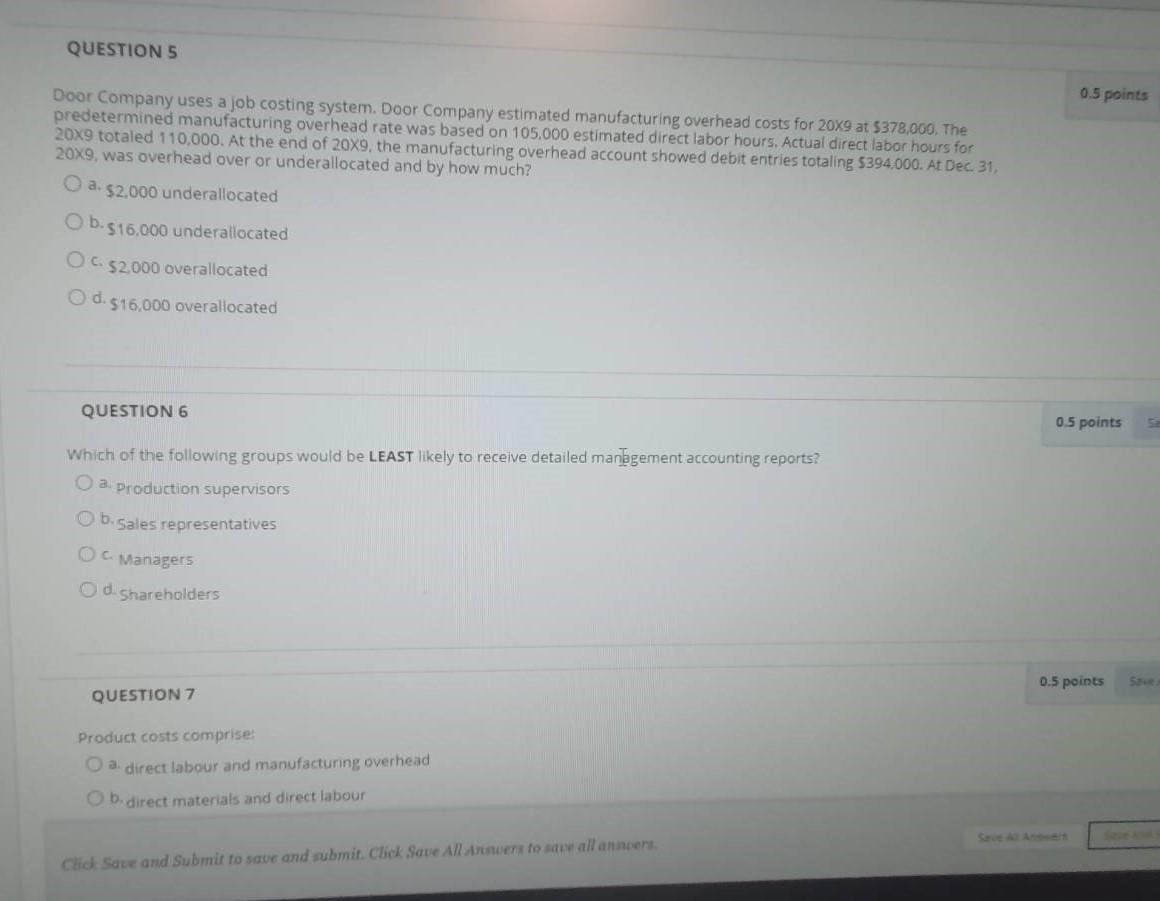

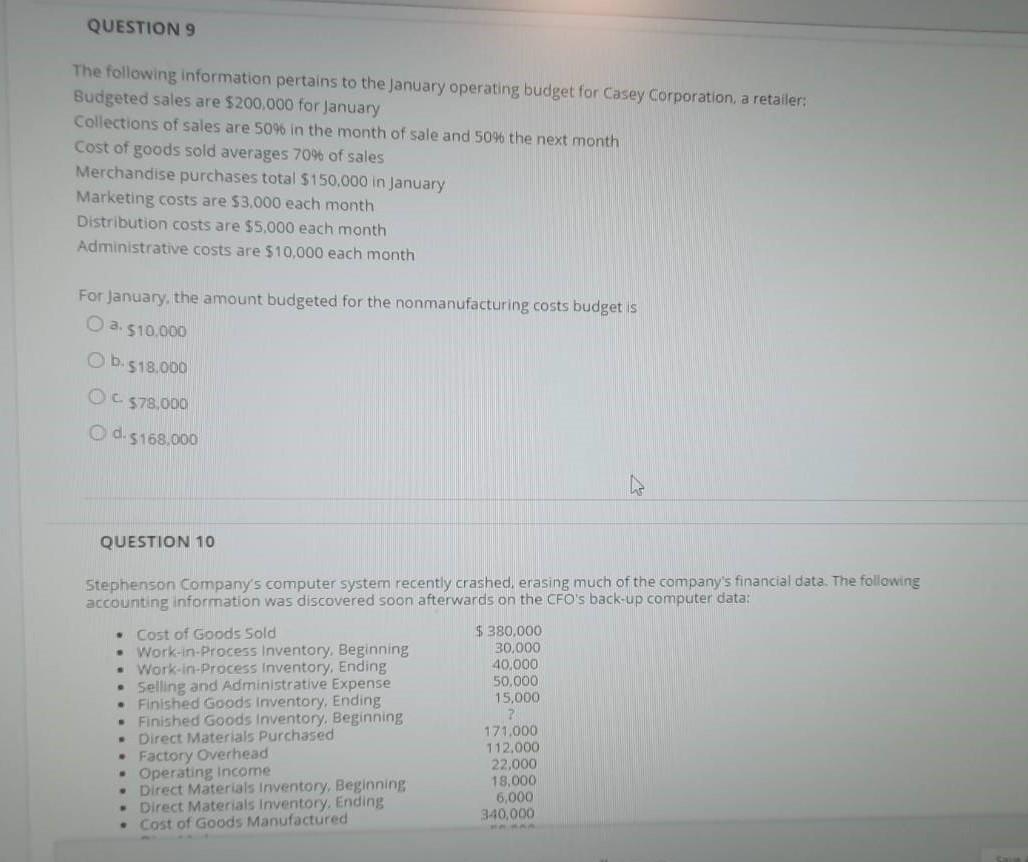

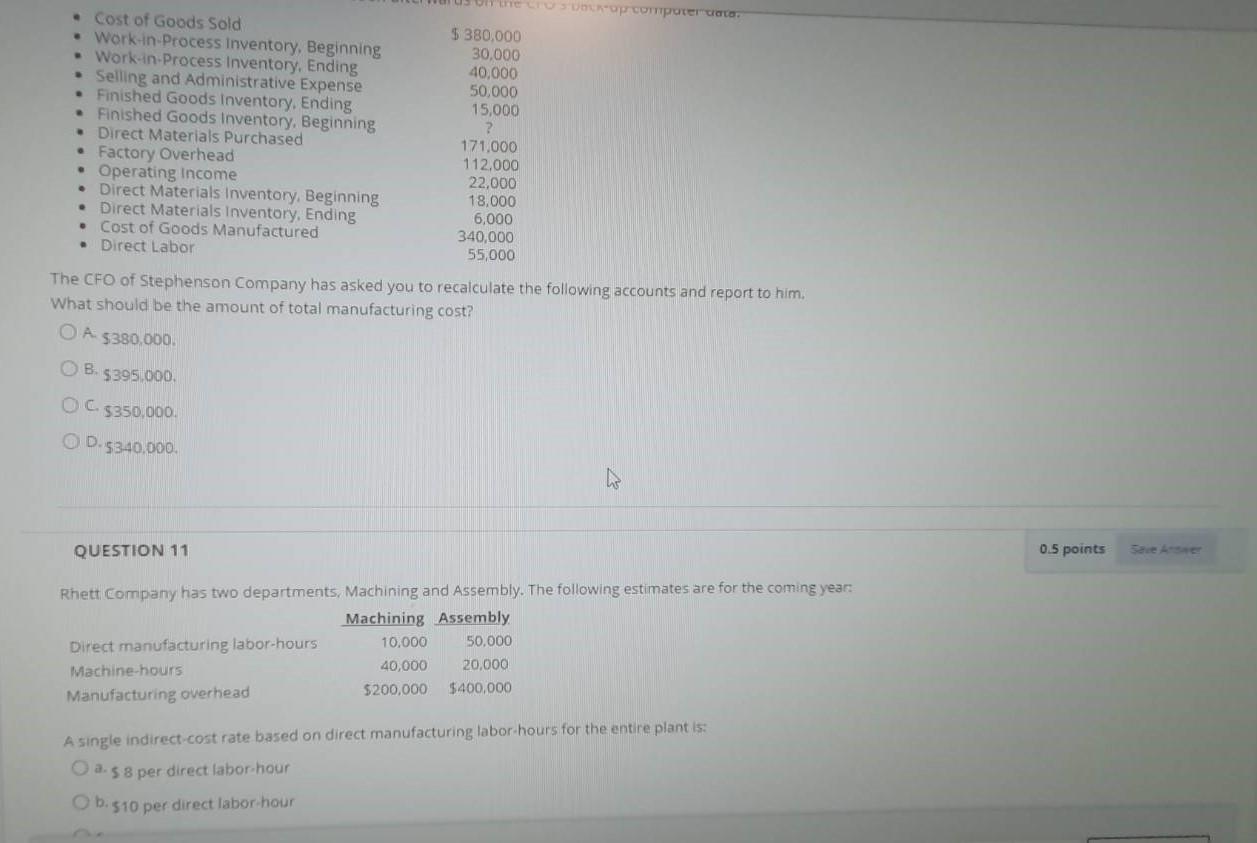

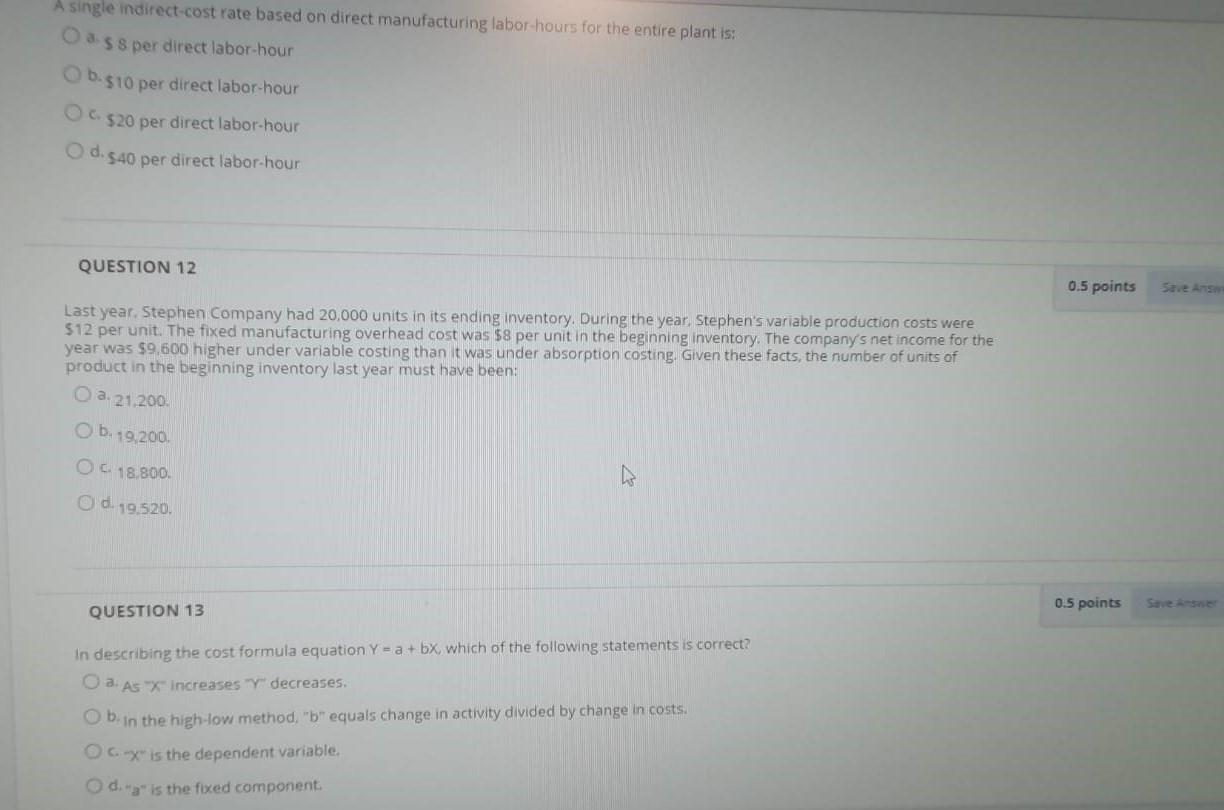

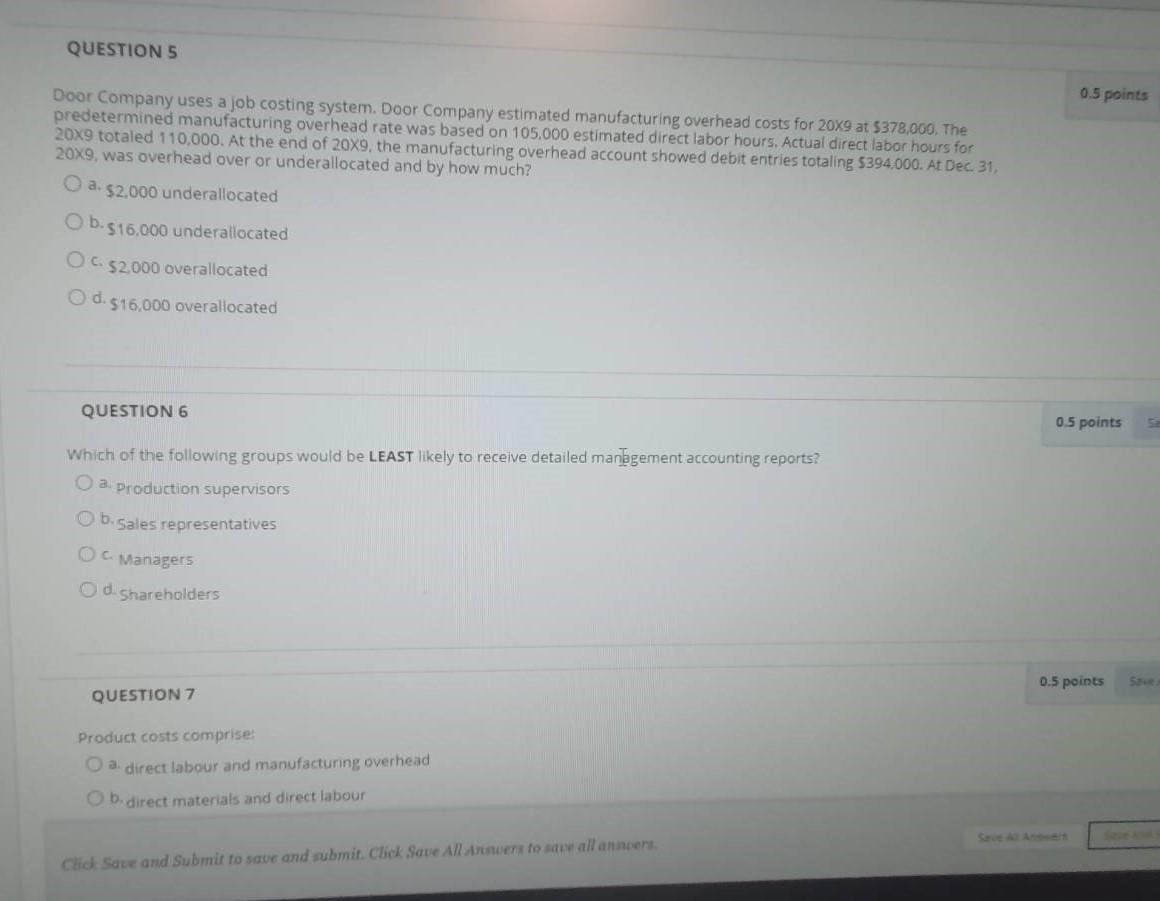

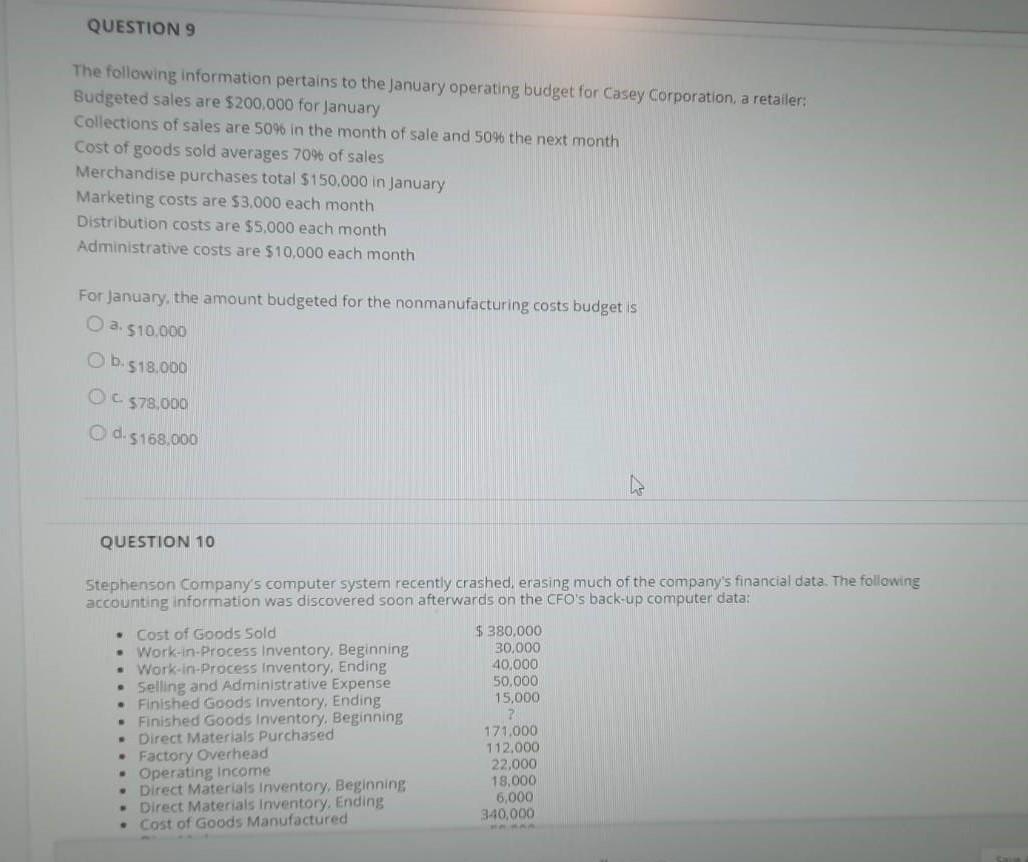

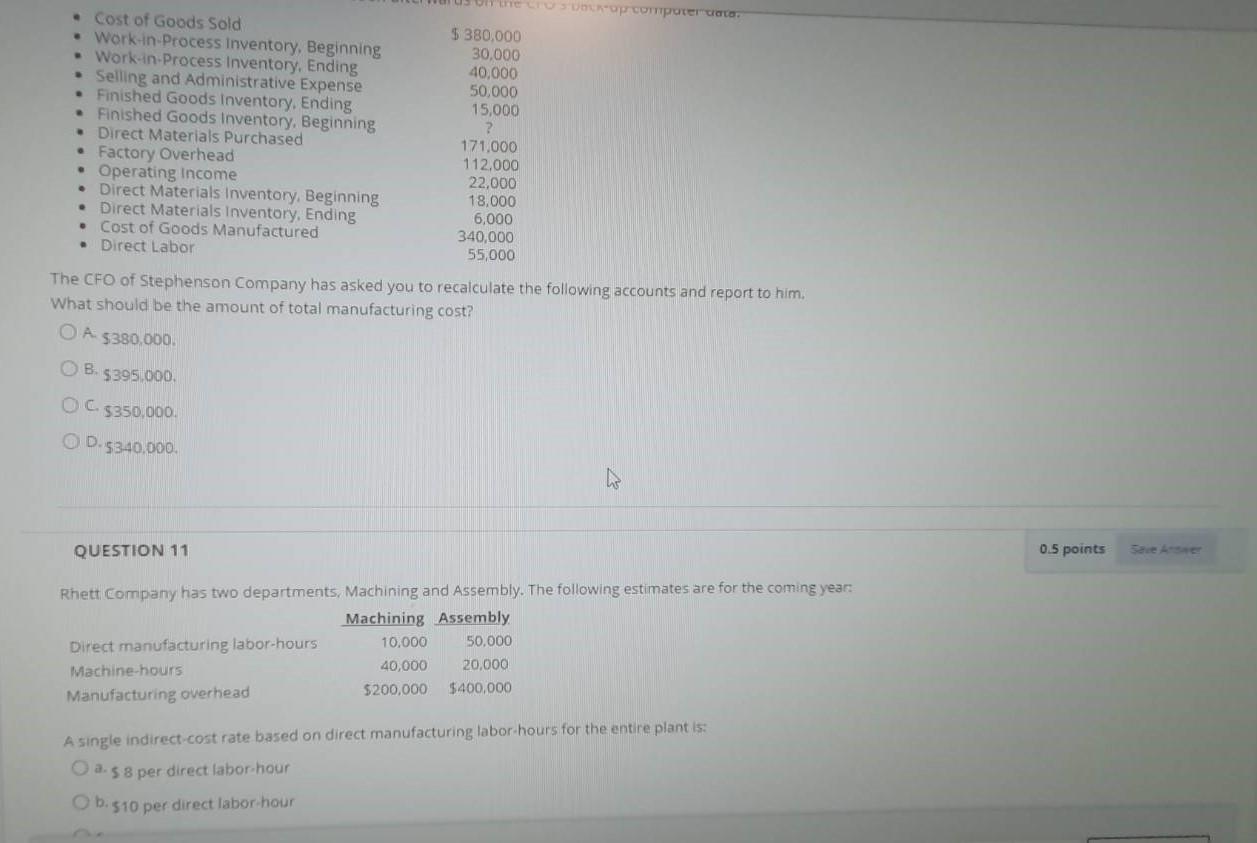

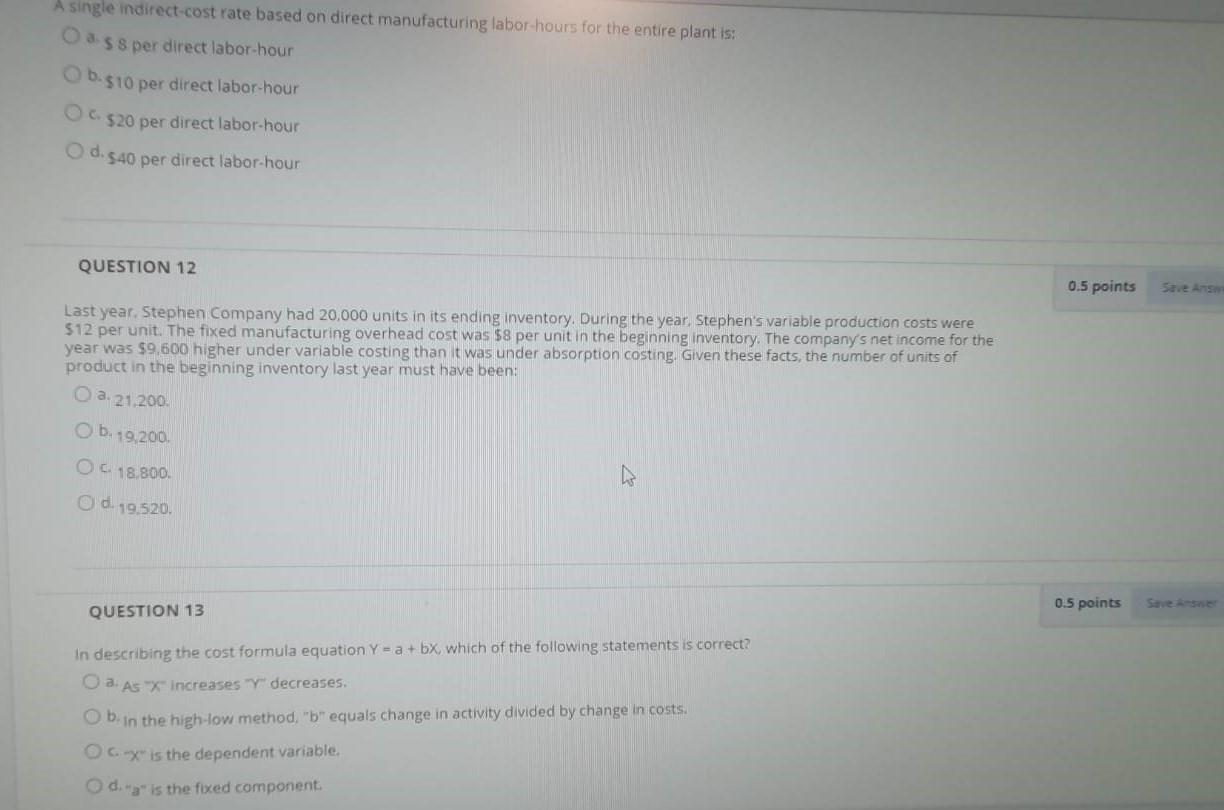

QUESTION 5 0.5 points Door Company uses a job costing system. Door Company estimated manufacturing overhead costs for 20x9 at $378,000. The predetermined manufacturing overhead rate was based on 105.000 estimated direct labor hours. Actual direct labor hours for 2009 totaled 110,000. At the end of 20x9, the manufacturing