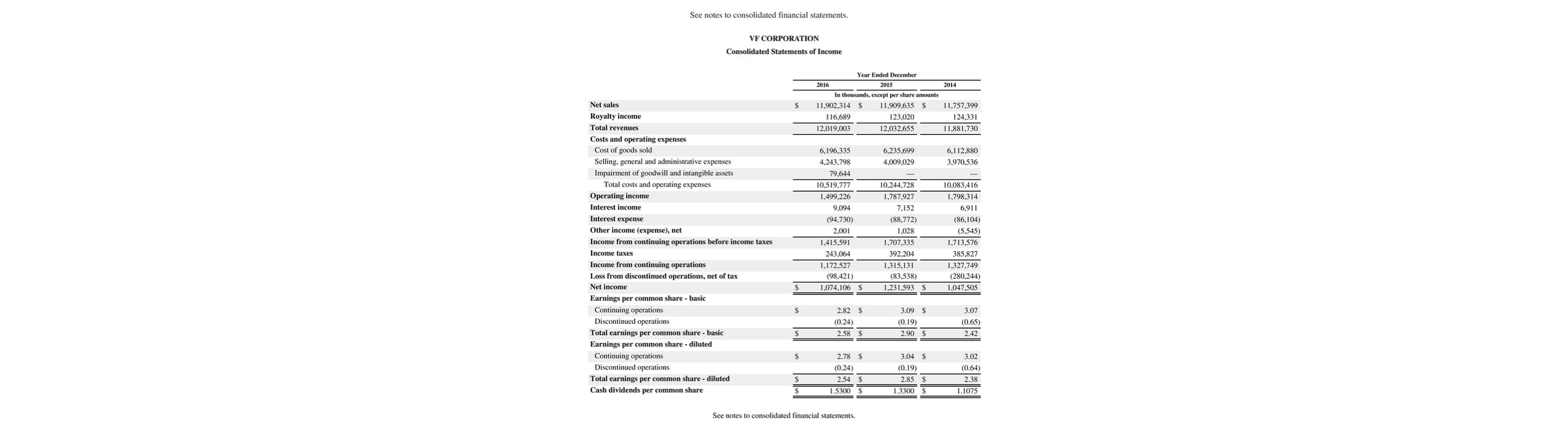

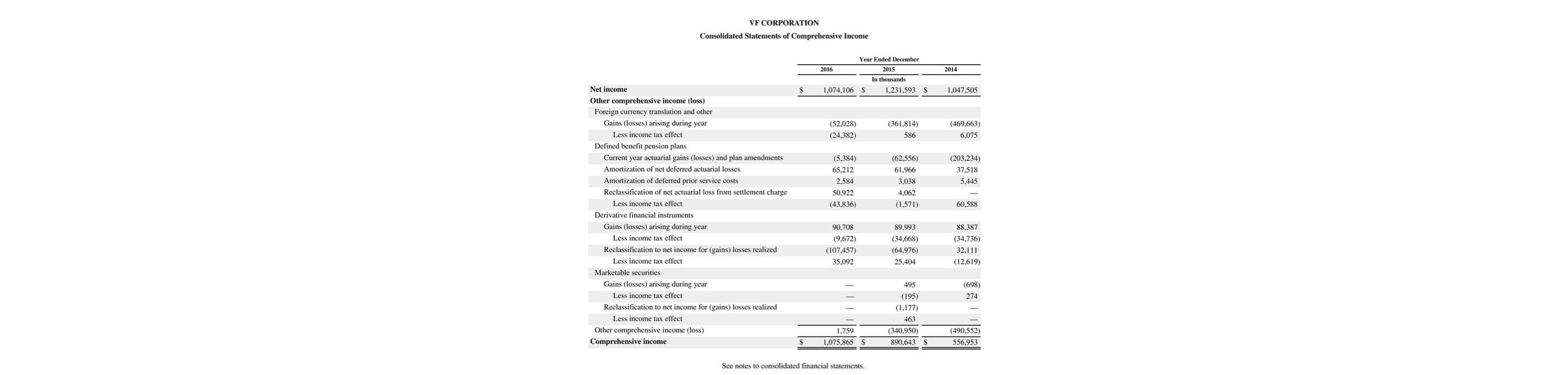

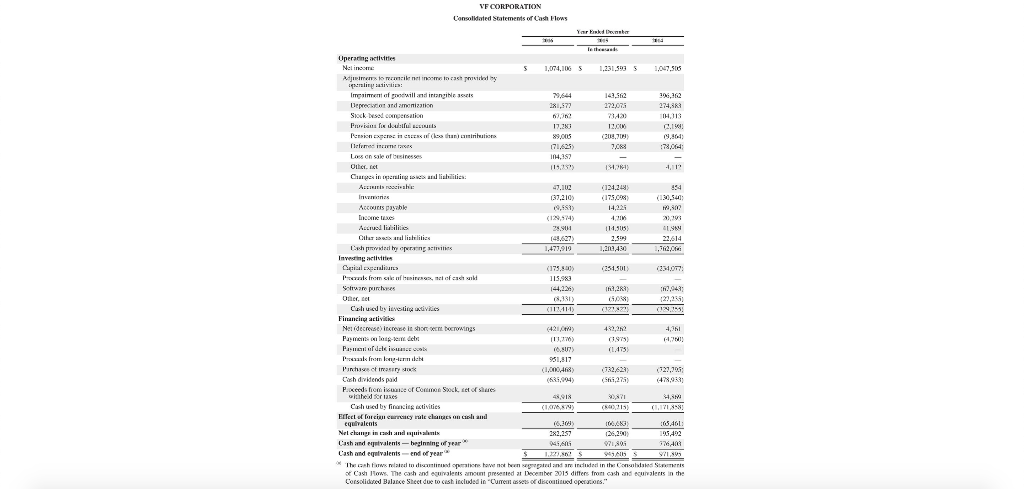

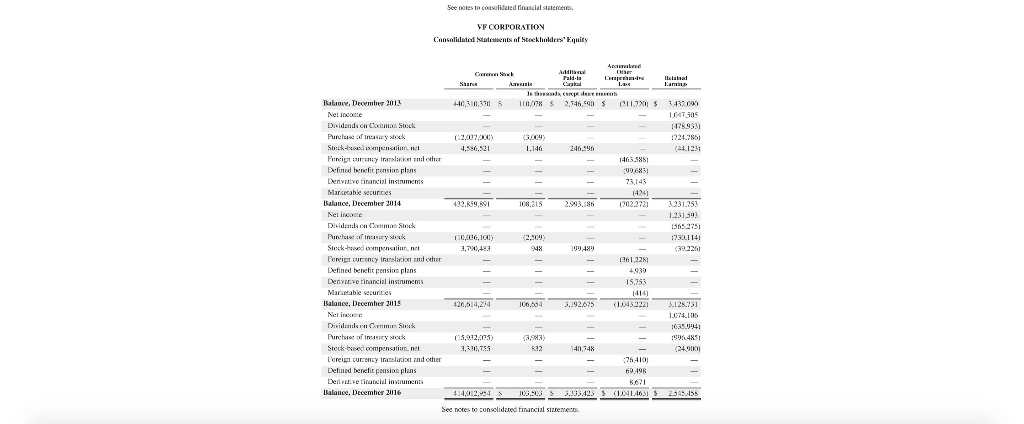

Question 5 0/1 View Policies Show Attempt History Current Attempt in Progress Your answer is incorrect The financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of VF Corporation are presented in Appendix C. Click here to yiew Appendix C The complete annual reports, including the notes to the financial statements, are available at each company's respective website. (a) Based on the information in these financial statements and the accompanying notes and schedules, compute the following values for each company in 2016. (Round all percentages to 1 decimal places e.g. 15.1% and asset turnover ratio to 2 decimal places, e.g. 15.21.) (1) Return on assets Return on assets Columbia Sportswear VF Corporation (2) Profit margin (use "Total Revenue"). Profit margin Columbia Sportswear VF Corporation (3) Asset turnover. Asset turnover Columbia Sportswear times VF Corporation times Appendix B Specimen Financial Statements: Columbia Sportswear Company Culumhi Spurtswar Cumpany ikkr inader sportannsr. Th lwing ane Culam repr. The aupleih antmad nepurt, iradu n the firalannls, is amaibablat the aumpany's wbil ncial stiamcni prescnbod in ils an6 COLUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) TEar Eded leater 31 2 2 2 14 52,377,04 S 2,326,180 210050 Nis sas C f s Groes prufit. Selling. g ind administrative expenses Ne ensing income.. 1,266,607 1,252680 1,145639 L10348 L03.500 954 95 76306 861,084 831.91 .. n 0,244 .192 95 256,50 1944 Inceme r operatioas 2421 .. tes incoe a a-- uteest expene cn ncte pable to related party (Nme 22). 13 (1099 2,00 114 1041 053 eming expen. Inm one inme las (572 (2834 274 256,808 247319 198521 Inm s expe (Neto 10 . (67468 (58459 (55662 Nut noome. Net inoome aibusable to non-conrolling interest . 98,439 179851 141859 6.541 5514 4.68 191,89 174337 .. Net nccme aibuable to Columbia Sportswear Company 1517 .. Eamings per share anributable to Columbia Sponswear Company (None 16i: Baic 275 S 248 1.97 Dilated J.9 2.2 245 Weighned aveaze shares outstnding (Note 1615 Basic. 7,162 71 Ditated. T0,32 714 See accompanying aotes to consolidated fcial statenests UBIA SINTSHEAR COPANY cONSOLmATEn STATEMENTSOF COMPRESHESTVE INCOME theeard F or a 4 JN4 SA 14 29 Crtrcrentew kpintkwe aridde fesesin e3s offx er 531 aad poctNE s 2 w sdawandivaimmactines fheof tac offcs o312L384edis1. apectd. . 843 3331 ge camy raadadce aqarmaen tof un effbas of ($347 ST d 5i atiy .. 