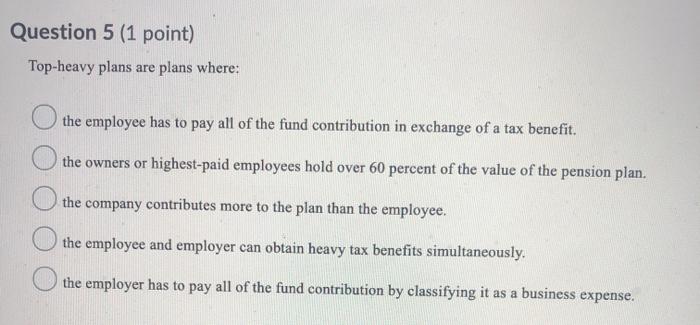

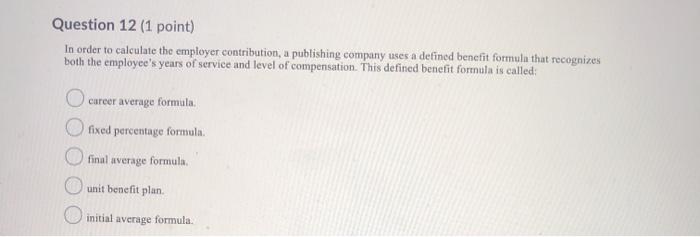

Question 5 (1 point) Top-heavy plans are plans where: the employee has to pay all of the fund contribution in exchange of a tax benefit. the owners or highest-paid employees hold over 60 percent of the value of the pension plan. the company contributes more to the plan than the employee. the employee and employer can obtain heavy tax benefits simultaneously. the employer has to pay all of the fund contribution by classifying it as a business expense. Question 9 (1 point) Universal life insurance contracts were introduced during a period of historically high, double-digit interest rates. True False Question 12 (1 point) In order to calculate the employer contribution, a publishing company uses a defined benefit formula that recognizes both the employee's years of service and level of compensation. This defined benefit formula is called: career average formula fixed percentage formula final average formula unit benefit plan initial average formula. Question 14 (1 point) Target pension plan is a defined contribution plan which favors newer employees of the organization, True False Question 17 (1 point) The renewability option gives the policyholder the right to renew the life insurance policy for a specified number of additional periods of protection, at a predetermined schedule of premium rates, without new evidence of insurability, True False Question 18 (1 point) The current mortality rate, in universal life, can be any amount determined periodically by the insurer as long as the charge does not exceed the guaranteed maximum mortality rate specified in the contract True False Question 19 (1 point) Which of the following is a drawback of Employee Retirement Income Security Act of 1974? Lower-level employees did not get protection under the act. The act failed to address portability issues when employees changed jobs The act and its amendments did not cover fiduciary responsibilities. The act is believed to cause discrimination amongst employees of an organization Reporting and disclosure rules were not given importance in the act. Question 22 (1 point) An employer provides a defined benefit plan and has opted for graded vesting. Under this plan, the employees are eligible for 80 percent of employer contributions after four years. True O False Question 23 (1 point) A qualified retirement plan must be for the exclusive benefit of the employees rather than their beneficiaries. True False False True a suunsut uus Susedap e st aquensui uopjoyd ejow (quod I) sz uopsnd