overhead account showed debit entries totaling 5394.000. At Dec 31, 20X9, was overhead over or underallocated and by how much? O a $2.000 underallocated Ob $16,000 underallocated O c. 52.000 overallocated O d. 516,000 overallocated QUESTION 6 0.5 points Which of the following groups would be LEAST likely to receive detailed management accounting reports? a. Production supervisors O b. Sales representatives OC Managers Od. Shareholders 0.5 points QUESTION 7 Product costs comprises a direct labour and manufacturing overhead b. direct materials and direct labour Click Save and Submit to save and submit. Click Save All Answers to small annor QUESTION 9 The following information pertains to the January operating budget for Casey Corporation, a retailer: Budgeted sales are $200,000 for January Collections of sales are 50% in the month of sale and 50% the next month Cost of goods sold averages 70% of sales Merchandise purchases total $150,000 in January Marketing costs are $3.000 each month Distribution costs are $5,000 each month Administrative costs are $10,000 each month For January, the amount budgeted for the nonmanufacturing costs budget is 3: 510,000 b.518,000 OC 378,000 d. 5168,000 QUESTION 10 Stephenson Company's computer system recently crashed, erasing much of the company's financial data. The following accounting information was discovered soon afterwards on the CFO's back-up computer data: Cost of Goods Sold $ 380,000 Work-in-Process Inventory. Beginning 30,000 Work-in-Process Inventory, Ending 40,000 Selling and Administrative Expense 50.000 Finished Goods Inventory, Ending 15,000 Finished Goods Inventory. Beginning . Direct Materials Purchased 171.000 Factory Overhead 112,000 Operating Income 22,000 Direct Materials inventory. Beginning 18,000 Direct Materials Inventory, Ending Cost of Goods Manufactured 340,000 6,000 DOLOP COTTpoter carto. Cost of Goods Sold Work in Process inventory. Beginning Work in Process Inventory, Ending