Question: Question 5 (10 marks) Show workings clearly to get part marks Whether you type in the Moodle space or on a page as you answer,

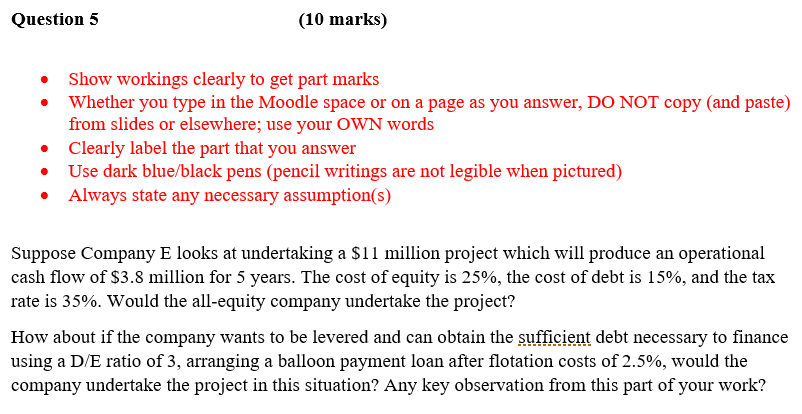

Question 5 (10 marks) Show workings clearly to get part marks Whether you type in the Moodle space or on a page as you answer, DO NOT copy (and paste) from slides or elsewhere; use your OWN words Clearly label the part that you answer Use dark blue/black pens (pencil writings are not legible when pictured) Always state any necessary assumption(s) Suppose Company E looks at undertaking a $11 million project which will produce an operational cash flow of $3.8 million for 5 years. The cost of equity is 25%, the cost of debt is 15%, and the tax rate is 35%. Would the all-equity company undertake the project? How about if the company wants to be levered and can obtain the sufficient debt necessary to finance using a D/E ratio of 3, arranging a balloon payment loan after flotation costs of 2.5%, would the company undertake the project in this situation? Any key observation from this part of your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts