Answered step by step

Verified Expert Solution

Question

1 Approved Answer

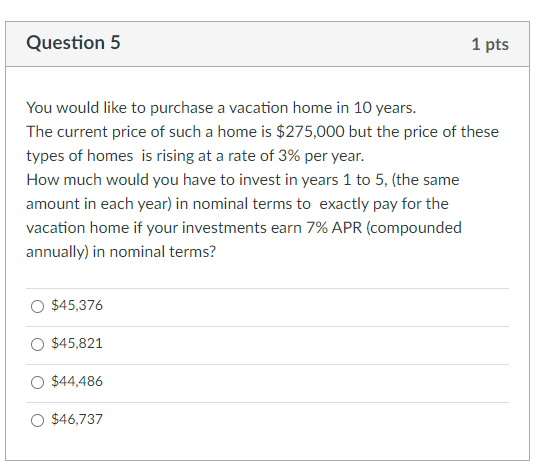

Question 5 1 pts You would like to purchase a vacation home in 10 years. The current price of such a home is $275,000

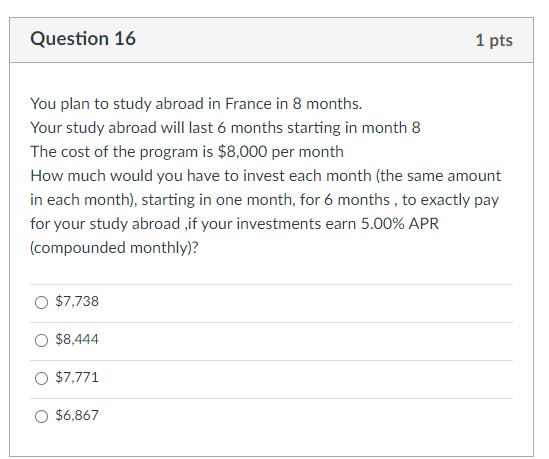

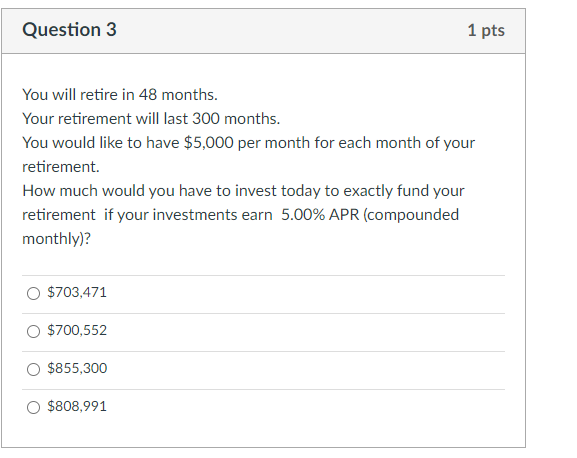

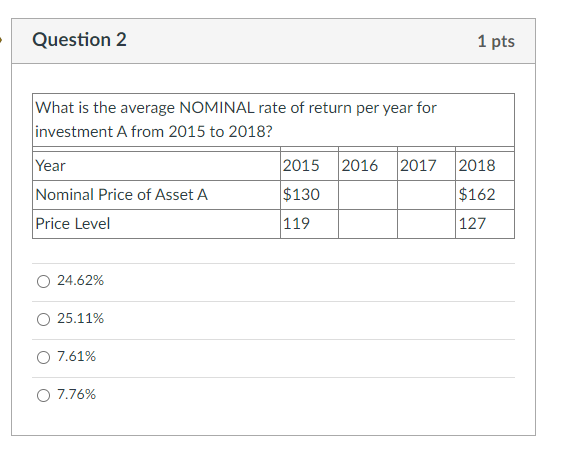

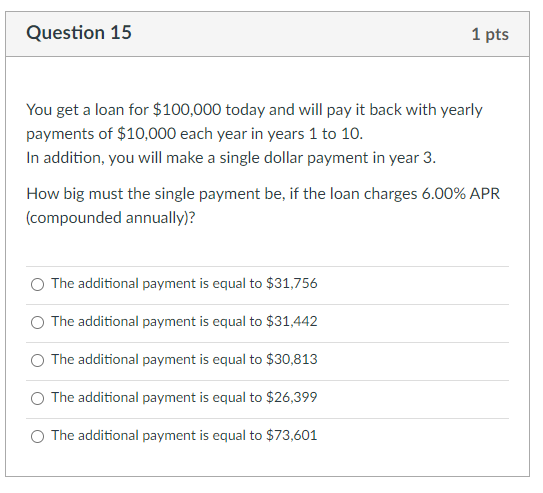

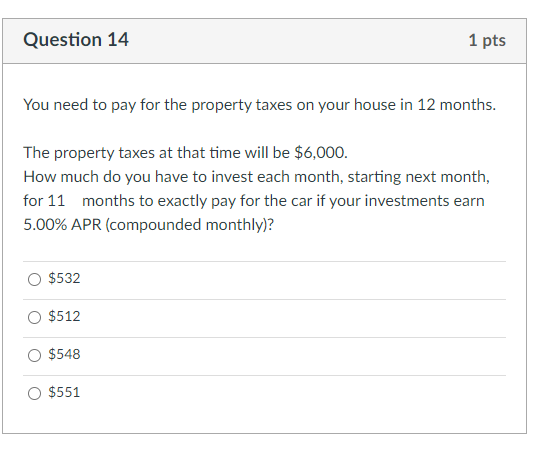

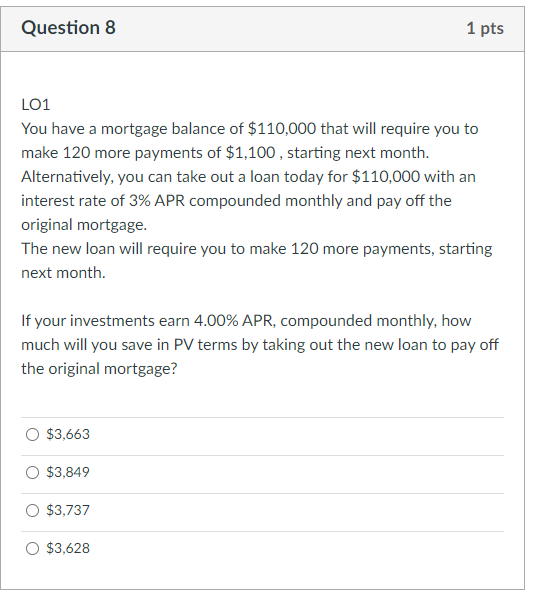

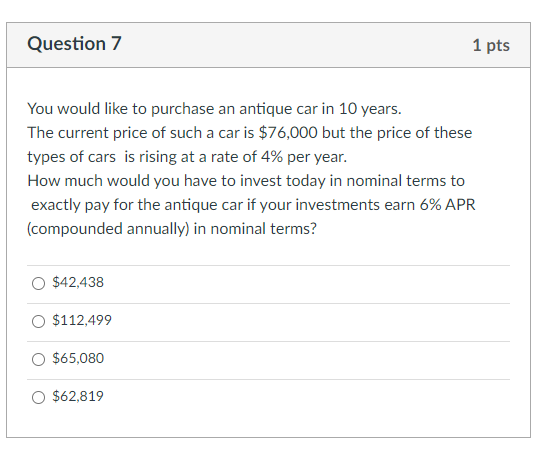

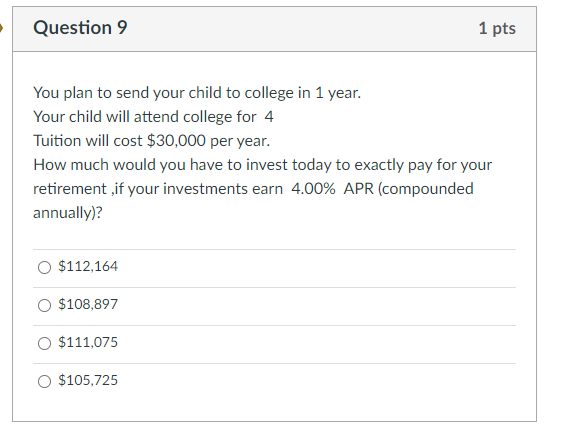

Question 5 1 pts You would like to purchase a vacation home in 10 years. The current price of such a home is $275,000 but the price of these types of homes is rising at a rate of 3% per year. How much would you have to invest in years 1 to 5, (the same amount in each year) in nominal terms to exactly pay for the vacation home if your investments earn 7% APR (compounded annually) in nominal terms? $45,376 $45,821 $44,486 $46,737 Question 16 1 pts You plan to study abroad in France in 8 months. Your study abroad will last 6 months starting in month 8 The cost of the program is $8,000 per month How much would you have to invest each month (the same amount in each month), starting in one month, for 6 months, to exactly pay for your study abroad, if your investments earn 5.00% APR (compounded monthly)? $7,738 $8,444 $7,771 $6,867 Question 3 1 pts You will retire in 48 months. Your retirement will last 300 months. You would like to have $5,000 per month for each month of your retirement. How much would you have to invest today to exactly fund your retirement if your investments earn 5.00% APR (compounded monthly)? $703,471 $700,552 $855,300 $808,991 Question 2 What is the average NOMINAL rate of return per year for investment A from 2015 to 2018? Year 1 pts 2015 2016 2017 2018 Nominal Price of Asset A $130 $162 Price Level 119 127 24.62% 25.11% 7.61% 7.76% Question 15 1 pts You get a loan for $100,000 today and will pay it back with yearly