4 487 taw 142J0 1L 123 a Cprhe ac ar k a-canal Irg imcs 4T 4282 415 19011 S paring nete candiand famcal sau nen oLRIASPoRSHEAKCOMPANY ASSITS Cetuey 4 Ivak 4 A Tca auKD . r d aees,N NaaWI 4123 L34214 1,32 i s d.. 2 231384 Ls Ma.rs AND ROITV Sti is s 14122 45 T cmtk. .... Nau wwair t elN ,12 stINi... 14e I7 T l ontngommtNex 1 Cor ti t 251otr b:S3rd c Sts Lana Itde L5S1 412 231354 51.,I LM N tigi 4 .. T T lt i asty. . COLUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In than 413,558448 Js, 1180 53.98 See ocpanviag aoles to consolidtod fcaicial stapemeres CULUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENIS OF EQUITY In thousands Certa Sericar Cona urshakkn Btr Accuralad C Stak Na Catrella Carpead Is de 3N Beirei Sucw is As Eaning Oabtasl krd BALANCEJANUARY L2014 T ET w r Net ione. Oher cpreheesive incone oM Udioal laig wi aalabl-ad ar 1 7446 S 1.15s54 S s2525 5IJT1.21 41,15 137173 4 ( _ Uial hng ansc dan nacions. e F ialaiajicat aet. Cadvikb 037 773 T751 25 27,288 39836 39,336 leorce aferescn anek tererineck a t a oen skock plans .......... S ead IqTD Rpd a k L 19.136 9,126 3119 12 1,20 (15000 ( 1,2550D 6 1.355.71 BALANCE, DECEMBER 31, 214 72.0 15.833 Na iauaK. 134337 5S14 39,35 Uial ihrg laan ilshle-tom le seceties, et Uueiad hodne ksses on deciwis (20 2,0 14,48 nmy nlin adjaen r 2 r e). eceofeocceorkusder euplovee stock 4354 4.54 _ 1254 835 ,54 T97 13caite fe nck pars uerin spe Repant nock BALANCE, DECEMBER 31, 2015 Na na .... .. . hrp ee nam a Iediad hoidrg ews on awilble foc , I.. Uedicl lidig uina dainaise 75 L072 11402 auns m277 34.776 355860 20,836 6013 4.5.1.3 .. . 91,s 41 2 $45 Foeg cmency ion djue.a Cashdder (9per shre. 245 4,4 18172 15.123 dck under oek S el aiespe Repce oas sk BAJANCE, DECEMBER 3, 16 008 D356 2217 S1.12A1 S1,11,1 Appendix C Specimen Financial Statements: VF Corporation VF Carporatiina leader in outclorspeeiswecar. The fulawing are VF e finanrial siademarnis as preeented in its aoi5 annadd repeort. The amplein anmusl nprt, induding nchec in the firamsial aaments, in avaibabNe at the tompanykwe ils rcorAUN ASSETS e 1,5 S1 1 13 1555 2521 825 2233 498 Taalan n 4.183 Twepatandcsipwe 45 ra Is k h as r a 33 a 2 m Tel LIABILITS AND STOC UERS EUITY is 20 | 1 4 44 84110 Curalasti d caid rae Taalca ik 140 1541,15 LA1.13 785 25% Jabilie erlatidprakn el eteds Te khrsuult r 4,7 36 alake 5125 esa ter ig is 3016 aad 4il424 a plimp 2200 : 414012 554 ranig e20 2 1 3331.423 1127 de als kns' an Telliknl n'npt 244 13 4E Sa n eandind femdal cnee as See notes to consolidated financial statements VF CORPORATION Consolidated Statements of Income Year Ended December 2016 2015 2014 In thousands, except per share amounts Net sales 11,902,314 $ 11,757,399 11,909,635 $ Royalty income 116.689 123,020 124,33 Total revenues 12,019,003 12,032,655 11,881,730 Costs and operating expenses Cost of goods sold Selling, general and administrative expenses 6,112,880 6,196,335 6.235.699 4,243,798 4,009,029 3,970,536 Impairment of goodwill and intangible assets 79,644 Total costs and operating expenses 10,519.777 10,083,416 10,244,728 Operating income 1.499,226 1,787,927 ,798,314 Interest income 9,094 7,152 6,911 Interest expense (86,104) (94,730) (88,772) Other income (expense), net 2,00 1,028 (5,545) Income from continuing operations before income taxes 1,415,591 1,707,335 1,713,576 Income taxes 243.064 392,204 385,827 Income from continuing operations ,172.527 1,315,131 1,327,749 Loss from discontinued operations, net of tax (98,421) (83,538) (280,244) Net income 1.231.593 $ 1,074,106 $ 1,047,505 Earnings per common share basic Continuing operations 2.82 $ 3.09 S 3.07 Discontinued operations (0.24) (0.19) (0.65) Total earnings per common share basic 2.58 $ 2.90 2,42 Earnings per common share - diluted Continuing operations Discontinued operations 3,04 $ 2.78 $ 3.02 (0.19) (0.24) (0.64) Total earnings per common share diluted 2.54 $ 2.85 2.38 Cash dividends per common share 1.3300 $ 1.5300 1.1075 See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Comprehensive Income Year Ended December 2016 2015 2014 In thousands Net income 1.074,106 $ $ 1,231,593 $ 1,047,505 Other comprehensive income (loss) Foreign currency translation and other Gains (losses) arising during year (469,663) (52,028) (361,814) Less income tax effect (24,382) 586 6,075 Defined benefit pension plans Current year actuarial gains (losses) and plan amendments (5,384) (62,556) (203,234) Amortization of net deferred actuarial losses 65,212 61,966 37,518 Amortization of deferred prior service costs 2,584 3,038 5,445 Reclassification of net actuarial loss from settlement charge 50.922 4,062 (43,836 Less income tax effect (1,571) 60,588 Derivative financial instruments Gains (losses) arising during year 90,708 89,993 88,387 Less income tax effect (34,736) (9,672) (34,668) Reclassification to net income for (gains) losses realized (107,457) (64,976) 32,111 Less income tax effect 35,092 25,404 (12,619) Marketable securities Gains (losses) arising during year 495 (698) Less income tax effect (195) 274 Reclassification to net income for (gains) losses realized (1,177) Less income tax effect 463 Other comprehensive income (loss) (340,950) ,759 (490,552) Comprehensive income 1,075,865 $ 556,953 890,643 See notes to consolidated financial statements Operating actites (204,70 1111 See notes to coasolidued finaicial statemens VF CORPORATION Consolidatod Stateents af Stockhnlders Equity Apaurukerd Additk k Co lianl Eain Faid-ia Ca Saars 440,30,37 08 2.746,59 Balane, December 2013 3432090 Net ince L047505 Didends ca Couman Stock 478933 Purchae of ireasay ock 112.007.000 1724.785 44.123 Steck mpnetion, net Fercig ournuy innslaricn nd other Defined beefit pensian plans 249 ,146 4.536,521 463.588 Derivive financial instruments 73143 (424) 702.272 Marseable securces 3231.353 Balance, December 2014 432,859,89 JO8,215 2993.186 Ne ineaer 1231393 565275 3114 Diidends n Cman Steck Purch af insry eck Steck-b oompensatiun, net Fereig ureny trelarion and other 250 99480 (39226 3,70483 948 36122 Defined benefit pension plans 4939 _ Denvve tinancial instruments IS.753 Marsesable gcurtes (414 432221 Balance, December 2015 128231 426,514,24 J6,04 3,192675 Net iee 1074.1 Disid Comman Sck Purchase of tneasey stek 3594 9485 5325 33) Steck bd cmpensation, net 3,330,7 14,748 249 R32 Lereig curency traelacio1 ind other :75410 Defined benefit pension plans 69.198 Denvve tinancial insument 671 10303 3.33423 11.46. 2345158 Balance, December 2116 LO4146 S 44029 414,01254 3333423 2545458 See notes to consclidzted tinancial stztements Question 5 0/1 View Policies Show Attempt History Current Attempt in Progress Your answer is incorrect The financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of VF Corporation are presented in Appendix C. Click here to yiew Appendix C The complete annual reports, including the notes to the financial statements, are available at each company's respective website. (a) Based on the information in these financial statements and the accompanying notes and schedules, compute the following values for each company in 2016. (Round all percentages to 1 decimal places e.g. 15.1% and asset turnover ratio to 2 decimal places, e.g. 15.21.) (1) Return on assets Return on assets Columbia Sportswear VF Corporation (2) Profit margin (use "Total Revenue"). Profit margin Columbia Sportswear VF Corporation (3) Asset turnover. Asset turnover Columbia Sportswear times VF Corporation times Appendix B Specimen Financial Statements: Columbia Sportswear Company Culumhi Spurtswar Cumpany ikkr inader sportannsr. Th lwing ane Culam repr. The aupleih antmad nepurt, iradu n the firalannls, is amaibablat the aumpany's wbil ncial stiamcni prescnbod in ils an6 COLUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) TEar Eded leater 31 2 2 2 14 52,377,04 S 2,326,180 210050 Nis sas C f s Groes prufit. Selling. g ind administrative expenses Ne ensing income.. 