Selling and Administrative Expense Finished Goods Inventory, Ending Finished Goods Inventory. Beginning Direct Materials Purchased Factory Overhead Operating Income Direct Materials Inventory, Beginning Direct Materials Inventory, Ending Cost of Goods Manufactured Direct Labor $ 380,000 30,000 40,000 50,000 15,000 ? 171.000 112,000 22,000 18,000 6,000 340,000 55,000 The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him. What should be the amount of total manufacturing cost? O A $380.000 OB.$395.000 OC. 5350,000 OD 5340.000 QUESTION 11 0.5 points Rhett Company has two departments, Machining and Assembly. The following estimates are for the coming year: Machining Assembly Direct manufacturing labor-hours 10,000 50.000 Machine-hours 40,000 20,000 Manufacturing overhead $200,000 $400,000 A single indirect cost rate based on direct manufacturing labor hours for the entire plant is: O a.s 8 per direct labor-hour b.510 per direct labor hour A single indirect-cost rate based on direct manufacturing labor-hours for the entire plant is: O ass per direct labor-hour b.$10 per direct labor-hour 06 520 per direct labor-hour O d. 540 per direct labor-hour QUESTION 12 0.5 points Save AS Last year. Stephen Company had 20,000 units in its ending inventory. During the year. Stephen's variable production costs were 512 per unit. The fixed manufacturing overhead cost was $8 per unit in the beginning inventory. The company's net income for the year was $9,600 higher under variable costing than it was under absorption costing. Given these facts, the number of units of product in the beginning inventory last year must have been: O a. 21.200 Ob: 19,200 OC 18.800 d. 19.520. 0.5 points QUESTION 13 In describing the cost formula equation Y = a + bx which of the following statements is correct? Oa: As x increases y decreases. Ob in the high-low method, "b" equals change in activity divided by change in costs. OCX" is the dependent variable, Odr" is the fixed component