Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 1. Abby leases out a machine to Choco plc under a four year lease and Choco plc elects to apply the low-value exemption.

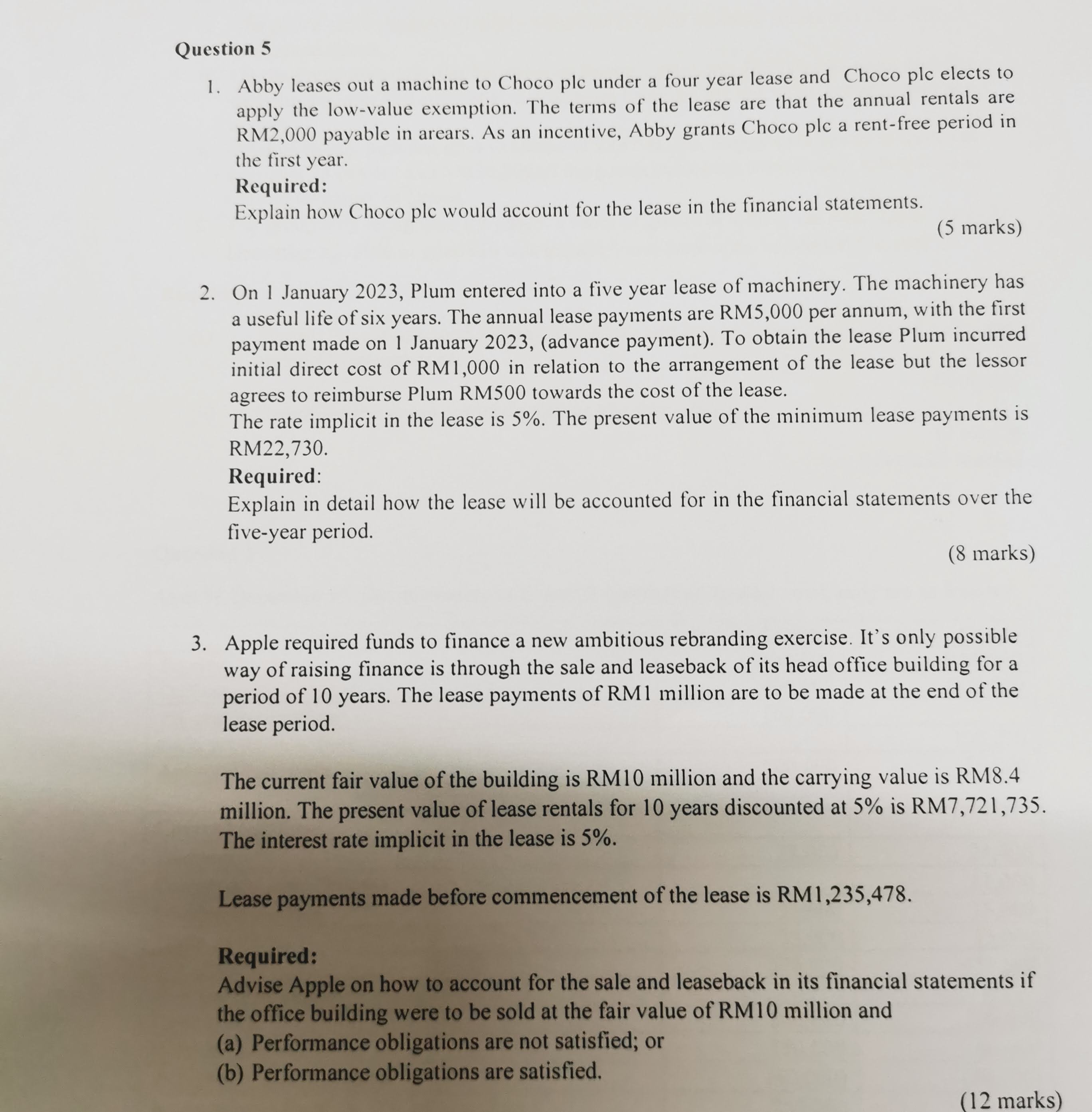

Question 5 1. Abby leases out a machine to Choco plc under a four year lease and Choco plc elects to apply the low-value exemption. The terms of the lease are that the annual rentals are RM2,000 payable in arears. As an incentive, Abby grants Choco plc a rent-free period in the first year. Required: Explain how Choco plc would account for the lease in the financial statements. (5 marks) 2. On 1 January 2023, Plum entered into a five year lease of machinery. The machinery has a useful life of six years. The annual lease payments are RM5,000 per annum, with the first payment made on 1 January 2023, (advance payment). To obtain the lease Plum incurred initial direct cost of RM1,000 in relation to the arrangement of the lease but the lessor agrees to reimburse Plum RM500 towards the cost of the lease. The rate implicit in the lease is 5%. The present value of the minimum lease payments is RM22,730. Required: Explain in detail how the lease will be accounted for in the financial statements over the five-year period. (8 marks) 3. Apple required funds to finance a new ambitious rebranding exercise. It's only possible way of raising finance is through the sale and leaseback of its head office building for a period of 10 years. The lease payments of RM1 million are to be made at the end of the lease period. The current fair value of the building is RM10 million and the carrying value is RM8.4 million. The present value of lease rentals for 10 years discounted at 5% is RM7,721,735. The interest rate implicit in the lease is 5%. Lease payments made before commencement of the lease is RM1,235,478. Required: Advise Apple on how to account for the sale and leaseback in its financial statements if the office building were to be sold at the fair value of RM10 million and (a) Performance obligations are not satisfied; or (b) Performance obligations are satisfied

Question 5 1. Abby leases out a machine to Choco plc under a four year lease and Choco plc elects to apply the low-value exemption. The terms of the lease are that the annual rentals are RM2,000 payable in arears. As an incentive, Abby grants Choco plc a rent-free period in the first year. Required: Explain how Choco plc would account for the lease in the financial statements. (5 marks) 2. On 1 January 2023, Plum entered into a five year lease of machinery. The machinery has a useful life of six years. The annual lease payments are RM5,000 per annum, with the first payment made on 1 January 2023, (advance payment). To obtain the lease Plum incurred initial direct cost of RM1,000 in relation to the arrangement of the lease but the lessor agrees to reimburse Plum RM500 towards the cost of the lease. The rate implicit in the lease is 5%. The present value of the minimum lease payments is RM22,730. Required: Explain in detail how the lease will be accounted for in the financial statements over the five-year period. (8 marks) 3. Apple required funds to finance a new ambitious rebranding exercise. It's only possible way of raising finance is through the sale and leaseback of its head office building for a period of 10 years. The lease payments of RM1 million are to be made at the end of the lease period. The current fair value of the building is RM10 million and the carrying value is RM8.4 million. The present value of lease rentals for 10 years discounted at 5% is RM7,721,735. The interest rate implicit in the lease is 5%. Lease payments made before commencement of the lease is RM1,235,478. Required: Advise Apple on how to account for the sale and leaseback in its financial statements if the office building were to be sold at the fair value of RM10 million and (a) Performance obligations are not satisfied; or (b) Performance obligations are satisfied Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started