1,266,607 1,252680 1,145639 L10348 L03.500 954 95 76306 861,084 831.91 .. n 0,244 .192 95 256,50 1944 Inceme r operatioas 2421 .. tes incoe a a-- uteest expene cn ncte pable to related party (Nme 22). 13 (1099 2,00 114 1041 053 eming expen. Inm one inme las (572 (2834 274 256,808 247319 198521 Inm s expe (Neto 10 . (67468 (58459 (55662 Nut noome. Net inoome aibusable to non-conrolling interest . 98,439 179851 141859 6.541 5514 4.68 191,89 174337 .. Net nccme aibuable to Columbia Sportswear Company 1517 .. Eamings per share anributable to Columbia Sponswear Company (None 16i: Baic 275 S 248 1.97 Dilated J.9 2.2 245 Weighned aveaze shares outstnding (Note 1615 Basic. 7,162 71 Ditated. T0,32 714 See accompanying aotes to consolidated fcial statenests UBIA SINTSHEAR COPANY cONSOLmATEn STATEMENTSOF COMPRESHESTVE INCOME theeard F or a 4 JN4 SA 14 29 Crtrcrentew kpintkwe aridde fesesin e3s offx er 531 aad poctNE s 2 w sdawandivaimmactines fheof tac offcs o312L384edis1. apectd. . 843 3331 ge camy raadadce aqarmaen tof un effbas of ($347 ST d 5i atiy .. 4 487 taw 142J0 1L 123 a Cprhe ac ar k a-canal Irg imcs 4T 4282 415 19011 S paring nete candiand famcal sau nen oLRIASPoRSHEAKCOMPANY ASSITS Cetuey 4 Ivak 4 A Tca auKD . r d aees,N NaaWI 4123 L34214 1,32 i s d.. 2 231384 Ls Ma.rs AND ROITV Sti is s 14122 45 T cmtk. .... Nau wwair t elN ,12 stINi... 14e I7 T l ontngommtNex 1 Cor ti t 251otr b:S3rd c Sts Lana Itde L5S1 412 231354 51.,I LM N tigi 4 .. T T lt i asty. . COLUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In than 413,558448 Js, 1180 53.98 See ocpanviag aoles to consolidtod fcaicial stapemeres CULUMBIA SPORISWEAR COMPANY CONSOLIDATED STATEMENIS OF EQUITY In thousands Certa Sericar Cona urshakkn Btr Accuralad C Stak Na Catrella Carpead Is de 3N Beirei Sucw is As Eaning Oabtasl krd BALANCEJANUARY L2014 T ET w r Net ione. Oher cpreheesive incone oM Udioal laig wi aalabl-ad ar 1 7446 S 1.15s54 S s2525 5IJT1.21 41,15 137173 4 ( _ Uial hng ansc dan nacions. e F ialaiajicat aet. Cadvikb 037 773 T751 25 27,288 39836 39,336 leorce aferescn anek tererineck a t a oen skock plans .......... S ead IqTD Rpd a k L 19.136 9,126 3119 12 1,20 (15000 ( 1,2550D 6 1.355.71 BALANCE, DECEMBER 31, 214 72.0 15.833 Na iauaK. 134337 5S14 39,35 Uial ihrg laan ilshle-tom le seceties, et Uueiad hodne ksses on deciwis (20 2,0 14,48 nmy nlin adjaen r 2 r e). eceofeocceorkusder euplovee stock 4354 4.54 _ 1254 835 ,54 T97 13caite fe nck pars uerin spe Repant nock BALANCE, DECEMBER 31, 2015 Na na .... .. . hrp ee nam a Iediad hoidrg ews on awilble foc , I.. Uedicl lidig uina dainaise 75 L072 11402 auns m277 34.776 355860 20,836 6013 4.5.1.3 .. . 