Answered step by step

Verified Expert Solution

Question

1 Approved Answer

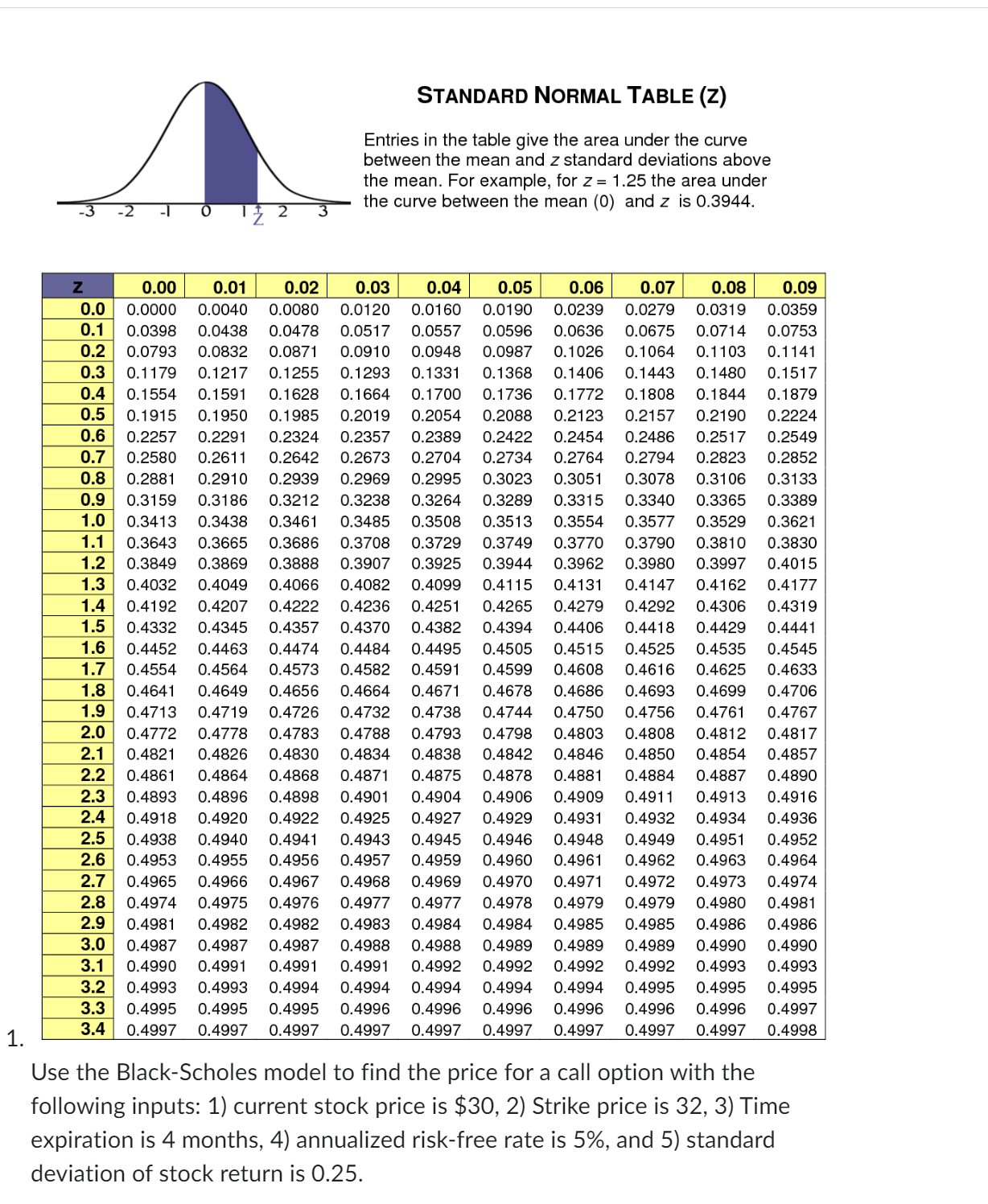

Question 5 (1 point) Calculate its Call premium: 1.0772.8922.9311.099 STANDARD NORMAL TABLE (z) Entries in the table give the area under the curve between the

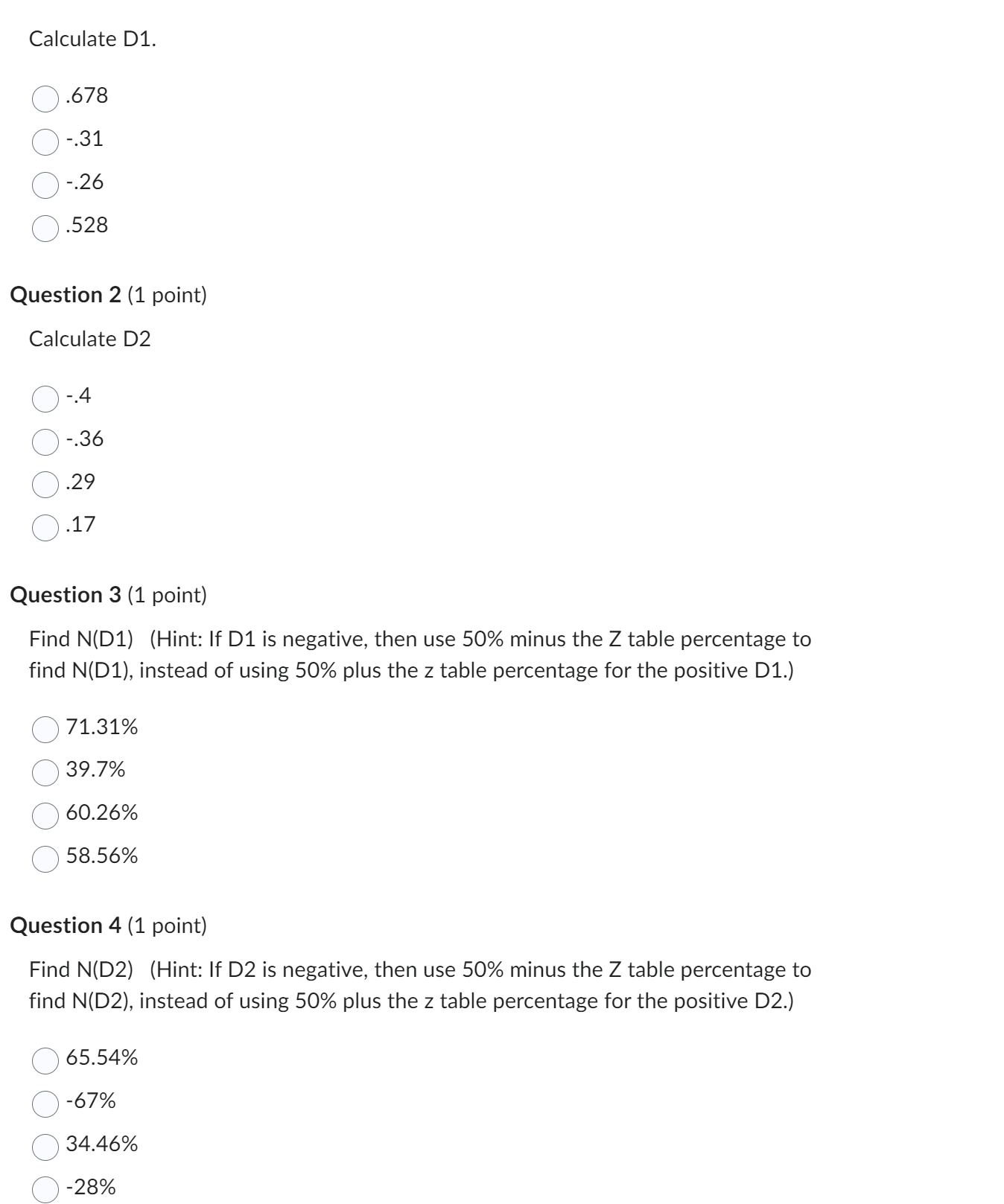

Question 5 (1 point) Calculate its Call premium: 1.0772.8922.9311.099 STANDARD NORMAL TABLE (z) Entries in the table give the area under the curve between the mean and z standard deviations above the mean. For example, for z=1.25 the area under the curve between the mean (0) and z is 0.3944. Use the Black-Scholes model to find the price for a call option with the following inputs: 1) current stock price is $30,2 ) Strike price is 32,3 ) Time expiration is 4 months, 4) annualized risk-free rate is 5%, and 5) standard deviation of stock return is 0.25 . Question 3 (1 point) Find N(D1) (Hint: If D1 is negative, then use 50% minus the Z table percentage to find N(D1), instead of using 50% plus the z table percentage for the positive D1.) 71.31% 39.7% 60.26% 58.56% Question 4 (1 point) Find N(D2) (Hint: If D2 is negative, then use 50% minus the Z table percentage to find N(D2), instead of using 50% plus the z table percentage for the positive D2.) 65.54% 67% 34.46% 28%

Question 5 (1 point) Calculate its Call premium: 1.0772.8922.9311.099 STANDARD NORMAL TABLE (z) Entries in the table give the area under the curve between the mean and z standard deviations above the mean. For example, for z=1.25 the area under the curve between the mean (0) and z is 0.3944. Use the Black-Scholes model to find the price for a call option with the following inputs: 1) current stock price is $30,2 ) Strike price is 32,3 ) Time expiration is 4 months, 4) annualized risk-free rate is 5%, and 5) standard deviation of stock return is 0.25 . Question 3 (1 point) Find N(D1) (Hint: If D1 is negative, then use 50% minus the Z table percentage to find N(D1), instead of using 50% plus the z table percentage for the positive D1.) 71.31% 39.7% 60.26% 58.56% Question 4 (1 point) Find N(D2) (Hint: If D2 is negative, then use 50% minus the Z table percentage to find N(D2), instead of using 50% plus the z table percentage for the positive D2.) 65.54% 67% 34.46% 28% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started