payments of $10,000 each year in years 1 to 10. In addition, you will make a single dollar payment in year 3. How big must the single payment be, if the loan charges 6.00% APR (compounded annually)? The additional payment is equal to $31,756 The additional payment is equal to $31,442 The additional payment is equal to $30,813 The additional payment is equal to $26,399 The additional payment is equal to $73,601 Question 14 1 pts You need to pay for the property taxes on your house in 12 months. The property taxes at that time will be $6,000. How much do you have to invest each month, starting next month, for 11 months to exactly pay for the car if your investments earn 5.00% APR (compounded monthly)? $532 $512 $548 $551 Question 8 1 pts LO1 You have a mortgage balance of $110,000 that will require you to make 120 more payments of $1,100, starting next month. Alternatively, you can take out a loan today for $110,000 with an interest rate of 3% APR compounded monthly and pay off the original mortgage. The new loan will require you to make 120 more payments, starting next month. If your investments earn 4.00% APR, compounded monthly, how much will you save in PV terms by taking out the new loan to pay off the original mortgage? $3,663 $3,849 $3,737 $3,628 Question 7 You would like to purchase an antique car in 10 years. The current price of such a car is $76,000 but the price of these types of cars is rising at a rate of 4% per year. How much would you have to invest today in nominal terms to exactly pay for the antique car if your investments earn 6% APR (compounded annually) in nominal terms? $42,438 $112,499 $65,080 $62,819 1 pts Question 9 1 pts You plan to send your child to college in 1 year. Your child will attend college for 4 Tuition will cost $30,000 per year. How much would you have to invest today to exactly pay for your retirement,if your investments earn 4.00% APR (compounded annually)? $112,164 $108,897 $111,075 O $105,725

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started