91,s 41 2 $45 Foeg cmency ion djue.a Cashdder (9per shre. 245 4,4 18172 15.123 dck under oek S el aiespe Repce oas sk BAJANCE, DECEMBER 3, 16 008 D356 2217 S1.12A1 S1,11,1 Appendix C Specimen Financial Statements: VF Corporation VF Carporatiina leader in outclorspeeiswecar. The fulawing are VF e finanrial siademarnis as preeented in its aoi5 annadd repeort. The amplein anmusl nprt, induding nchec in the firamsial aaments, in avaibabNe at the tompanykwe ils rcorAUN ASSETS e 1,5 S1 1 13 1555 2521 825 2233 498 Taalan n 4.183 Twepatandcsipwe 45 ra Is k h as r a 33 a 2 m Tel LIABILITS AND STOC UERS EUITY is 20 | 1 4 44 84110 Curalasti d caid rae Taalca ik 140 1541,15 LA1.13 785 25% Jabilie erlatidprakn el eteds Te khrsuult r 4,7 36 alake 5125 esa ter ig is 3016 aad 4il424 a plimp 2200 : 414012 554 ranig e20 2 1 3331.423 1127 de als kns' an Telliknl n'npt 244 13 4E Sa n eandind femdal cnee as See notes to consolidated financial statements VF CORPORATION Consolidated Statements of Income Year Ended December 2016 2015 2014 In thousands, except per share amounts Net sales 11,902,314 $ 11,757,399 11,909,635 $ Royalty income 116.689 123,020 124,33 Total revenues 12,019,003 12,032,655 11,881,730 Costs and operating expenses Cost of goods sold Selling, general and administrative expenses 6,112,880 6,196,335 6.235.699 4,243,798 4,009,029 3,970,536 Impairment of goodwill and intangible assets 79,644 Total costs and operating expenses 10,519.777 10,083,416 10,244,728 Operating income 1.499,226 1,787,927 ,798,314 Interest income 9,094 7,152 6,911 Interest expense (86,104) (94,730) (88,772) Other income (expense), net 2,00 1,028 (5,545) Income from continuing operations before income taxes 1,415,591 1,707,335 1,713,576 Income taxes 243.064 392,204 385,827 Income from continuing operations ,172.527 1,315,131 1,327,749 Loss from discontinued operations, net of tax (98,421) (83,538) (280,244) Net income 1.231.593 $ 1,074,106 $ 1,047,505 Earnings per common share basic Continuing operations 2.82 $ 3.09 S 3.07 Discontinued operations (0.24) (0.19) (0.65) Total earnings per common share basic 2.58 $ 2.90 2,42 Earnings per common share - diluted Continuing operations Discontinued operations 3,04 $ 2.78 $ 3.02 (0.19) (0.24) (0.64) Total earnings per common share diluted 2.54 $ 2.85 2.38 Cash dividends per common share 1.3300 $ 1.5300 1.1075 See notes to consolidated financial statements. VF