Answered step by step

Verified Expert Solution

Question

1 Approved Answer

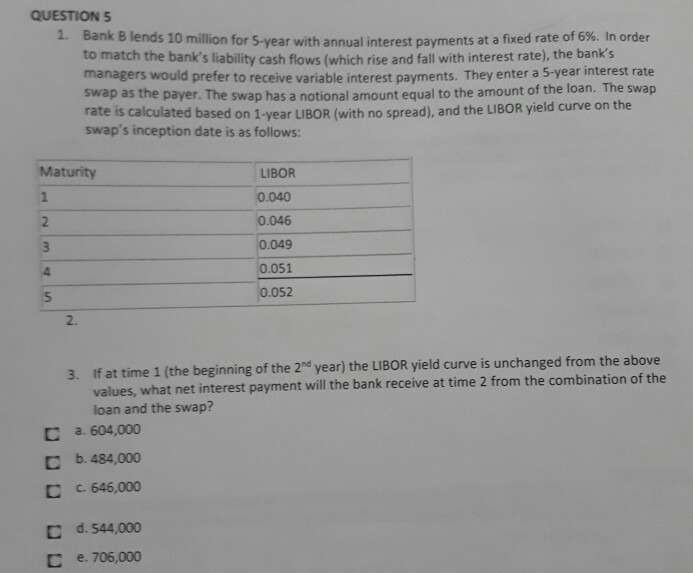

QUESTION 5 1. Bank B lends 10 million for 5-year with annual interest payments at a fixed rate of 6%. In order to match the

QUESTION 5 1. Bank B lends 10 million for 5-year with annual interest payments at a fixed rate of 6%. In order to match the bank's liability cash flows (which rise and fall with interest rate), the bank's managers would prefer to receive variable interest payments. They enter a 5-year interest rate swap as the payer. The rate is calculated based on 1-year LIBOR (with no spread), and the LIBOR yield curve on t swap's inception date is as follows: swap has a notional amount equal to the amount of the loan. The swap he Maturity LIBOR 0.040 0.046 0.049 0.051 0.052 2 5 2. If at time 1 (the beginning of the 2nd year) the LIBOR yield curve is unchanged from the above values, what net interest payment will the bank receive at time 2 from the combination of the 3. loan and the swap? C a, 604,000 C b.484,000 ? ?. 646,000 c d. 544,000 C e, 706,000 QUESTION 5 1. Bank B lends 10 million for 5-year with annual interest payments at a fixed rate of 6%. In order to match the bank's liability cash flows (which rise and fall with interest rate), the bank's managers would prefer to receive variable interest payments. They enter a 5-year interest rate swap as the payer. The rate is calculated based on 1-year LIBOR (with no spread), and the LIBOR yield curve on t swap's inception date is as follows: swap has a notional amount equal to the amount of the loan. The swap he Maturity LIBOR 0.040 0.046 0.049 0.051 0.052 2 5 2. If at time 1 (the beginning of the 2nd year) the LIBOR yield curve is unchanged from the above values, what net interest payment will the bank receive at time 2 from the combination of the 3. loan and the swap? C a, 604,000 C b.484,000 ? ?. 646,000 c d. 544,000 C e, 706,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started