CORPORATION Consolidated Statements of Comprehensive Income Year Ended December 2016 2015 2014 In thousands Net income 1.074,106 $ $ 1,231,593 $ 1,047,505 Other comprehensive income (loss) Foreign currency translation and other Gains (losses) arising during year (469,663) (52,028) (361,814) Less income tax effect (24,382) 586 6,075 Defined benefit pension plans Current year actuarial gains (losses) and plan amendments (5,384) (62,556) (203,234) Amortization of net deferred actuarial losses 65,212 61,966 37,518 Amortization of deferred prior service costs 2,584 3,038 5,445 Reclassification of net actuarial loss from settlement charge 50.922 4,062 (43,836 Less income tax effect (1,571) 60,588 Derivative financial instruments Gains (losses) arising during year 90,708 89,993 88,387 Less income tax effect (34,736) (9,672) (34,668) Reclassification to net income for (gains) losses realized (107,457) (64,976) 32,111 Less income tax effect 35,092 25,404 (12,619) Marketable securities Gains (losses) arising during year 495 (698) Less income tax effect (195) 274 Reclassification to net income for (gains) losses realized (1,177) Less income tax effect 463 Other comprehensive income (loss) (340,950) ,759 (490,552) Comprehensive income 1,075,865 $ 556,953 890,643 See notes to consolidated financial statements Operating actites (204,70 1111 See notes to coasolidued finaicial statemens VF CORPORATION Consolidatod Stateents af Stockhnlders Equity Apaurukerd Additk k Co lianl Eain Faid-ia Ca Saars 440,30,37 08 2.746,59 Balane, December 2013 3432090 Net ince L047505 Didends ca Couman Stock 478933 Purchae of ireasay ock 112.007.000 1724.785 44.123 Steck mpnetion, net Fercig ournuy innslaricn nd other Defined beefit pensian plans 249 ,146 4.536,521 463.588 Derivive financial instruments 73143 (424) 702.272 Marseable securces 3231.353 Balance, December 2014 432,859,89 JO8,215 2993.186 Ne ineaer 1231393 565275 3114 Diidends n Cman Steck Purch af insry eck Steck-b oompensatiun, net Fereig ureny trelarion and other 250 99480 (39226 3,70483 948 36122 Defined benefit pension plans 4939 _ Denvve tinancial instruments IS.753 Marsesable gcurtes (414 432221 Balance, December 2015 128231 426,514,24 J6,04 3,192675 Net iee 1074.1 Disid Comman Sck Purchase of tneasey stek 3594 9485 5325 33) Steck bd cmpensation, net 3,330,7 14,748 249 R32 Lereig curency traelacio1 ind other :75410 Defined benefit pension plans 69.198 Denvve tinancial insument 671 10303 3.33423 11.46. 2345158 Balance, December 2116 LO4146 S 44029 414,01254 3333423 2545458 See notes to consclidzted tinancial stztements